Asian Futures:

- Australia's ASX 200 futures are up 22 points (0.3%), the cash market is currently estimated to open at 7,451.30

- Japan's Nikkei 225 futures are up 360 points (1.26%), the cash market is currently estimated to open at 28,815.60

- Hong Kong's Hang Seng futures are down -62 points (-0.26%), the cash market is currently estimated to open at 23,892.91

- China's A50 Index futures are up 184 points (1.16%), the cash market is currently estimated to open at 16,153.88

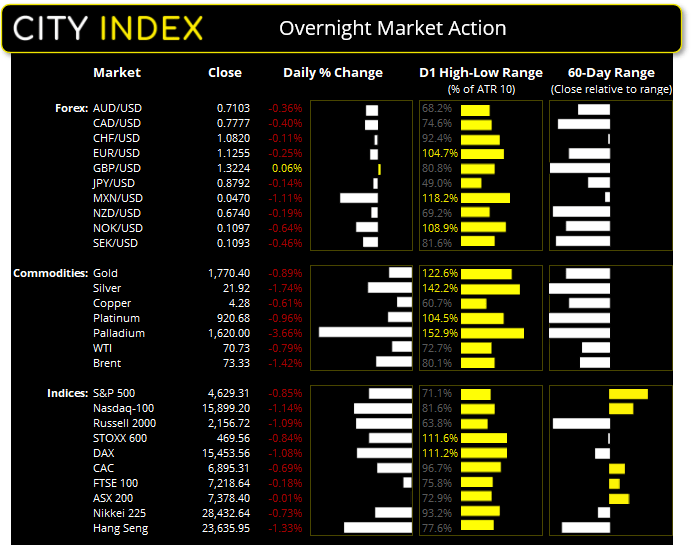

Tuesday US Close:

- The Dow Jones Industrial fell -106.77 points (-0.3%) to close at 35,544.18

- The S&P 500 index rose 95.08 points (2.08%) to close at 4,686.75

- The Nasdaq 100 index rose 479.503 points (3.03%) to close at 16,325.66

This image will only appear on forex websites!

Producer prices have continued to rise in the US with bottlenecks very much remaining along supply chains. Final demand producer prices rose to a record high of 9.6%, or 7.7% excluding food and energy. Goods rose 14.9% y/y, (9.3% excluding food and energy) and services rose 7.1% y/y. Whilst we suspected this would be coming the data set was likely a little more potent being on the even of the FOMC meeting, where there are some calls for the Fed to double their current pace of tapering and begin hiking rates from as soon as March.

Everything you need to know about the Federal Reserve

The S&P 500 fell -0.75% to 5-day low but held above its 50-day eMA and monthly pivot point with a Doji. The technology sector was the underperformer and traded around -1.7% on the day. The Nasdaq 100 initially fell around -1.2% and was the weaker performer among the large cap indices.

Mixed results from Pfizer with Omicron on the scene

Pfizer claimed that their antiviral COVID-19 pill has showed effectiveness in reducing the spread of Omicron and that it has a near 90% efficacy in preventing hospitalisations in high-risk patients. Separately, a study has shown the Pfizer vaccination has become less effective in South Africa with the arrival of Omicron.

