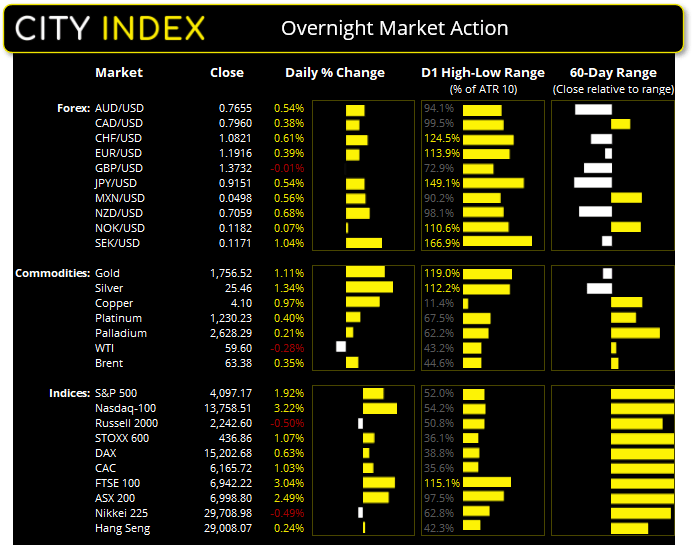

Asian Futures:

- Australia's ASX 200 futures are down -14 points (-0.2%), the cash market is currently estimated to open at 6,984.80

- Japan's Nikkei 225 futures are up 50 points (0.17%), the cash market is currently estimated to open at 29,758.98

- Hong Kong's Hang Seng futures are down -49 points (-0.17%), the cash market is currently estimated to open at 28,959.07

UK and Europe:

- The UK's FTSE 100 futures are up 60.5 points (0.88%)

- Euro STOXX 50 futures are up 19 points (0.49%)

- Germany's DAX futures are up 20 points (0.13%)

Thursday US Close:

- The Dow Jones Industrial rose 57.27 points (0.17%) to close at 33,503.57

- The S&P 500 index rose 17.22 points (0.43%) to close at 4,097.17

- The Nasdaq 100 index rose 141.805 points (1.04%) to close at 13,758.51

Treasury yields lower on Powell comments, tech stocks rally:

Speaking at an International Monetary Fund event overnight, Jerome Powell said that price rises from spending combined with bottlenecks in the supply chain would not cause the kind of yearly increases that would be considered as inflation. Bond traders were quick to snap up treasuries and send yields lower, allowing technology stocks to resume their ascent and send the Nasdaq 100 up 3.2% to a seven-week high, just below its record. The Dow Jones closed above 33,500 for the first time and the S&P 500 enjoyed its second day in history above 4,000.

With futures mostly higher, we expect a positive open across Asia. The Hang Seng shows potential to break above 29,100 resistance which would also invalidate trendline resistance to suggest prices are trying to revert to its longer-term bullish trend, whilst a break below 28,500 warns of another leg lower.

The ASX 200 broke to a 13-month high after its fifth consecutive bullish session, yet 7,000 capped as resistance. From here we would look for the 6938-breakout level to hold as support before targeting the 7,100 handle and the 7,197 highs.

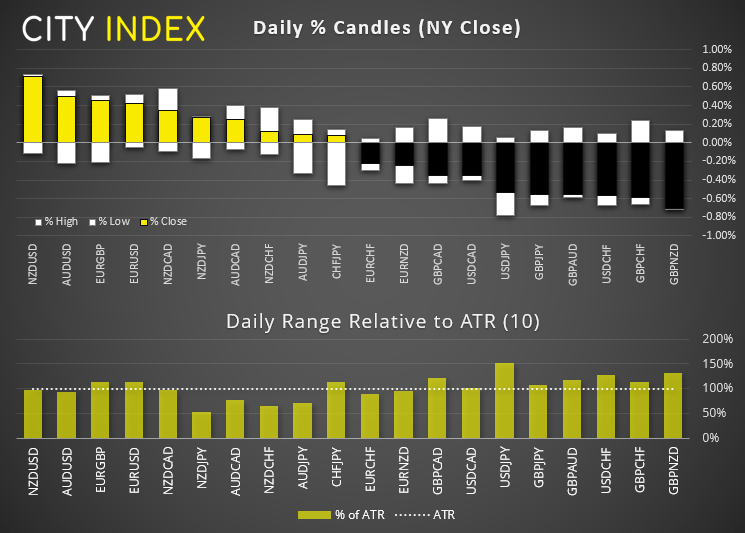

Forex traders exchange GBP and USD for anything else

Correlations (or in many cases, inverted correlations) were strong overnight with traders snapping up antipodeans and offloading the US dollar and the British pound. NZD, CHF and AUD were the strongest majors whilst GBP and USD were the weakest overnight.

The British pound continued to reverse much of its gains accumulated in a strong first quarter, seemingly triggered by issues surrounding the AstraZeneca vaccine setback. And the dollar was weaker following more dovish comments from the fed and higher than expected jobless claims overnight.

- 92.50 resistance held for the US dollar index (DXY) before it fell to a 12-day low, allowing EUR/USD to rise to a 12-day high.

- AUD/USD closed with a bullish inside day after failing to break the lows of Wednesday’s bearish outside day. So, the inverted head and shoulders pattern remains in play but a clear break above 0.7680 / neckline invalidates it, whilst direct losses from here beneath 0.7600 keeps the pattern alive.

- USD/JPY was the most volatile pair relative to its 10-day ATR (average true range) and fell to a two-week low, closing beneath its 20-day eMA. This takes it correction to -1.8% from peak to trough although, technically, the trend remains bullish above the 108.40 swing low. But given the strength of the trend this year, a correction is not overdue.

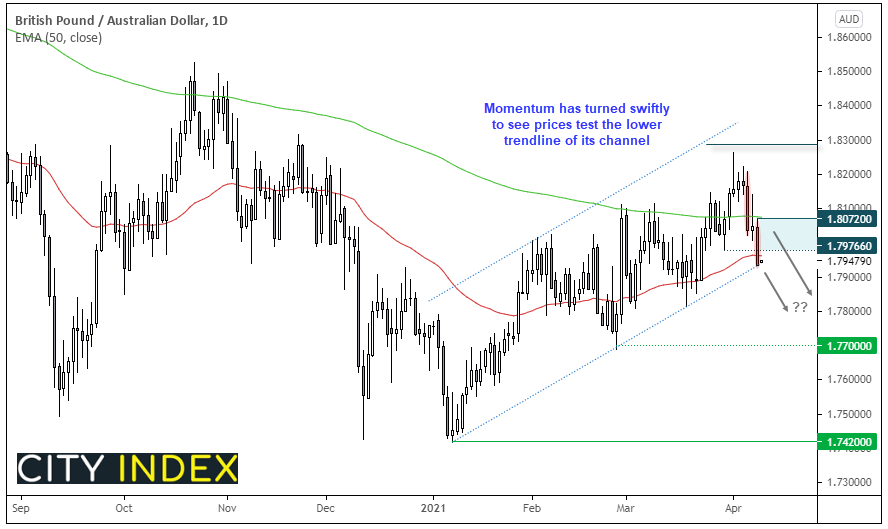

GBP/AUD teases bears with a channel breakout

The weekly chart of GBP/AUD is on track for a bearish outside week, and last week’s close found resistance at the 200-week eMA before prices turned lower. Switching to the daily chart shows that prices closed on the trendline of its rising channel and yesterday’s high found resistance at its 200-dar eMA. Given the negative sentiment surrounding the British pound and the noteworthy pickup of bearish momentum this week, then we are on guard for a downside break of the channel. As always, allow for some noise around such technical levels but, when crosses like GBP/AUD want to move, they do so with vigour.

- The bias remains bearish below 1.8100.

- Given strength of the recent decline, any minor bounce from the trendline could tempt bears to fade into moves (as long as they do not break above yesterday’s high).

- A clear break of the trendline targets the 1.7416 low, with 1.7690 and 1.7800 providing interim bearish targets.

- However, until the trendline breaks the channel remain intact. Si any clear signs of bullish momentum from current lows should be taken seriously. Ideally any bounce should be with low volatility, if the recent bearish leg really does have any… legs.

Commodities: Gold’s double bottom remains very much in play

It was a strong close for gold which now trades around 1755, very much keeping its double bottom pattern alive. Given its bullish pinbar last week and rise this week, we’ll be keeping a close eye on its potential to break above 1764 resistance here on.

Silver also notched up a bullish session although structurally it lacks the allure that gold shows on the daily chart. Still, it closed above trendline resistance on the daily chart but needs to clear its 50-day eMA at 25.68.

Oil prices remain very much range-bound at present. Despite lockdown pressures persisting, markets know OPEC will likely support prices and the weaker dollar is also providing a layer of support, yet by not enough to help it rise. Brent recouped the prior day’s losses and rose 0.35% to 63.38, just below its 20-day eMA yet just above its 50-day. WTI was -0.28% lower for the session but closed just above its 50-day eMA, around the centre of it 57.25 – 62.27 range.

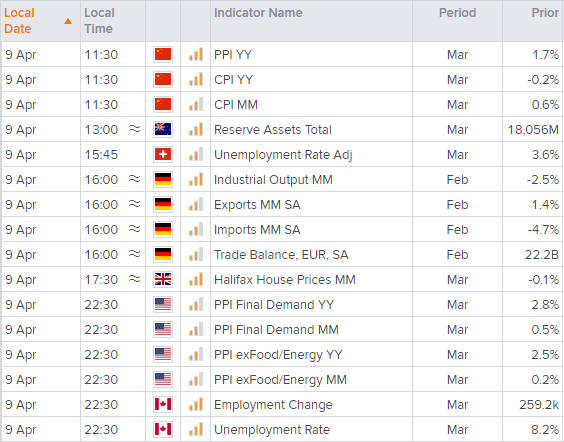

Up Next (Times in AEST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.