Asian Futures:

- Australia's ASX 200 futures are up 17 points (0.24%), the cash market is currently estimated to open at 7,050.80

- Japan's Nikkei 225 futures are up 10 points (0.03%), the cash market is currently estimated to open at 29,001.89

- Hong Kong's Hang Seng futures are up 92 points (0.32%), the cash market is currently estimated to open at 29,033.54

UK and Europe:

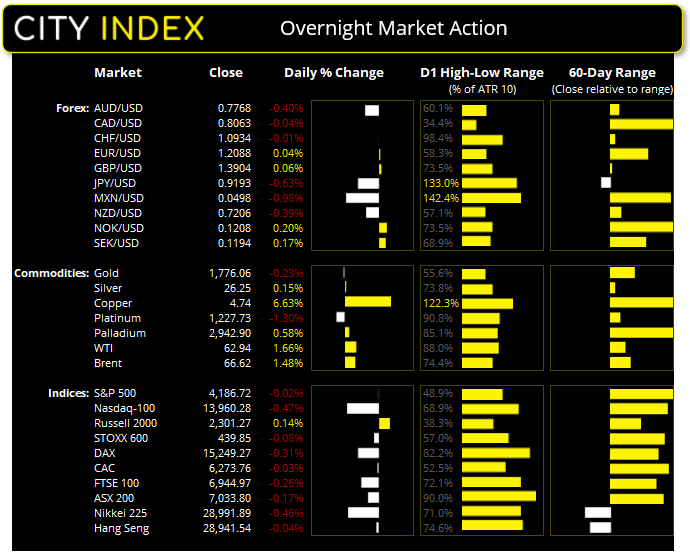

- UK's FTSE 100 index fell -18.15 points (-0.26%) to close at 6,944.97

- Europe's Euro STOXX 50 index fell -8.92 points (-0.22%) to close at 4,011.91

- Germany's DAX index fell -47.07 points (-0.31%) to close at 15,249.27

- France's CAC 40 index fell -1.76 points (-0.03%) to close at 6,273.76

Tuesday US Close:

- The Dow Jones Industrial rose 3.36 points (0.01%) to close at 33,984.93

- The S&P 500 index fell -0.9 points (-0.03%) to close at 4,186.72

- The Nasdaq 100 index fell -65.882 points (-0.47%) to close at 13,960.28

Indices: Nasdaq Falls Back Below 14,000

Markets traded in tight ranges overnight, with no major stock market index reaching its ATR 10 (average true range). The Russell 2000 rose to a five-week high before giving back earlier gains, to close the session with a small indecision candle.

It was less impressive for tech stocks, with the Nasdaq 100 opening at the high of the day and producing bearish 2-bar reversal which closed back beneath 14,000. Tesla (TSLA) fell -4.5% on disappointing earnings, which were fuelled mostly by the sale of its Bitcoin earnings and not by selling cars. Microsoft (MSFT) was down -4% with its own earnings miss, whilst Alphabet (GOOGL) rose +5. IBM (IBM), Visa (V) and Boeing (BA) are scheduled to release their earnings reports overnight.

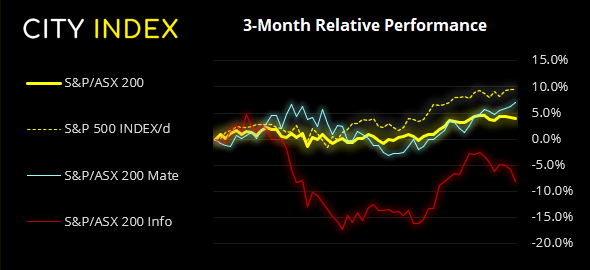

ASX 200 Market Internals:

The ASX 200 printed a large bearish pinbar last week, and prices have remained soft for the past three sessions. Whilst there was a mild recovery yesterday, they remain beneath 7036 resistance which could prove to ab a pivotal level this session.

ASX 200: 7033.8 (-0.17%), 27 April 2021

- Materials (0.74%) was the strongest sector and Information Technology (-2.53%) was the weakest

- 8 out of the 11 sectors closed lower

- 6 stocks hit a new 52-week high, 5 hit a new 52-week low

- 72% of stocks closed above their 200-day average

- 59% of stocks closed above their 20-day average

Outperformers

- + 6.25% - Bingo Industries Ltd (BIN.AX)

- + 4.58% - United Malt Group Ltd (UMG.AX)

- + 4.17% - Tabcorp Holdings Ltd (TAH.AX)

Underperformers:

- -12.1% - Nickel Mines Ltd (NIC.AX)

- -7.84% - Mesoblast Ltd (MSB.AX)

- -6.31% - Zip Co Ltd (Z1P.AX)

