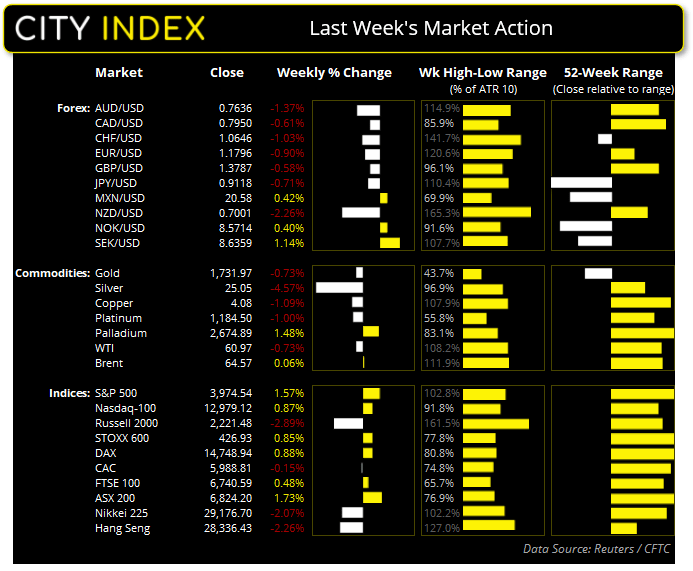

Asian Futures:

- Australia’s ASX 200 is currently estimated to open at 6824.2

- Japan's Nikkei 225 futures rose 340 points (1.17%), the cash market is currently estimated to open at 29516.7

- Hong Kong's Hang Seng futures fell -37 points (-0.13%), the cash market is currently estimated to open at 28299.43

European Friday close:

- UK's FTSE 100 index rose 65.76 points (0.99%) to close at 6740.59

- Europe's Euro STOXX 50 index rose 34.11 points (0.89%) to close at 3866.68

- Germany's DAX index rose 127.58 points (0.87%) to close at 14748.94

- France's CAC 40 index rose 36.4 points (0.61%) to close at 5988.81

US Friday close:

- The Dow Jones rose 453.38 points (1.39%) to close at 33,072.88

- The S&P 500 rose 65.02 points (1.66312%) to close at 3,974.54

- The Nasdaq 100 rose 198.606 points (1.55%) to close at 12,979.12

Indices push higher late on Friday

Inflated hopes of an economic rebound lifted the S&P 500 and Dow Jones to record highs in late trade on Friday. Core PCE (the Federal Reserve’s preferred inflation gauge) rose to 1.6% versus 1.4% prior and the Michigan consumer sentiment index rose to 84.9, up from 83 previously.

The S&P 500 is now just 25 points below 4,000 and could hit the milestone level today if bullish recent momentum is sustained. The Nasdaq 100 rose to a 2-day high and closed the week with a Rikshaw man doji (indecision candle), although the Nasdaq composite posted a second consecutive weekly decline. The Russell 2000 closed back above its 50-day eMA after a rebound on Thursday and Friday but was the only major US index to close lower for the week at -2.9%.

The ASX 200 closed to an 8-day high last week, although it has been effectively trading sideways since the end of February. A break above 6850 brings the February high into focus, but until then range trading strategies are preferred.

The Hang Seng index rebounded on Thursday and Friday and is now re-testing the neckline of its head and shoulders top pattern. A break above Friday’s high invalids the bearish reversal pattern on the daily chart.

Learn how to trade indices.

Forex: USD closes to a 4-month high

The US dollar index (DXY) produced a bearish inside day on Friday and remains around its 200-day eMA. Still, it closed at its highest level since the end of November and was its most bullish session in three and now sits at a 4-month high. And given traders remain net-long US dollar index futures, our core bias remains long the dollar.

- The British pound was higher on Friday thanks to stronger-than-expected retail sales. Excluding fuel, retail sales MoM rose by 2.4% compared with 1.9% forecast and -8.7% previously. On a year-over-year basis it fell just -1.1% compared with -1.5% forecast and -3.7% forecast.

- Despite the dollar’s strength, the Australian dollar rose to a two-day high on Friday after printing an indecision candle on Thursday (Rikshaw man doji) and holding above 0.7557 support.

- EUR/AUD found resistance at its 50-day eMA last week and fell to a four-day low on Friday. The near-term bias remains bearish below 1.5500 (just beneath Wednesday and Thursday’s lows).

- USD/JPY hit our initial target at 109.85 on Friday and closed to its highest level since June. A break above 1.1000 brings the March high into focus around 111.50.

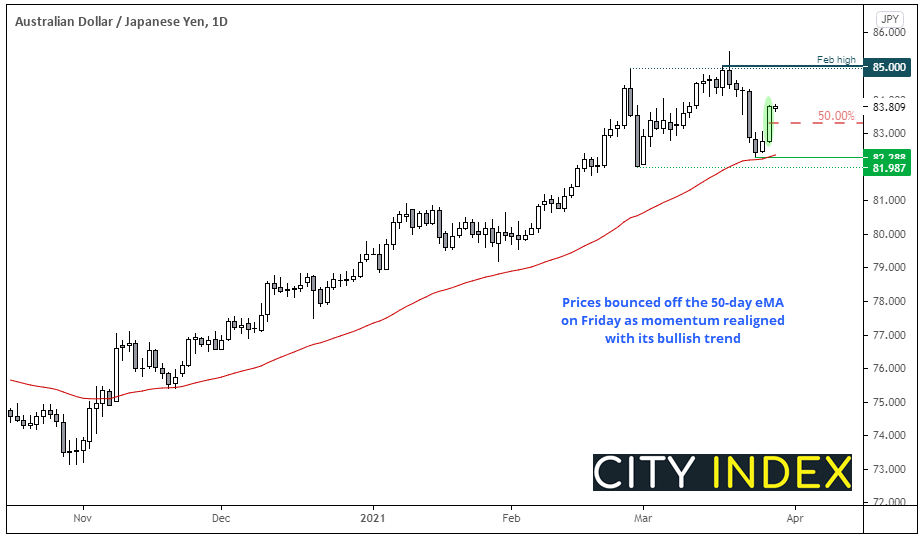

AUD/JPY bounces off its 50-day eMA

After five consecutive bearish days, AUD/JPY found support at its 50-day eMA and bulls regained control with a strong bullish session on Friday. In fact, Friday’s candle was a bullish opening Marabuzo candle, which means it opened at the low and produced a large bullish candle with a small upper wick.

This places the Marabuzo line (50% retracement between the candle’s open and close) around 83.30 as potential support next week.

- The bias remains bullish above the Marabuzo line around 83.30.

- Initial target is 85.00.

- A break below the 81.98 low warns of a potential trend reversal.

Learn how to trade Forex

Commodities: Palladium set to retest 2020 highs?

Palladium broke above 6757.50 resistance on Friday to suggest is short correction may be over. Prices broke aggressively higher two weeks ago from its multi-month range and shows the potential to retest its record highs set in February 2020. The bias remains bullish above 2564.50.

We remain neutral on gold as bears have repeatedly failed to drive prices below the bearish outside candle’s low at 1718.40. However, we are more open to the idea that the low may be in place, but indecisive price action makes it hard to want to be bullish on gold until prices break above 1764.73.

Silver bulls failed to take prices materially above Thursday’s bullish pinbar on Friday, leaving a small indecision candle (Rikshaw man Doji). Still, not all reversals come off the back of single candlestick pattern, so we’ll continue to look for a burst higher above 24.35 support.

WTI has seen up and down days alternate over the past four. Although whilst this is part of a choppy and volatile range, prices have remains above the 50-day eMA. We will reinstate out bullish bias should prices break above 63.13.

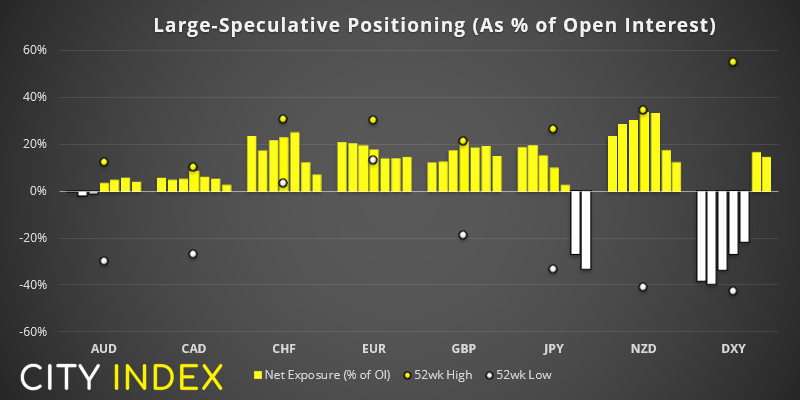

Weekly COT report (Commitment of Traders)

- Traders extended their net-short exposure to JPY futures to their most bearish level since March 2020.

- Large speculators were net-long DXY (dollar index) futures for a second consecutive week.

- Net-long exposure to NZD futures fell to their least bullish level since October, at just 4.7k contracts.

- Traders reduced their net-long exposure to their least bullish level since August 2020.

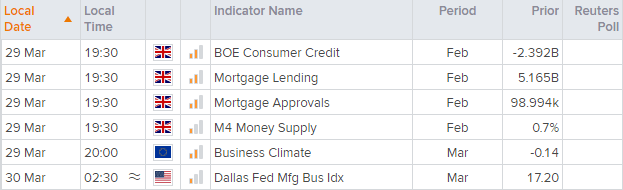

Up Next (Times in AEDT)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

It’s a very quiet calendar today to we may find that trading ranges are smaller than usual unless a new catalyst arises.