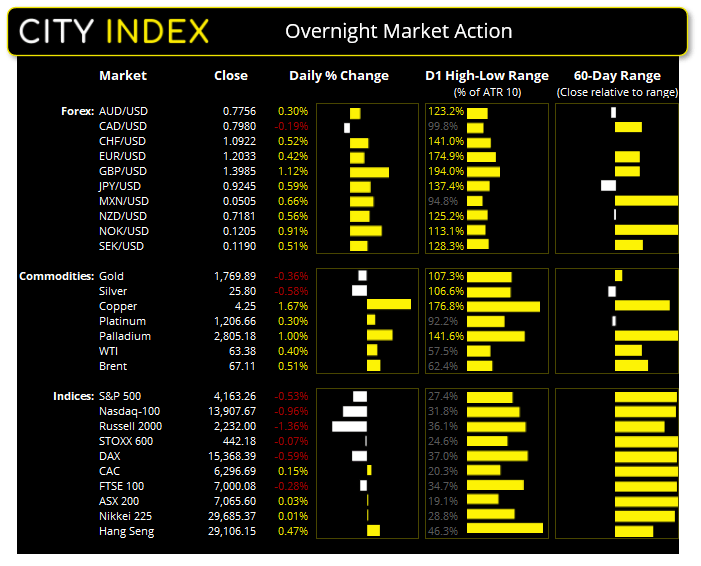

Asian Futures:

- Australia's ASX 200 closed at 7,065.60 (+0.03%)

- Japan's Nikkei 225 futures are down -380 points (-1.28%), the cash market is currently estimated to open at 29,305.37

- Hong Kong's Hang Seng futures are down -158 points (-0.54%), the cash market is currently estimated to open at 28,948.15

UK and Europe:

- The UK's FTSE 100 futures are down -19 points (-0.27%)

- Euro STOXX 50 futures are down -11 points (-0.28%)

- Germany's DAX futures are down -76 points (-0.49%)

Monday US Close:

- The Dow Jones Industrial fell 123.04 points (-0.36%) to close at 34,077.63

- The S&P 500 index fell -22.21 points (-0.54%) to close at 4,163.26

- The Nasdaq 100 index fell -134.237 points (-0.96%) to close at 13,907.67

Indices: Wall Street retreated from their highs

Wall Street retreated from record highs amid their worst session in a month, despite earnings beating expectations overall. Consumer discretionary and information technology were the weakest sectors whilst real estate was the strongest. Tesla shares fell -3.4% upon reports that two passengers were killed whilst operating a vehicle using their driverless technology.

The ASX 200 was effectively flat yesterday after early gains were later reversed. Oil prices weighed on energy stocks yesterday whilst travel stocks rallied as the travel bubble between New Zealand and Australia has opened up.

The day closed with a bearish pinbar on the daily chart, which shows buyer exhaustion just below our 7100 target. Whilst this warns of a potential retracement over the near-term the trend remains bullish above the 6957.40 low.

Learn how to trade indices

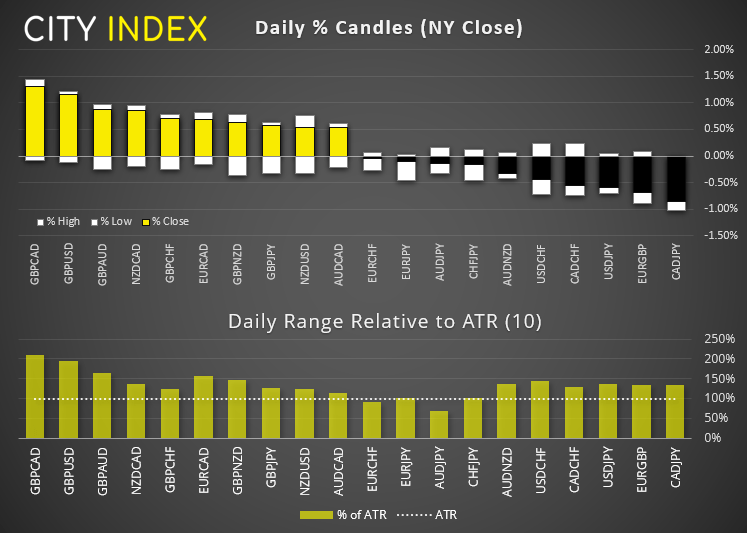

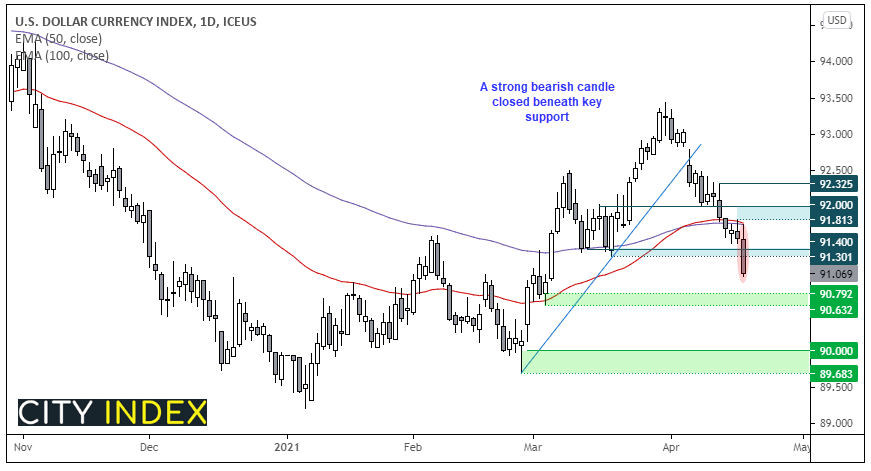

Forex: The dollar’s demise continues

Lower yields and the Fed’s reiteration that they expect inflation to be transitory has continued to weigh on the greenback this week, allowing the dollar to continue reversing gains posted in March. Since its peak on 31st of March, DXY has since fallen -2.6%.

- The US dollar index (DXY) fell -0.54% and broke convincingly beneath our initial target of the 91.30/40 lows, amid its most bearish session in nearly two weeks.

- USD/CHF broke beneath 0.9183 support to a seven-week low and USD/JPY closed beneath the March low to its own seven-week low.

- After initially dipping lower, AUD/USD recovered and closed with a bullish outside day. Its low was just above 77c, so our bias remains bullish above this key support level and for a retest of the 0.7800/50 highs.

Note that the 50 and 100-day eMA’s have converged and both yesterday and Friday’s high respected them as resistance. With prices now beneath a key support level, it provides an ideal area for bearish to load up should prices respect it as a resistance level. The break of trendline support projects a target at the base of the trendline from the 89.68 low, although 90.00 is also a viable number given it significance as a round number.

- The trend (and therefore, the bias) remains bearish below 91.82. However, we’d like to see prices remains beneath the 91.30/40 resistance zone.

- 90.63/80 is a likely support zone, therefore an interim target.

- A break below the 90.63/80 support zone brings the 90.00 target into focus.

The British pound was the strongest major yesterday, rising 1.1% against the US dollar and 1.3% against the Canadian dollar (GBP/CAD was the biggest gainer). Expectations for data to improve over the coming week and even months is on the rise, given the UK is opening back up. And today’s employment and earnings reports kick off what is a busy week of data for the UK, which also includes inflation data, PMI’s and BOE members speaking.

Learn how to trade forex

Commodities: Palladium shines

Palladium was the strongest metal, rising above 2800 to a record high and reaching our 2840 target projected from its sideways range breakout.

Despite a weaker US dollar, gold (-0.36%) failed to hold onto earlier gains and found resistance at its 200-day eMA. Given the significance of this technical level and the two-bar reversal at it, we suspect a retracement is now due before it tries to break above 1800.

Silver (-0.56%) also struggled to retain last week’s bullish momentum but has found support above its 50-day eMA. Given the 50 and 20-day eMA reside at 25.66 and 25.47 then we suspect this band of support could hold prices up for now.

Oil prices remains in a tight range near last week’s highs, after breaking above key resistance levels last Wednesday. WTI rose 0.4% and traders at 63.38 whilst brent was 0.5% higher ad settled at 67.11.

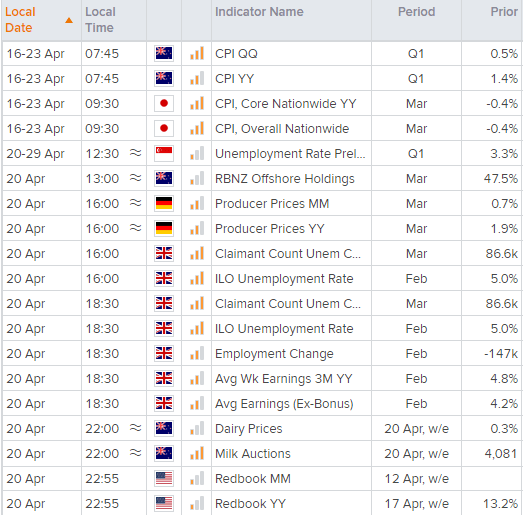

Up Next (Times in AEST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.