Asian futures:

- Australia’s ASX 200 futures are currently down -38 points (-0.56%), the cash market is currently estimated to open at 6,780

- Nikkei 225 futures are currently down -210 points (-0.71%), the cash market is currently estimated to open at 29,349.1

- Hang Seng futures are currently down -269 points (-0.91%), the cash market is currently estimated to open at 29,611.42

FTSE 100:

- FTSE 100 futures are currently up 16 points (0.24%)

European futures:

- Euro STOXX 50 futures are currently down -15 points (-0.4%)

- Germany’s DAX future are currently down -25 points (-0.18%)

- France’s CAC 40 futures are currently down -10.5 points (-0.18%)

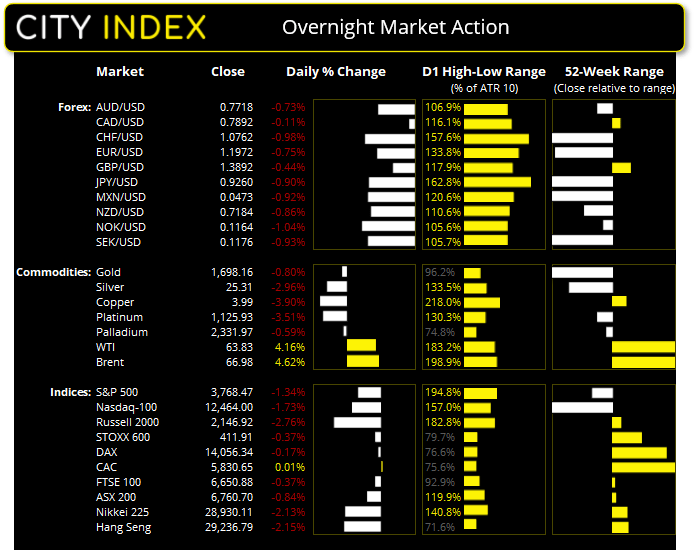

Tuesday’s US close:

- The Dow Jones index fell -121.43 points (-0.39%) to close at 31,270.09

- The S&P 500 index fell -50.57 points (-1.31%) to close at 3,819.72

- The Nasdaq 100 index fell -376.62 points (-2.88%) to close at 12,683.328

Whilst bond volatility was not at the higher levels seen last week it was enough to suggest equity traders are still keeping a close eye. A weak ISM manufacturing print and mediocre employment report also weighed on equity prices which helped the dollar catch a bid.

The Nasdaq 100 led Wall Street lower overnight and came close to testing its lowest point this year. Healthcare and technology stocks were the worst hit, nearly 70% of stocks within the index fell over 1% and over 20% declined over 4%. At the equity level, Moderna (MRNA) was the weakest stock at -9%, Zoom (ZM) fell -7.5%, PayPal (PYPL) slipped -4.8%, Ebay (EBAY) traded -3.9% lower and Tesla Inc (TSLA) was down -3%.

Technically the Nasdaq fell through key support at 12,755 and closed near the low of the session. Of the major indices on Wall Street it is the only one to have closed beneath the 20 and 50-day eMA’s. The S&P 500 held above its 50-day eMA whilst small cap stocks on the Russell 200 continue to remain favourable and shed just -0.32%. The index remains in a sideways range just off record highs and holds above its 20-day eMA.

ISM services ‘got served’

The ISM services PMI failed to live up to expectations, with the headline figure expanding at a slower pace of 55.3 versus 58.7 forecast. At the headline level the rate of growth is far from terrible but was overshadowed by the much stronger ISM manufacturing report on Monday. It is also its weakest expansion since in 10-months since it rose back above 50. Prices paid (an inflationary input) were their lowest since September 2008, the employment index fell to 52.7 and new orders fell form 61.8 in January to 51.9 in February. Still, the rival Markit services PMI remained at a healthy 59.8 which took the combined composite figure to 59.5. So perhaps its not the end of the world.

Forex: The dollar tracked yields higher

Any expectations of a weaker dollar yesterday failed to materialise as USD was one of the stronger currencies overnight. Yet volatility remained caped for the greenback with the US dollar index (DXY) rising around 0.16%. Holding above its 20-day eMA, a small bullish candle has formed yet its volatility is around half the size of Monday’s bearish hammer. So, on a day-to-day basis its next direction could be a flip of a coin.

The Canadian dollar was supported by higher oil prices which saw USD/CAD fall to a two day low but find support at the January 2021 low. Yet USD/JPY and USD/CHF etched out new multi-month highs.

GBP/USD (+0.08%) produced a minor break above Monday’s hammer low yet met resistance at 1.4000 and retreated back within Monday’s range. The bias remains bullish above 1.3828 but upside momentum is currently lacking. Rishi Sunk released his annual budget statement where he announced the extension of the furlough scheme and the VAT cut, and expects the UK’s economy to reach pre-pandemic levels by mid-2022.

EUR/USD also failed to live up to expectations with a false break of Monday’s bullish hammer and met resistance around 1.2100 and its 20-day eMA. Traders will keep a close eye to see if 1.2000 continues to hold as support.

Commodity currencies NZD and AUD were the worst hit, with NZD/USD falling -0.7% and AUD/USD down 0.65% at their session lows before closing at 0.7244 and 0.7775 respectively. NZD was helped lower by comments from RBNZ Governor, who said a multipronged approach was required to manage the multifaceted nature of housing prices. This comes just after RBNZ announced housing prices will be considered in future policy meetings and growing expectations that macro-prudential tools to be implemented.

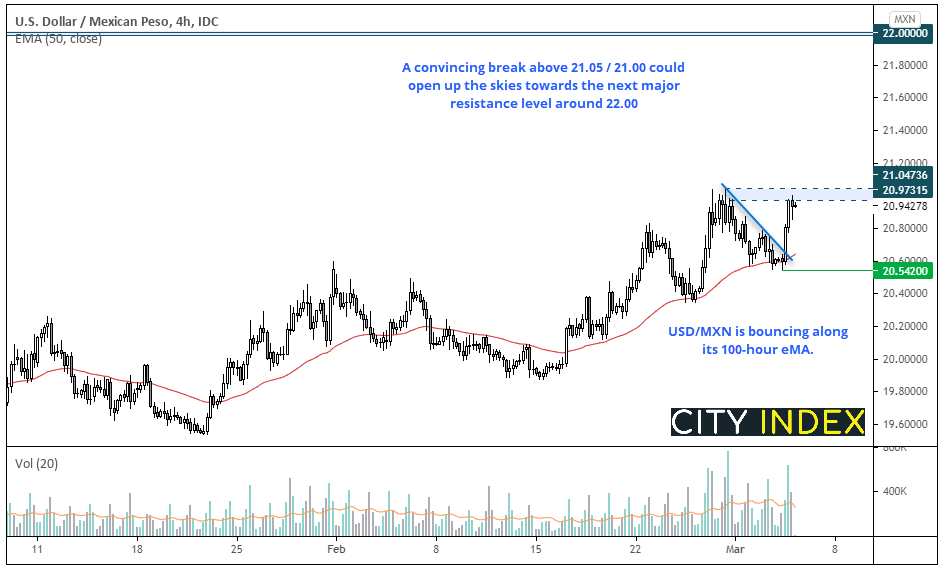

USD/MXN: Divisive ‘power’ bill to send Peso lower?

The Mexican peso was the weakest currency overnight as the Mexican Senate approved a controversial power bill which gives the state power utility priority. USD/MXN rallied 1.7% and is close to breaking above recent highs around 21.00.

The daily chart has been producing a rounding bottom formation since November, although its breakout level is less than clear. Regardless, the daily chart continues to print a series of higher lows, accelerate away from its 20-day eMA and yesterday formed a bullish engulfing (and outside) day.

We can see the hourly chart has found support at the 100-hour eMA and momentum has seen prices breakout of compression. If it can break convincingly above the 21.05 / 21.00 area then it could open up the skies towards the next major resistance level at 22.00.

- Bulls could consider entering with a break above last week’s high (21.07) to assume bullish continuation

- Alternatively, they could seek to enter on dips within yesterday’s bullish engulfing candle.

- The bias remains bullish above the 20.53 low and the next major resistance level (or bullish target) is the spike high around 21.98.

Commodities: Gold probes 1700

We had begun to wonder if gold had formed an interim low after Monday’s bullish hammer failed to touch 1700. Yet yesterday’s bearish engulfing candle quickly quashed that, after prices fell and stopped just shy of this key level. Price action can get messy around such round numbers so a clear break lower is not a guarantee. But a daily close beneath it or evidence that a broken 1700 level has been respected as new resistance could be a calling to any bears currently side-lined.

Oil prices produced bullish engulfing candles at their 20-day eMA, WTI is back above $60 and closed above its 10-day eMA whilst Brent closed on its 10-day eMA around 64.00. Check out Matt Weller’s OPEC+ meeting preview to see how it could impact oil prices this week.

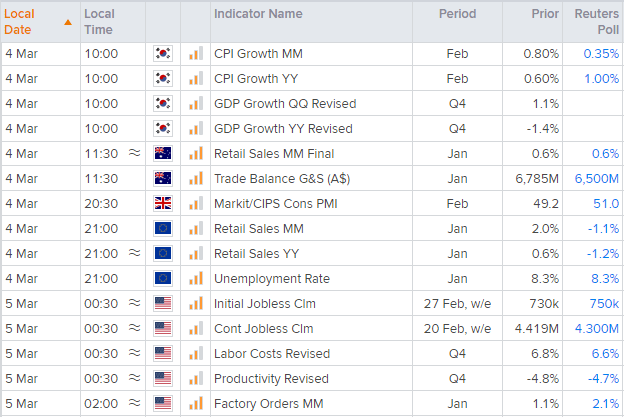

Up Next (Times in AEDT)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

- South Korean inflation data and revised GDP could provide pockets of volatility for riskier assets such as Asian indices, AUD or NZD pairs if they deviate too far from consensus (typically they could rise on strong results or weaken on soft numbers).

- Australian retail sales warrant a look to see if they can maintain momentum seen in Q4’s GDP report released earlier this week.

- Overnight, (04:05 AEDT) ed Chair Jerome Powell is to talk of the US economy before the Wall Street Journal’s job summit.

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.