Strong bearish signals likely to favour a downturn

AstraZeneca, which produces pharmaceutical and medical products, posted 1H results: "Total Revenue increased by 12% (14% at CER) to 12,629 million dollars in the half, with growth across all three therapy areas and in every region. (...) Reported EPS of 1.17 dollars in the half, representing an increase of 108% (106% at CER). Core EPS increased by 24% (26% at CER) to 2.01 dollars. (...) An unchanged first interim dividend of 0.90 dollar per share." The company confirmed 2020 guidance.

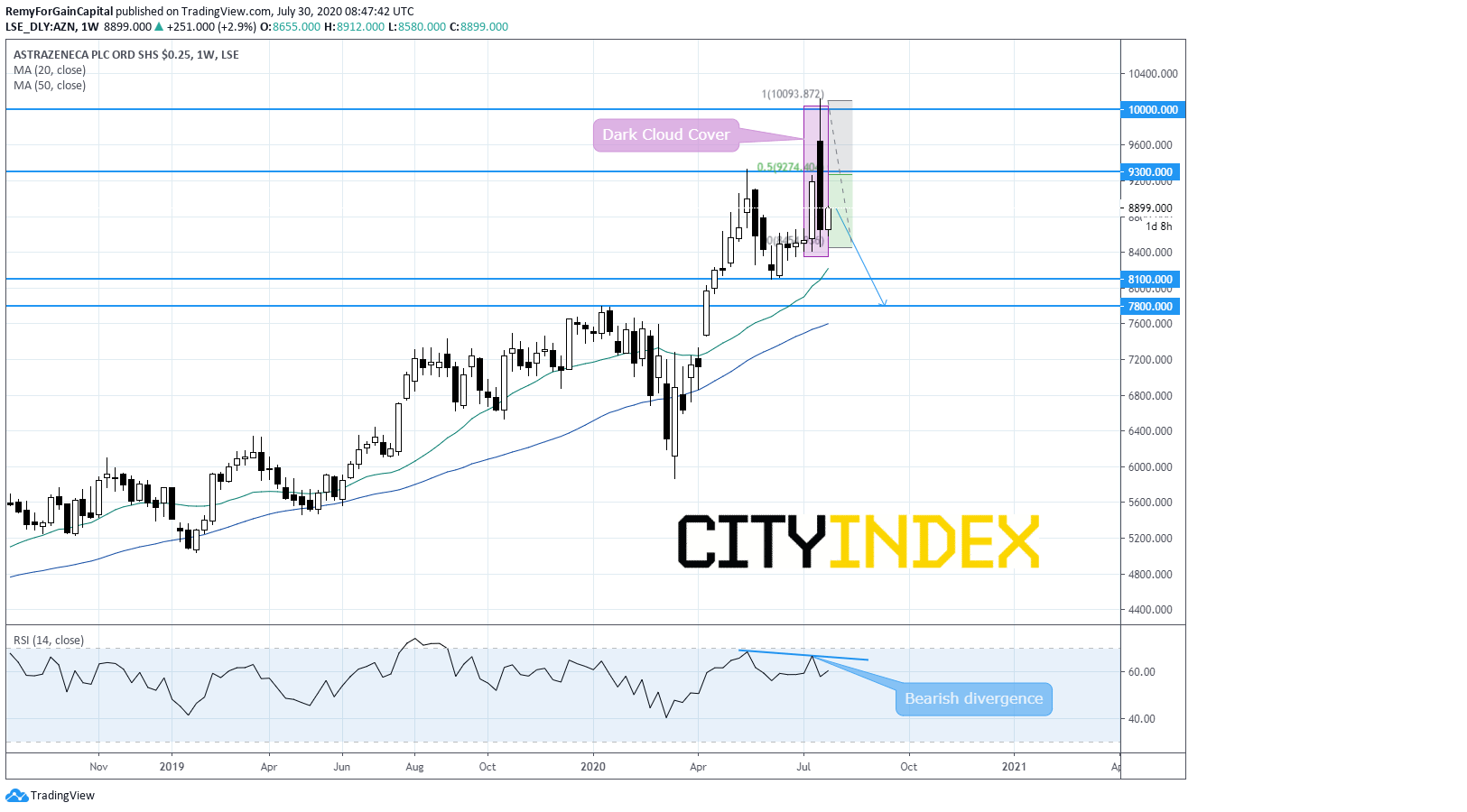

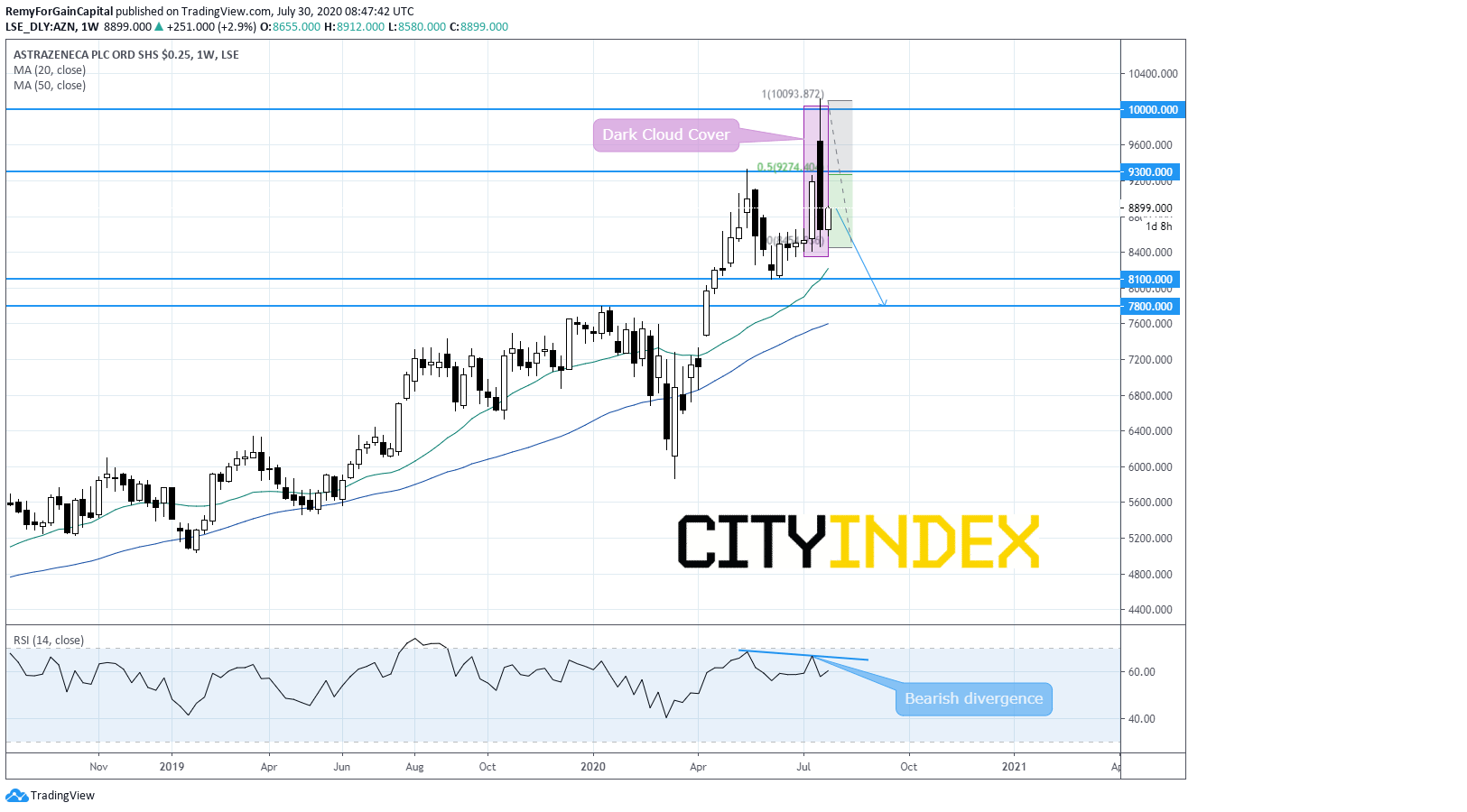

From a chartist point of view, the failure to confirm the upside breakout of former 2020 top area at 9200 is a significant sign of weakness. In addition, the stock is posting a Dark Cloud Cover: a bearish reversal candlestick pattern while at the same time the weekly RSI is posting a bearish divergence: both are strong signals likely to favour a downturn. As a consequence, traders might consider short position below 50% retracement of the decline since the top (invalidation level of the candlestick pattern) at 9300 to target a decline towards June bottom area at 8100 and even January top at 7800. Alternatively, an upside breakout of 9300 would lower the immediate corrective risk and favour another test of the 10k area.

From a chartist point of view, the failure to confirm the upside breakout of former 2020 top area at 9200 is a significant sign of weakness. In addition, the stock is posting a Dark Cloud Cover: a bearish reversal candlestick pattern while at the same time the weekly RSI is posting a bearish divergence: both are strong signals likely to favour a downturn. As a consequence, traders might consider short position below 50% retracement of the decline since the top (invalidation level of the candlestick pattern) at 9300 to target a decline towards June bottom area at 8100 and even January top at 7800. Alternatively, an upside breakout of 9300 would lower the immediate corrective risk and favour another test of the 10k area.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM