ASML Holdings: Consolidate before Next Rally

In July, Dutch semiconductor equipment manufacturer ASML Holdings reported better than expected 2Q net sales that increased 36.3% on year to 3.33 billion euros. However, Investment bank UBS said it struggles to see "compelling upside" to company's share price on a 12-month view and downgraded it to "neutral" from "buy".

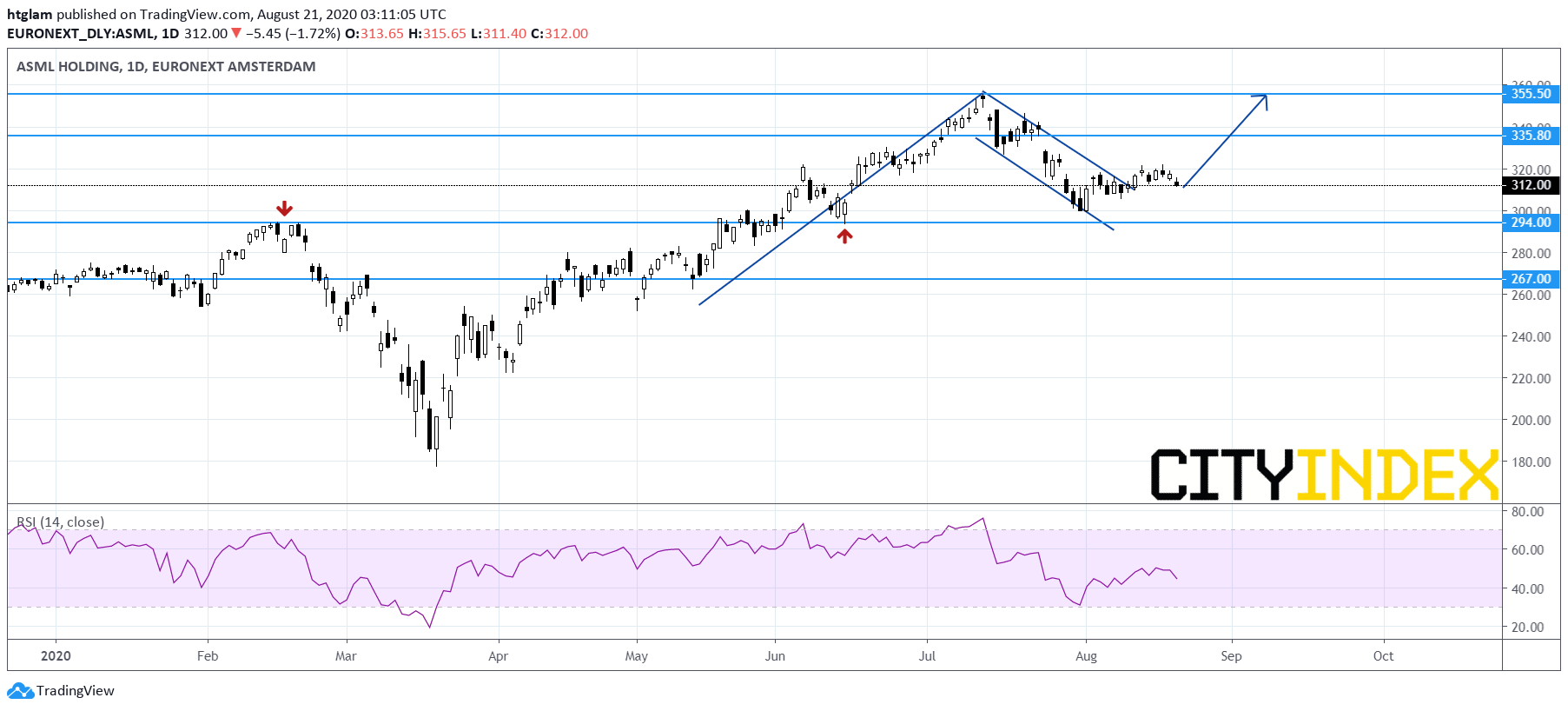

From a technical point of view, ASML Holdings is likely to have entered into a consolidation range as shown on the daily chart. It has broken above a bullish cup and handle pattern last week, but remains capped by the 38.2% Fibonacci retracement resistance of the decline started from July. The level at E294.00 might be considered as the nearest support level, while the 1st and 2nd resistances are expected to be located at E335.80 and E355.50 respectively. Alternatively, losing E294.00 may suggest that the next support at E267.00 would be challenged.