Learn how to trade indices

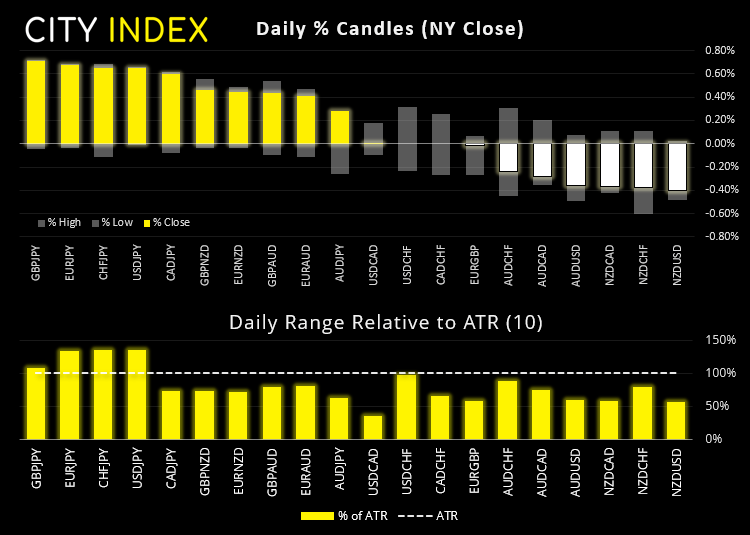

Forex: The yen deflates

The US dollar index (DXY) was effectively flat overnight, with a lack of economic data and a pending FOMC meeting to blame. Despite no expectations for the Fed to change policy, we could find trading ranges to remain limited ahead of the meeting as traders square up their positions. Unless, of course, we get a surprise print for Australia’s CPI report today.

- The Japanese yen was the weakest currency yesterday after the BOJ (Bank of Japan) cut their inflation forecast. The yen was broadly lower against its major peers.

- CAD/JPY rose to a three-day high in line with our bullish bias. The trend remains bullish above the 85.41 low, although we would look for 86.79 to hold as support upon any retracements.

- CHF/JPY closed to its highest level since January 2016 after breaking out of a flag formation on the daily chart. If successful, the pattern projects a target around 120.00.

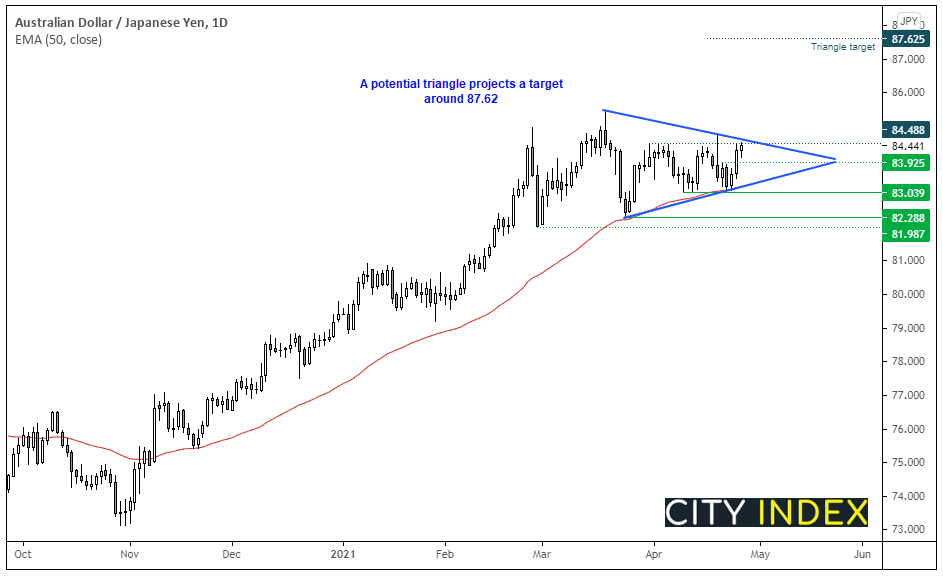

AUD/JPY is in a longer-term uptrend and now appears it may want to break higher. We had previously favoured its potential to top out yet its failure to break below 83.04 and its 50-day eMA shows demand around 83.00. Furthermore, prices are coiling up within a potential symmetrical triangle which projects a target around 87.62. However, take note that if prices remain in the triangle and continue to coil then the projected target will need to be revised for if and when it eventually breaks higher.

Learn how to trade forex

Commodities: Palladium Hits New Highs

WTI rose to a five-day high, having found support above its 50-day eMA and 60.38 low. The bias remains bullish above this key support level. Brent remains supported above 64.64 support and appears to be the stronger of the two oil markets, given its retracement from tis high is shallower than WTI’s and prices remain elevated above the 50-day eMA.

Gold remains above its bullish trendline and 50-bar eMA on the four-hour chart, yet bullish momentum I currently lacking. Still, we suspect prices to remain support above the 1760/69 zone, even if the channel breaks to the downside. So long as prices remain above 1760 then the next target remains 1800.

Palladium futures hit a fresh record high, reaching a high of 2962.50 before settling at 2946.50. Whilst the trend clearly remains bullish, we may find resistance at around 3,000 being such a significant round number.

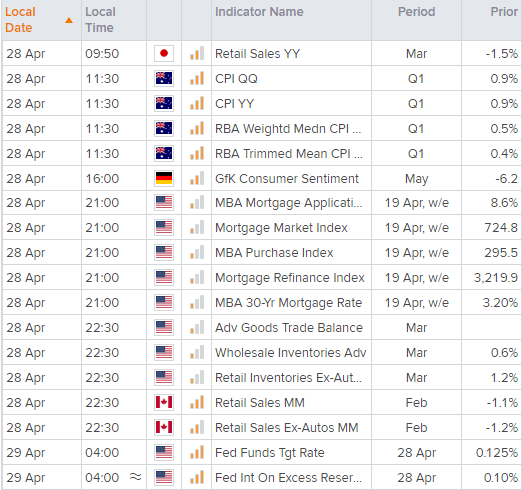

Up Next (Times in AEST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.