Asian Futures:

- Australia's ASX 200 futures are down -14 points (-0.19%), the cash market is currently estimated to open at 7,259.80

- Japan's Nikkei 225 futures are down -40 points (-0.13%), the cash market is currently estimated to open at 29,799.71

- Hong Kong's Hang Seng futures are down -43 points (-0.18%), the cash market is currently estimated to open at 24,178.54

UK and Europe:

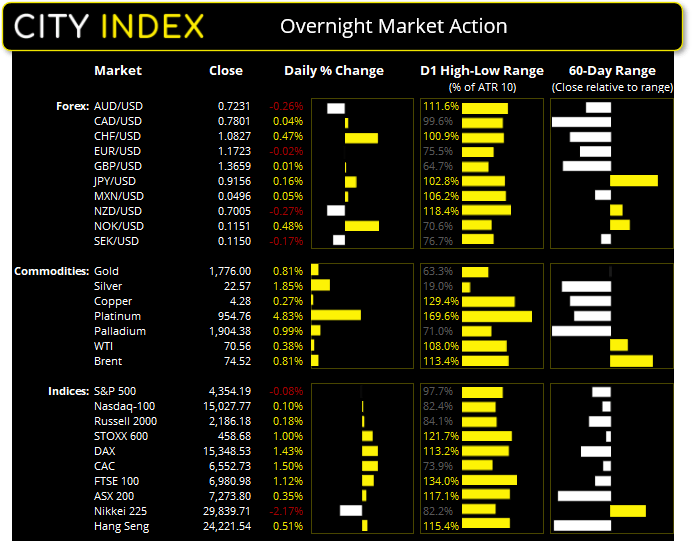

- UK's FTSE 100 index rose 77.07 points (1.12%) to close at 6,980.98

- Europe's Euro STOXX 50 index rose 53.88 points (1.33%) to close at 4,097.51

- Germany's DAX index rose 216.47 points (1.43%) to close at 15,348.53

- France's CAC 40 index rose 96.92 points (1.5%) to close at 6,552.73

Tuesday US Close:

- The Dow Jones Industrial fell -166.42 points (-0.48%) to close at 34,584.88

- The S&P 500 index fell -3.54 points (-0.09%) to close at 4,354.19

- The Nasdaq 100 index rose 15.585 points (0.1%) to close at 15,027.77

Learn how to trade indices

Indices:

The selling subsided on Wall Street yesterday but any early signs of a Turnaround Tuesday failed to materialise by the close. The Nasdaq 100 squeaked a 0.1% gain on the day yet closed below its 200-day eMA for a second day, although it did outperform the S&P 500 and Dow Jones, which closed the day -0.08% and -0.15% lower respectively. Traders were also likely risk averse ahead of tonight’s FOMC meeting.

Canada’s TSX 60 closed 0.5% higher after Justin Trudeau was re-elected, although his failure to secure a majority means he’ll continue to have his work cut out regarding policy.

With China’s markets set to reopen today after a 4-day weekend, all eyes are on how their markets will react to the ongoing Evergrande saga, and whether Biejing will step in to support markets or restructure the flailing company. Failure to do so could prompt another bout of risk-off selling.

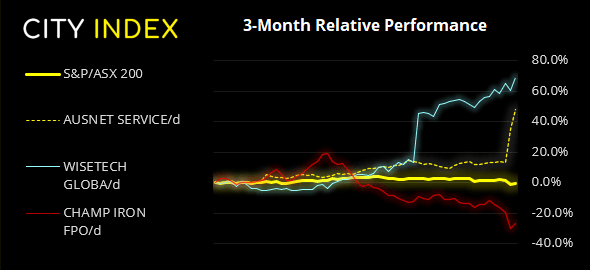

The ASX 200 printed a small bullish hammer around the 7200 support zone, and closed above the October trendline following a brief intraday spell beneath it. The ASX VIX (AXVI) also retreated to show nerves were slightly soothed following Monday’s sell-off. It’s worth noting that call options due to expire tomorrow outstrip put options between 7300 and 7400, and the cash index currently trades at 7273.80.

ASX 200 Market Internals:

ASX 200: 7273.8 (0.35%), 21 September 2021

- Energy (1.47%) was the strongest sector and Financials (-0.43%) was the weakest

- 10 out of the 11 sectors closed higher

- 1 out of the 11 sectors closed lower

- 8 out of the 11 sectors outperformed the index

- 130 (65.00%) stocks advanced, 58 (29.00%) stocks declined

- 66% of stocks closed above their 200-day average

- 45% of stocks closed above their 50-day average

- 30% of stocks closed above their 20-day average

Outperformers:

- + 9.75% - AusNet Services Ltd (AST.AX)

- + 5.05% - WiseTech Global Ltd (WTC.AX)

- + 4.24% - Champion Iron Ltd (CIA.AX)

Underperformers:

- -4.73% - APA Group (APA.AX)

- -4.52% - Nickel Mines Ltd (NIC.AX)

- -3.92% - Janus Henderson Group PLC (JHG.AX)

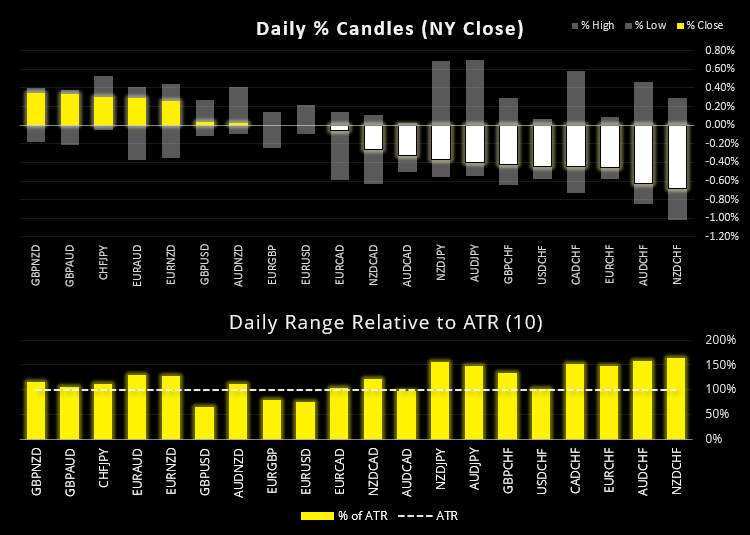

Forex:

The Swiss franc and Japanese yen continued to attract safe haven flows for a second day, despite earlier signs of a of a Wall Street rebound earlier in the day. Even the dollar felt the strain of the safe haven currencies ahead of today’s FOMC meeting. We will likely find volatility to be lower today leading up to the meeting, unless we get a fresh catalyst ahead of it.

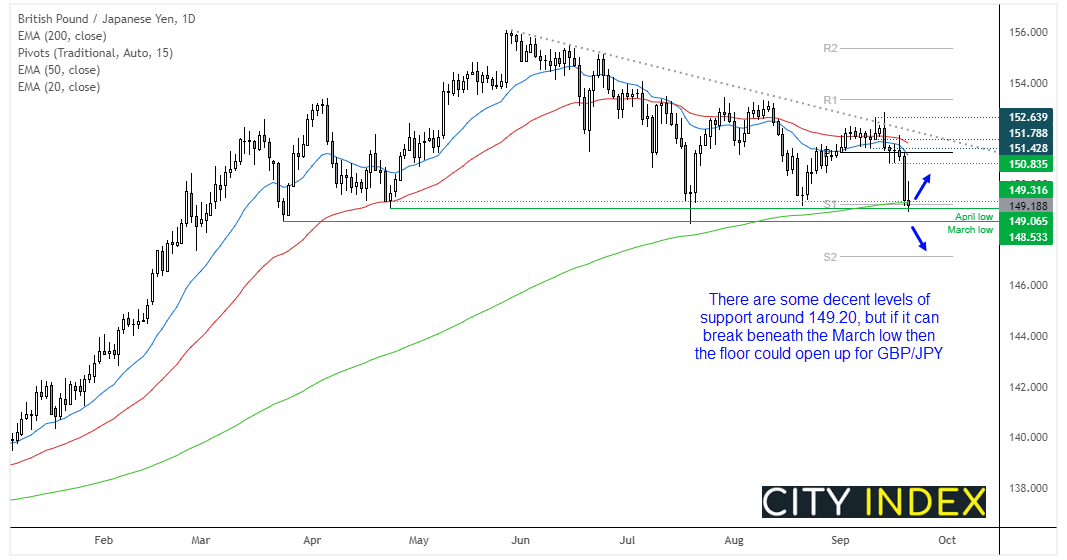

The British pound remains under pressure ahead of tomorrow’s BOE meeting as the energy price crisis now has many suspecting they will not be as hawkish as originally anticipated. Soaring gas prices (up 250% in the past three months alone) are expected to weigh heavily on the economy, with 10 gas suppliers having folded in the past 5 weeks and many more to follow.

GBP/JPY remains of interest for bears as the hedge-appeal of the yen and UK economic woes are the ideal storm for the pair. It has fallen around -2.5% since its false break of trend resistance and spent a day consolidating around the 200-day eMA and April/August low after Monday’s selloff. The inverted hammer shows a mild attempt to change direction, but given the backdrop explained above then a break of yesterday’s low could trigger its next move lower. Especially if Evergrande fails to weigh on broader sentiment and BOE have a dovish tone.

BOJ’ policy meeting is scheduled for today around 12:30 AEST, although this time is never fixed and no change of policy is expected).

Learn how to trade forex

Commodities:

WTI held above $70 after another false break beneath it and formed a slightly bullish Doji candle, breaking a 4-day bearish streak. Should the Fed disappoint and not announce tapering (and weaken the dollar) then we may well see WTI turn higher once more.

Gold prices rallied to our near-term bullish target of 1780 overnight. It remains a pivotal level over the next day or two but, with the FOMC meeting pending, happy to step aside for now.

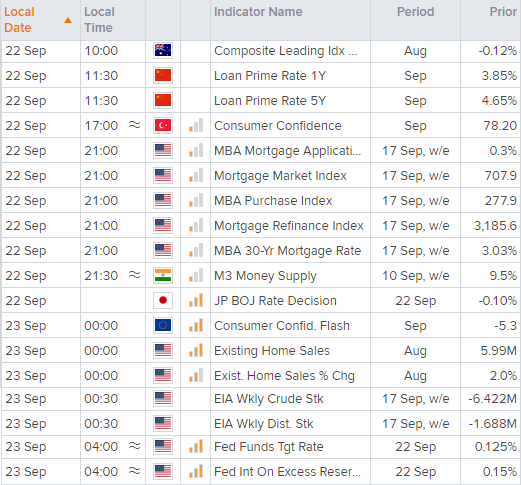

Up Next (Times in AEST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.