Asian Futures:

- Australia's ASX 200 futures are down -36 points (-0.48%), the cash market is currently estimated to open at 7,434.10

- Japan's Nikkei 225 futures are down -20 points (-0.07%), the cash market is currently estimated to open at 29,756.80

- Hong Kong's Hang Seng futures are down -22 points (-0.09%), the cash market is currently estimated to open at 25,368.91

- China's A50 Index futures are up 46 points (0.3%), the cash market is currently estimated to open at 15,598.25

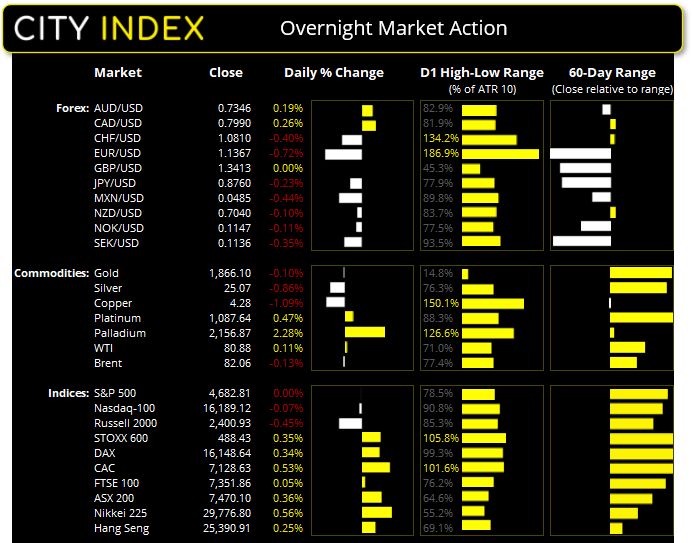

UK and Europe:

- UK's FTSE 100 index rose 3.95 points (0.05%) to close at 7,351.86

- Europe's Euro STOXX 50 index rose 15.86 points (0.36%) to close at 4,386.19

- Germany's DAX index rose 54.57 points (0.34%) to close at 16,148.64

- France's CAC 40 index rose 37.23 points (0.53%) to close at 7,128.63

Monday US Close:

- The Dow Jones Industrial fell -12.86 points (-0.04%) to close at 36,087.45

- The S&P 500 index fell -0.03 points (-0.01%) to close at 4,682.82

- The Nasdaq 100 index fell -10.77 points (-0.07%) to close at 16,189.12

Major US indices closed the session slightly lower, but effectively flat. Higher yields weighed on tech stocks in the first half of the session before recovering earlier losses to close around -0.07% lower. A lack of market-driving news for equities kept volatility on the low side overall.

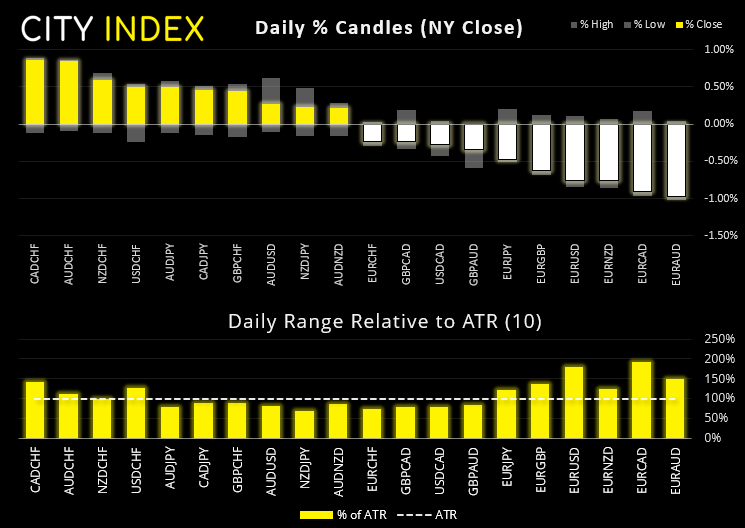

ECB’s Lagarde sent the euro tumbling

Christine Lagarde sent the euro tumbling after ruling out any rate hike next year despite the surge in inflation, as the ECB expect inflation to moderate below 2%. Whilst admitting that higher energy prices could see inflation remain higher and longer than expected, she argued “an undue tightening of financing conditions is not desirable” as it would present an “unwanted headwind for the recovery” given higher energy bills are squeezing purchasing power.

EUR/USD traded below 1.14 for the firt time since July 2020 which helped push the US dollar index to 95.42. EUR/NZD has seemingly topped out after failing to break back above the March 2021 low. 1.6100 is the next level for bears to conquer as part of a larger down move we have been anticipating.

You can read the original analysis for EUR/NZD here, where we take a big picture view.

It was a “close call” to hold rates, said BOE Governor Andrew Bailey

The unreliable boyfriend (mark II) teased expectations of a potential hike again, when speaking to the House of Commons yesterday. Whilst felling “very uneasy” about inflation, he said that “most of” the nine members who voted at the last BOE meeting wanted more employment data, as they’re unsure of that happened to around 1 million workers when the furlough scheme ended. This makes today’s employment figures the more important then.

Xi and Biden to meeting (virtually) this morning

We never expected their first meeting to be love at first sight, but it seems it could be a frosty one with Taiwan being a sore talking point between the two leaders. On Monday, the state-backed China Daily wrote that “In order to reduce the risk of a strategic collision between China and the U.S., the latter must take a step back from the Taiwan question and show its restraint”.

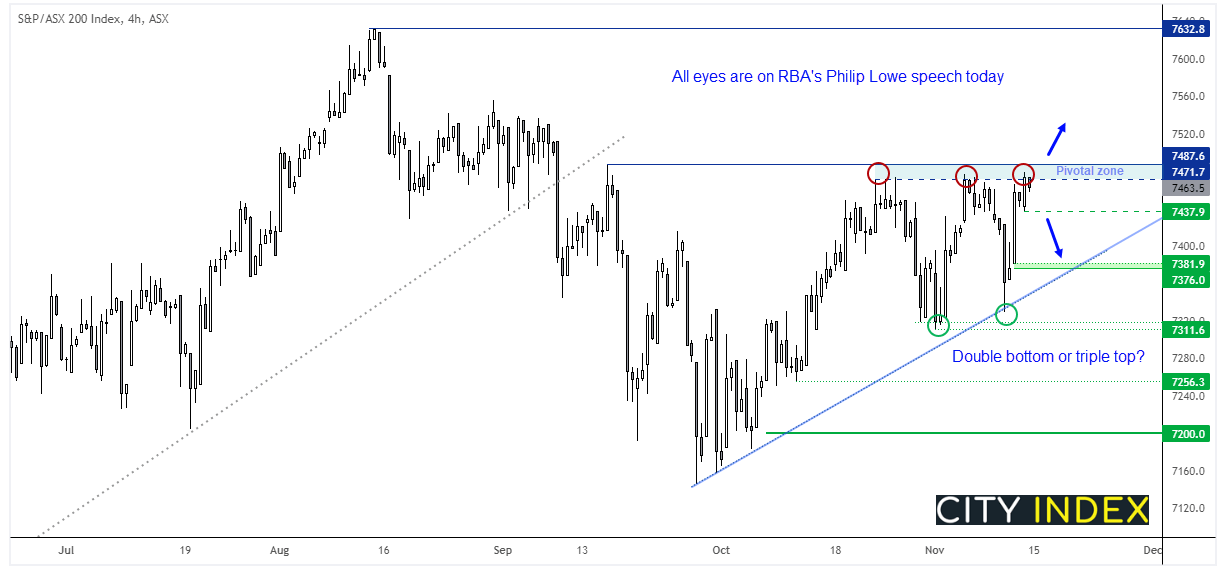

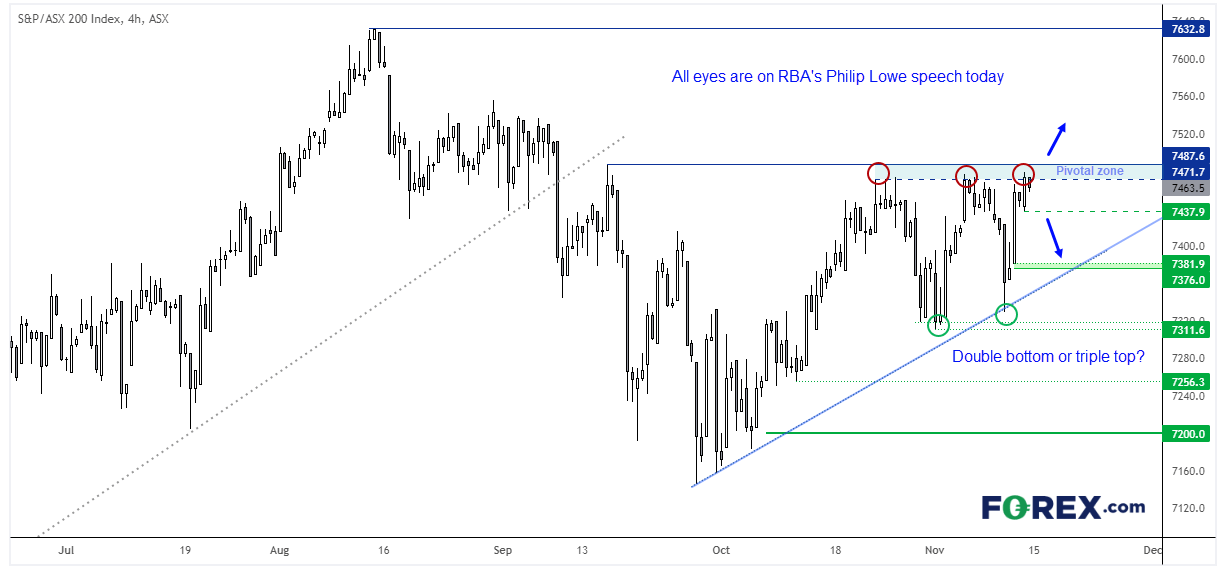

RBA minutes and Governor speech up next

RBA’s Governor Philip Lowe will present “Recent Trends in Inflation” at the Australian Business Economic Forum at 13:30 AEDT. Given that the central bank has favoured speeches or newspaper columns to drop hints of a policy change in recent years and many market participants think they really are behind the curve, we suggest you keep this on your radar. They argue that they want to see wage inflation to bring up their own expectations of actual inflation, and that inflation is mostly and overseas issue. Therefore, any hint from the governor that wages may pick up would be as good as saying they’ll hike rates. Perhaps it will be a non-event, but it is better to be prepared than caught offside.

ASX 200 stalls at resistance ahead of Lowe speech:

The ASX 200 is expected to open lower ahead of Philip Lowe’s speech today. Its two-day rally met resistance around the October and November highs, just below the September 16th high, which underscores its importance as a pivotal area ahead of today’s speech. Simply put, a hawkish speech could send the index lower below resistance, whilst a (defiantly) dovish stance could see the index break to new highs.

ASX 200: 7470.1 (0.36%), 15 November 2021

- Healthcare (1.21%) was the strongest sector and Energy (-0.19%) was the weakest

- 8 out of the 11 sectors closed higher

- 3 out of the 11 sectors closed lower

- 6 out of the 11 sectors outperformed the index

- 116 (58.00%) stocks advanced, 67 (33.50%) stocks declined

- 63.5% of stocks closed above their 200-day average

- 54% of stocks closed above their 50-day average

- 55% of stocks closed above their 20-day average

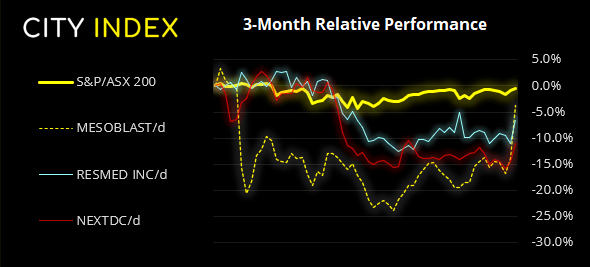

Outperformers:

- + 11.76%-Mesoblast Ltd(MSB.AX)

- + 5.16%-Resmed Inc(RMD.AX)

- + 4.11%-NEXTDC Ltd(NXT.AX)

Underperformers:

- ·-2.48%-Uniti Group Ltd(UWL.AX)

- ·-2.08%-Ampol Ltd(ALD.AX)

- ·-2.02%-Platinum Asset Management Ltd(PTM.AX)

Up Next (Times in AEDT)

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade