AstraZeneca’s Lynparza gets approval – Bullish bias above 8048p

AstraZeneca, the pharmaceutical group, said its Lynparza has been approved in the U.S. as 1st-line maintenance treatment with bevacizumab for HRD-positive advanced ovarian cancer. Meanwhile, it reported that its Enhertu has been granted Breakthrough Therapy Designation (BTD) in the US for the treatment of patients with HER2-positive metastatic gastric cancer.

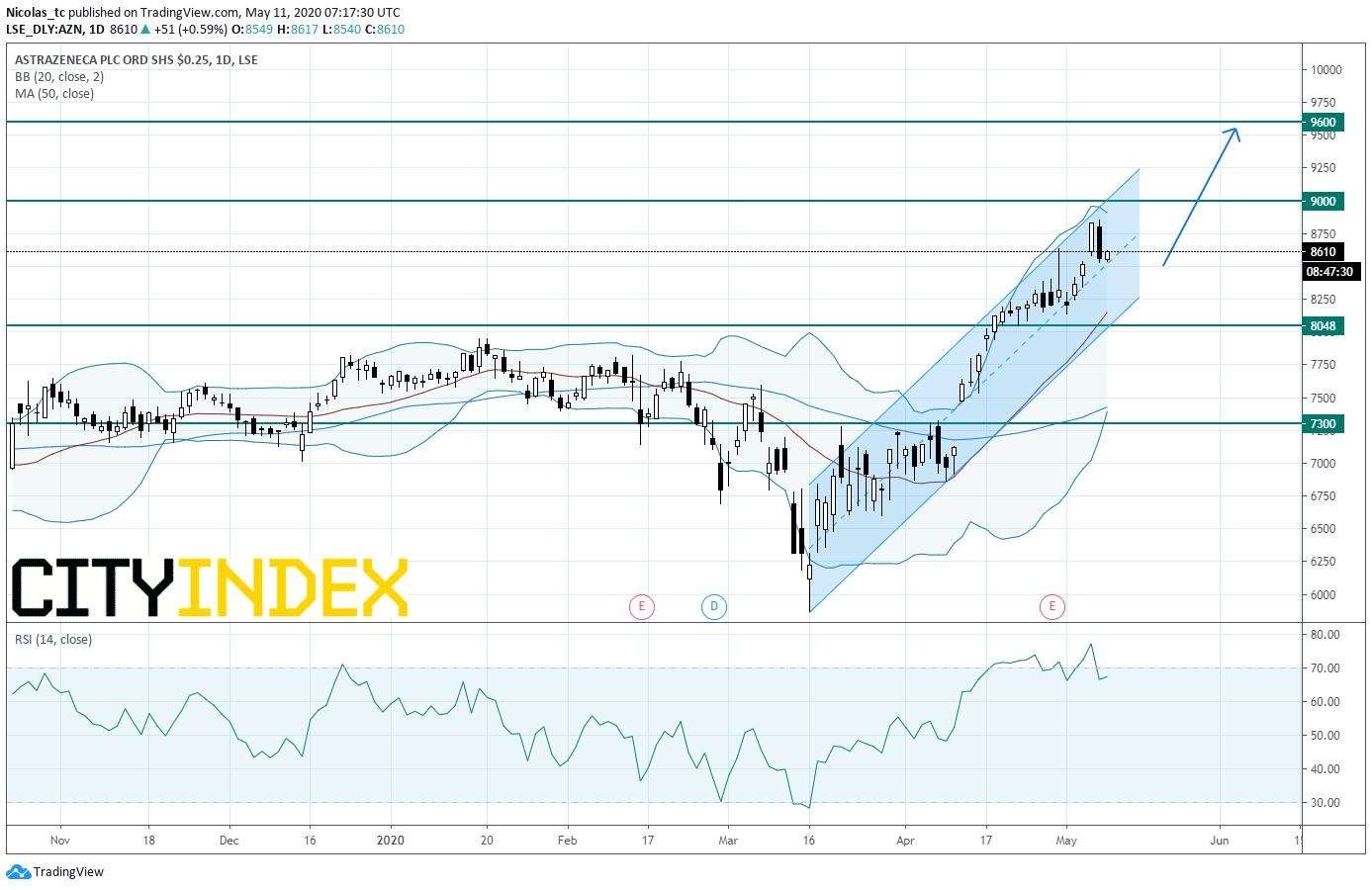

From a technical perspective, the stock price remains in a bullish trend, within an ascending channel since March 2020 bottom. Both the 20/50-day simple moving averages are heading upwards. However, the daily Relative Strength Index (RSI, 14) has broken down its overbought area at 70%. This may indicate that a consolidation move is on the cards.

As long as 8048p is support, the bias remains bullish. Next resistance levels are set at 9000p and then 9600p.

Only a break below 8048p would invalidate the short term bullish bias and would call for a drop towards 7300p.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM