In yesterday’s article we wrote that while a trade truce or “mini deal” coming from this week’s U.S. – China trade talks would benefit the S&P 500 and offer President Trump some relief from his impeachment and tax issues, the most likely outcome is for escalation rather than de-escalation.

This opinion has been reinforced overnight as a slew of negative reports hit the wires including a Chinese spokesman warning China would retaliate to the blacklisting of 28 Chinese companies by the U.S. Commerce Department for human rights abuses. While the U.S. State Department announced that Chinese officials linked to Muslim abuse in Xinjiang would be banned from traveling to the U.S.

It is possible the more aggressive rhetoric from both parties in recent days is an attempt to leverage bargaining power before the start of trade talks tomorrow, rather than being symptomatic of a growing a divide between the two countries. However, stock traders on Wall Street were not willing to take that risk.

In response, the ASX200 has fallen -0.71% today closing at 6546.7, although it has managed to outperform its U.S. counterparts on a relative basis. The outperformance is more surprising after the release this morning of a key gauge of consumer sentiment in Australia fell 5% in October, to its lowest level since mid-2015. This is despite the RBA cutting interest rates for the third time this year just last week and consumers having received an increasing portion of their tax rebates.

Technical update:

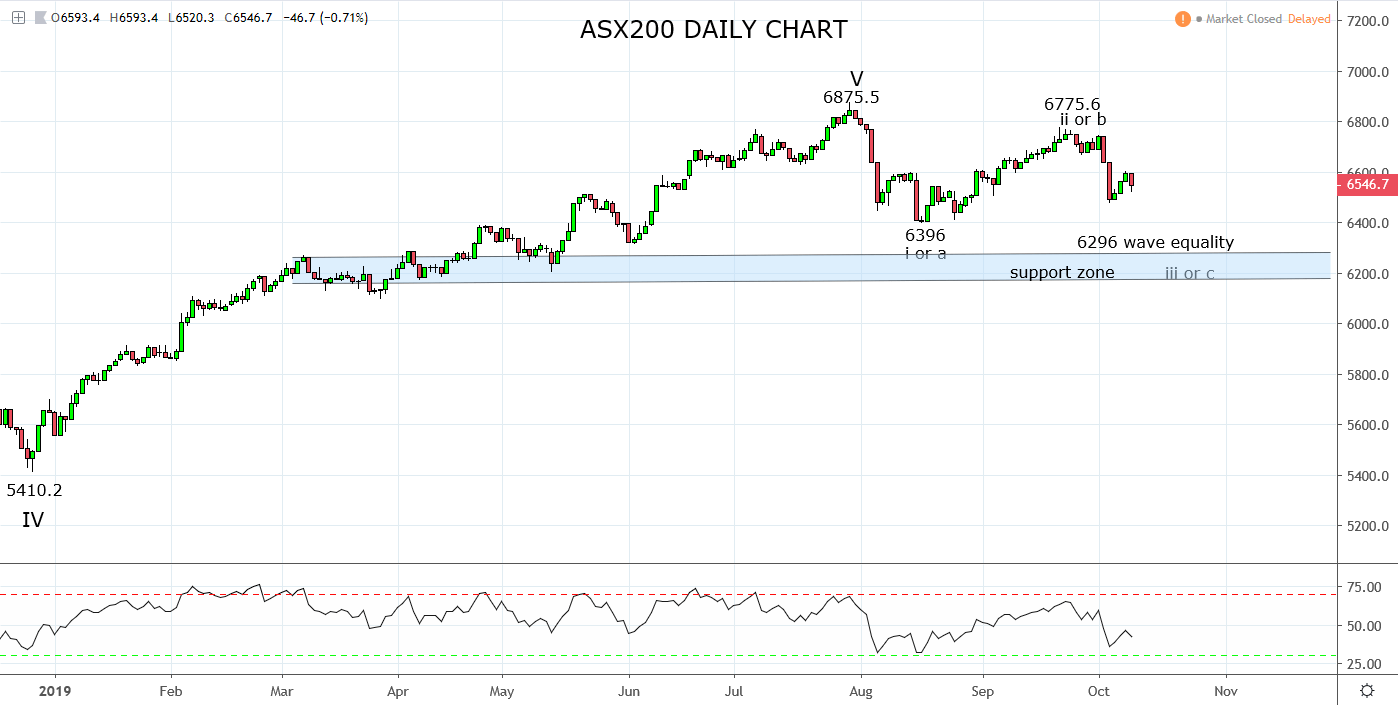

After rallying over 25% from its December lows to the 6875.5 high of July 2019, the view remains that the ASX 200 is currently tracing out a corrective pullback. The target for the pullback is wave equality support at 6296 with the risk of a deeper pullback towards a confluence of horizontal support at 6200.

Therefore, we view the 6300/6200 area as an area for value buyers to emerge and a bounce to commence. Keeping in mind that a break above year to date highs is unlikely should the trade war continue to escalate.

Source Tradingview. The figures stated are as of the 9th of October 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.