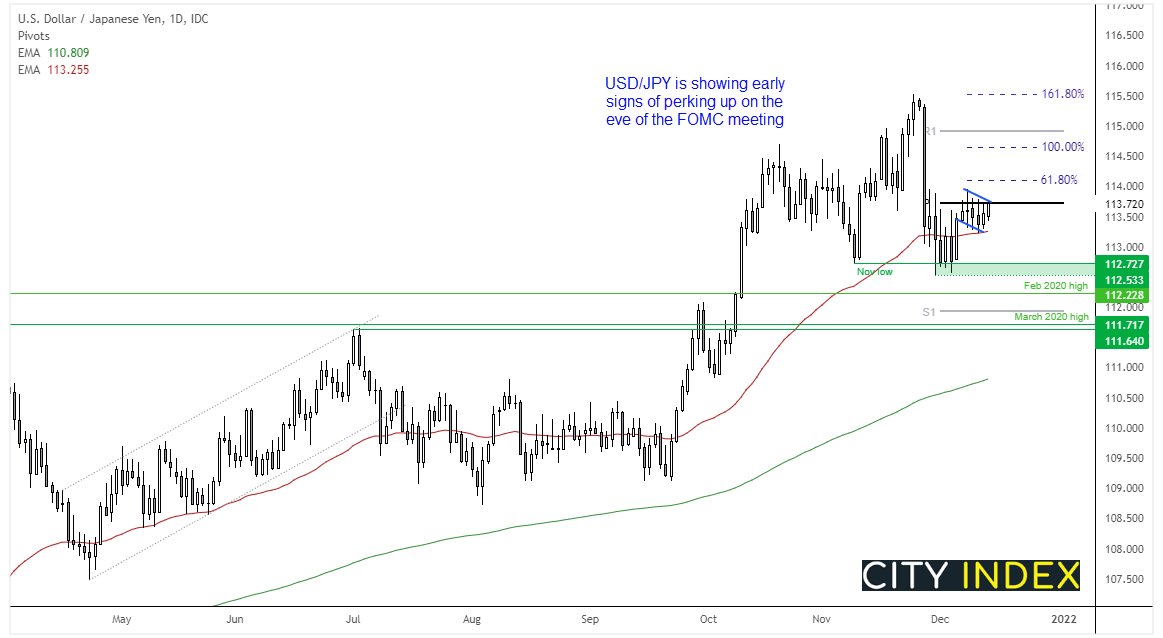

USD remains firm ahead of FOMC

The US dollar and British pound were the strongest currencies, which saw USD/CAD break to a 3-month high. And the pair is likely susceptible to further volatility as Canada release their inflation data ahead of the FOMC meeting.

AUD/JPY continues to flirt with a breakout on the daily chart, although it saw a false break of 80.67 and is on track fort a Doji to close back above that level. It’s also respecting trend resistance, but we’d want to see a break (or daily close) above 82.0 before becoming confident of a sustainable bullish move.

USD/JPY is beginning to perk up the FOMC, with the rate ad tapering announcement scheduled for 06:00 AEDT tomorrow. We can see a base has formed around 112.50 after several failed attempts to close beneath the November low, followed by a higher high towards 114.00. Support has been found above the 50-day eMA so we’re now looking for a break above last week’s high. Fibonacci expansion ratio’s place potential upside targets near 114.11, 114.65 and back at the November high around 115.50. Of course, what bulls need to hear is for tapering to be increased (and likely doubled) – anything ‘short’ of that could become a US dollar bear play.

Gold hits a 7-day low

The yellow metal has consistently failed to rise to 1800 this month and the more volatile days are down days. So, there’s clearly a lack of appetite to bid this higher for now, with the potential for a break beneath the November low should the Fed come out swinging with hawkish taper tomorrow.

Silver probed its November low around $22.0 – a level we expect to remain pivotal over the next 24 hours. And whilst the trend is clearly bearish on the daily chat we are mindful of historical lows nearby at 21.43 and 21.66 which could act as support (or even a springboard should the Fed underwhelm hawkish expectations).

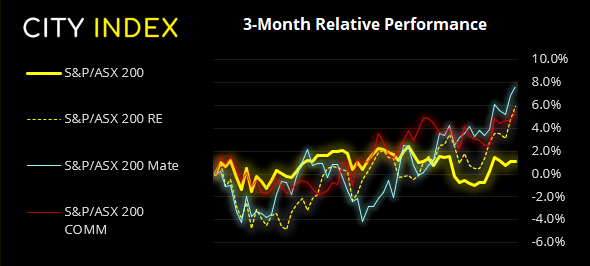

ASX 200 Market Internals:

ASX 200: 7378.4 (-0.01%), 14 December 2021

- Real Estate (1.1%) was the strongest sector and Consumer Staples (-3.96%) was the weakest

- 7 out of the 11 sectors closed higher

- 7 out of the 11 sectors outperformed the index

- 112 (56.00%) stocks advanced, 81 (40.50%) stocks declined

- 59% of stocks closed above their 200-day average

- 56.5% of stocks closed above their 50-day average

- 57% of stocks closed above their 20-day average

Outperformers:

- + 15.44% - Polynovo Ltd (PNV.AX)

- + 6.71% - Blackmores Ltd (BKL.AX)

- + 5.28% - Charter Hall Group (CHC.AX)

Underperformers:

- -17.4% - Mesoblast Ltd (MSB.AX)

- -7.67% - Woolworths Group Ltd (WOW.AX)

- -4.12% - Whitehaven Coal Ltd (WHC.AX)

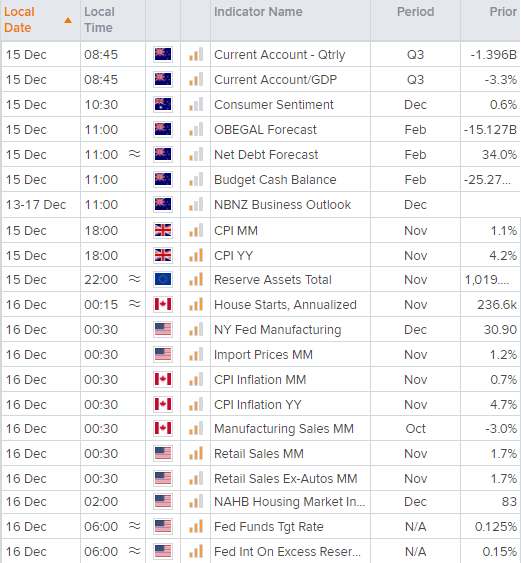

Up Next (Times in AEDT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade