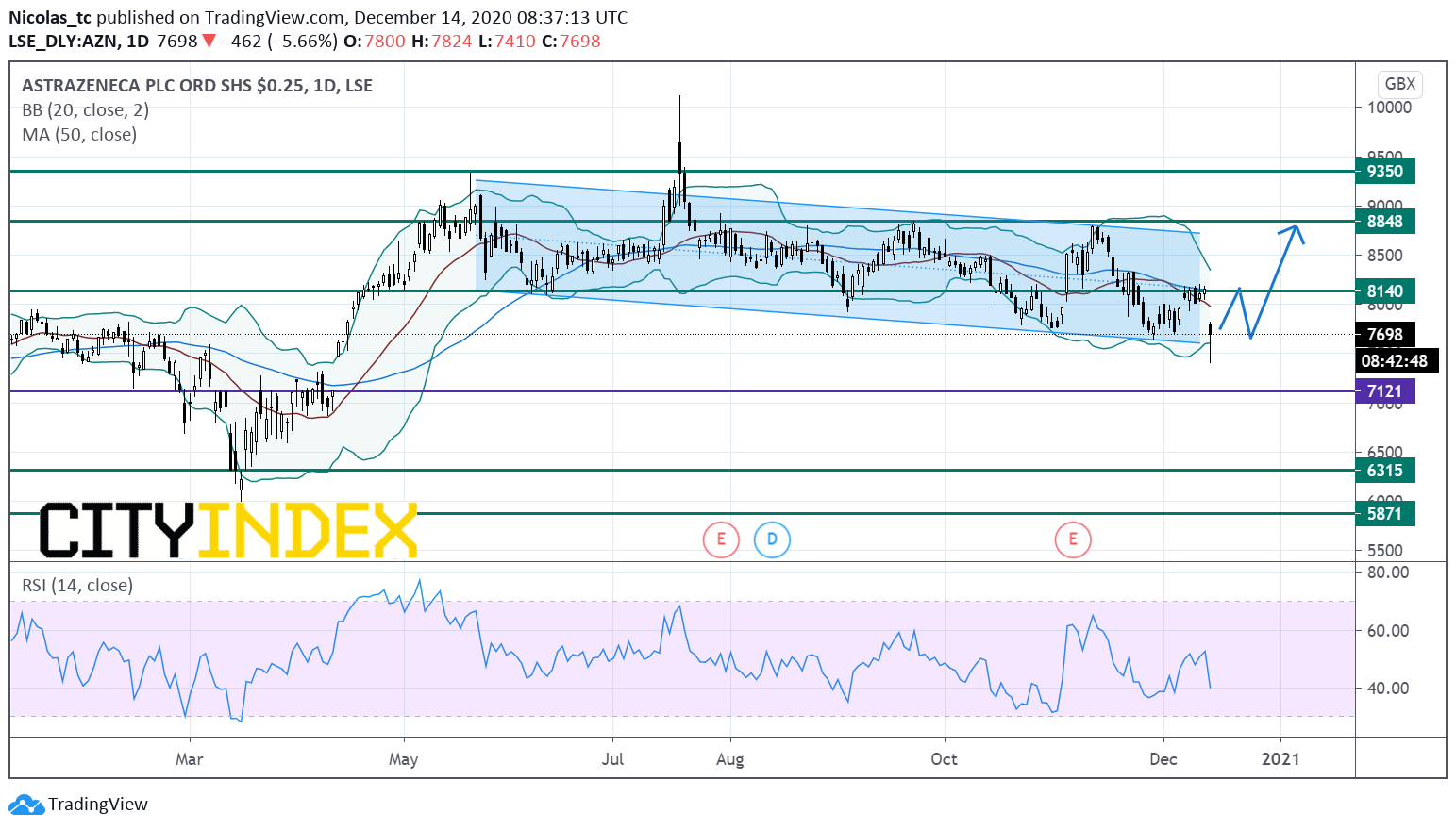

AstraZeneca: technical support at 7121

AstraZeneca, the global biopharmaceutical firm, announced its acquisition of rare-disease US specialist Alexion Pharmaceuticals for $39 billion or $175 per share. Alexion shareholders will receive $60 in cash and 2.12 of AstraZeneca's shares for each share they hold. The transaction values Alexion at $175 per share, 45% above its closing price on Friday on Wall Street. This is the largest acquisition in the pharmaceutical sector since the beginning of the pandemic.

Separately, the Company reported that its Trixeo Aerosphere has been approved in the European Union (EU) for maintenance treatment in adult patients with moderate to severe chronic obstructive pulmonary disease (COPD).

From a chartist point of view, the stock price is under pressure within a bearish channel and is nearing its lower Bollinger boundary. The daily RSI (14) lacks downward momentum. Prices remain supported by the rising 100WMA currently at 7350. As long as 7121 is support, a rebound could take place. A push above 8140 would open a path to see 8848. Alternatively, a break below 7121 would call for a bearish acceleration towards 6315 and 5871.

Source: TradingView, Gain Capital

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM