Associated British Foods pulls dividend

Associated British Foods, a food processing and retailing company, reported that full-year adjusted EPS declined 40% on year to 81.1p and adjusted operating profit slid 31% to 1.02 billion pounds on revenue of 13.94 billion pounds, down 12% (-11% at constant currency). The company said: "We have elected not to propose a final dividend for the year whilst we monitor the impact of further COVID-19 restrictions on Primark during this important trading season. (...) Notwithstanding the currently announced periods of restriction, we expect Primark full year sales and profit to be higher next year."

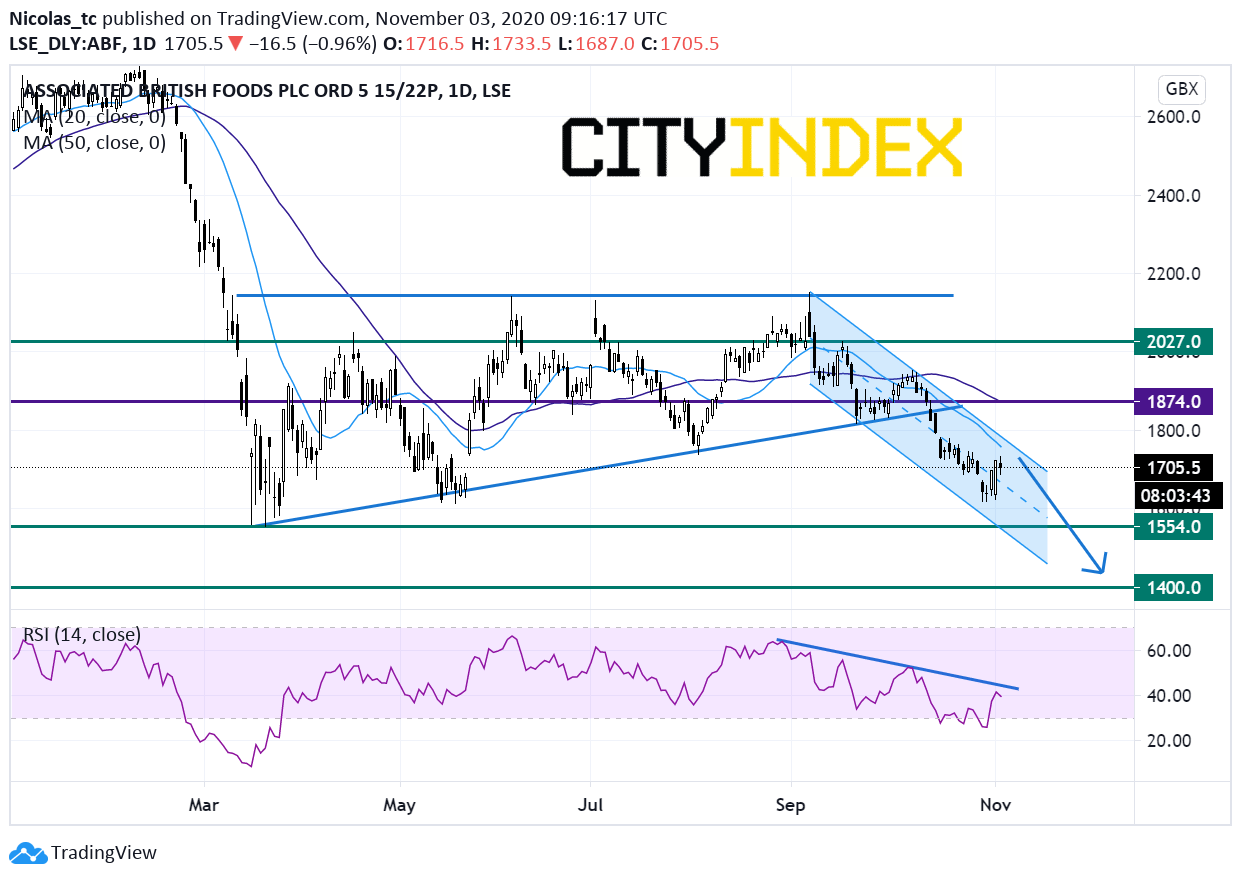

From a chartist's point of view, the downside breakout of a short term rising trend line has reinstated a bearish bias. Prices remain within a downward-sloping channel and are capped by the declining 20/50DMAs. The daily RSI (14) is below 50% and capped by a declining trend line. Readers may want to consider the potential for opening Short positions below the key resistance at 1874p, with 1554p and 1400p as bearish targets. Alternatively, a break above 1874p would call for a short term recovery towards 2027p and 2200p.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM