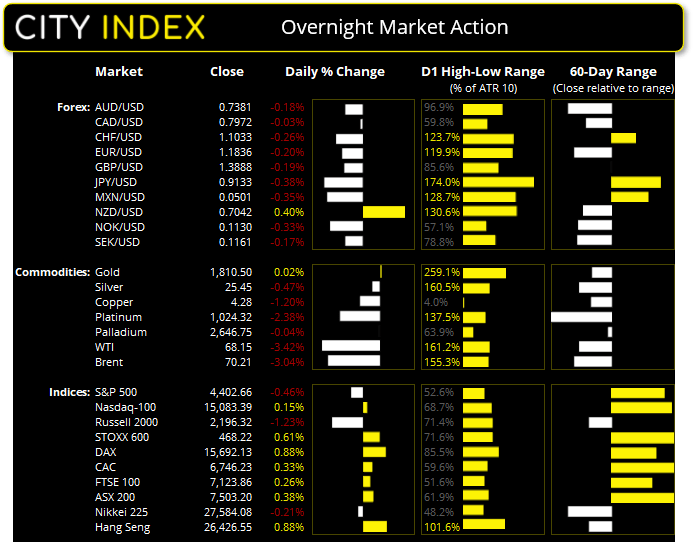

Asian Futures:

- Australia's ASX 200 futures are down -16 points (-0.21%), the cash market is currently estimated to open at 7,487.20

- Japan's Nikkei 225 futures are down -100 points (-0.36%), the cash market is currently estimated to open at 27,484.08

- Hong Kong's Hang Seng futures are up 5 points (0.02%), the cash market is currently estimated to open at 26,431.55

UK and Europe:

- UK's FTSE 100 index rose 18.14 points (0.26%) to close at 7,123.86

- Europe's Euro STOXX 50 index rose 26.95 points (0.65%) to close at 4,144.90

- Germany's DAX index rose 137.05 points (0.88%) to close at 15,692.13

- France's CAC 40 index rose 22.42 points (0.33%) to close at 6,746.23

Wednesday US Close:

- The Dow Jones Industrial fell -323.73 points (-0.92%) to close at 34,792.67

- The S&P 500 index fell -20.49 points (-0.47%) to close at 4,402.66

- The Nasdaq 100 index rose 21.969 points (0.15%) to close at 15,083.39

Learn how to trade indices

US Indices mostly lower, tech outperforms

ADP private payroll data missed expectations, adding only 333k jobs relative to the 695k expected by a Reuters poll. Naturally, this raises a red flag for Friday’s NFP report although the employment components for ISM PMI service and manufacturing reports both expended in July, so there’s hope it may not be a complete disappointment. But, over the past 12 months, the directional change of ADP and NFP have been in sync 8 of the 12 reports (66.6%) of the time.

Still, the ISM manufacturing rose to a record high of 64.1, new orders increased to 63.7 from 52.1 and business activity hit a 4-month high of 67.0 (3rd highest on record). So, ADP employment aside, services PMI takes the edge off-of a weak manufacturing report.

Small caps bore the brunt selling pressures with the S&P SC600 and Russell 2000 value stock falling -2.24% and -1.88% respectively. The Dow Jones (DJI) fell -0.92% and S&P 500 was down -0.46%, led by the energy sector. The Nasdaq 100 closed marginally higher at 0.15% with biotech stocks outperforming.

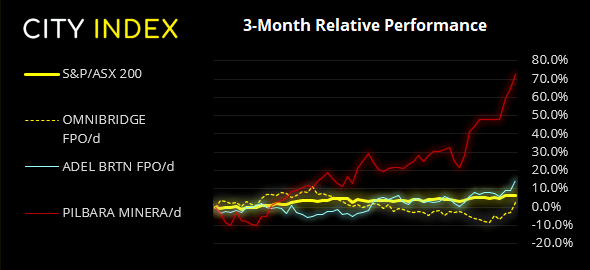

ASX 200 Market Internals:

ASX 200: 7503.2 (0.38%), 04 August 2021

- Materials (1.18%) was the strongest sector and Healthcare (-0.45%) was the weakest

- 8 out of the 11 sectors closed higher

- 4 out of the 11 sectors closed lower

- 110 (55.00%) stocks advanced, 81 (40.50%) stocks declined

- 71% of stocks closed above their 200-day average

- 60.5% of stocks closed above their 50-day average

- 68% of stocks closed above their 20-day average

Outperformers:

- + 5.59% - Omni Bridgeway Ltd (OBL.AX)

- + 4.66% - Adbri Ltd (ABC.AX)

- + 4.57% - Pilbara Minerals Ltd (PLS.AX)

Underperformers:

- -5.62% - Chalice Mining Ltd (CHN.AX)

- -3.31% - GUD Holdings Ltd (GUD.AX)

- -2.88% - Inghams Group Ltd (ING.AX)

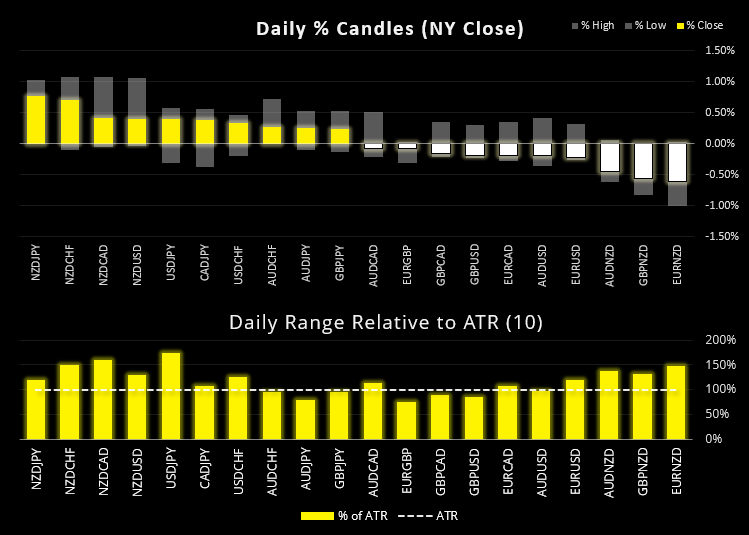

Forex: USD rebounds, second only to the Kiwi dollar

The New Zealand dollar maintained its lead throughout the European and US sessions yesterday, to close the strongest currency thanks to a strong employment bolstering expectations of rate hike/s. NZD/JPY and NZD/CHF were the strongest crosses although not due to a classic ‘risk-on’ carry play, but because weak US employment data saw traders favour the US dollar as a safety play in favour of the yen, making USD the second strongest major. NZD/USD stopped just shy of out 0.7100 target before closing with a bearish hammer on the daily, so it’s a step-aside for now. JPY and CHF were the weakest majors with all but NZD trading lower against the greenback.

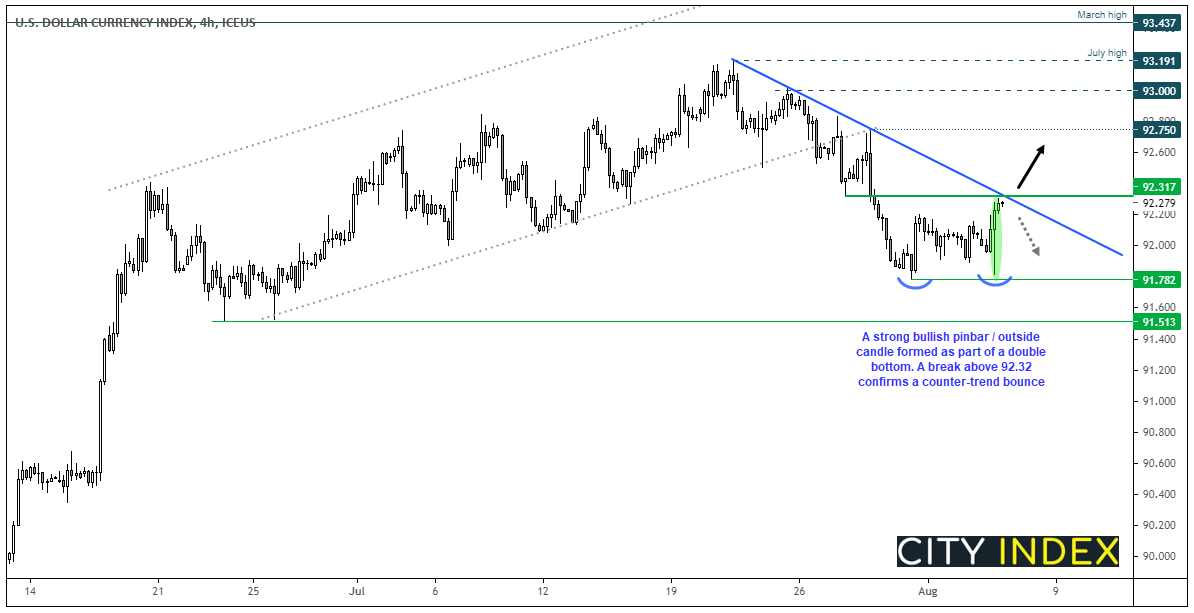

The US dollar index (DXY) printed a bullish outside candle and accelerated above the 50 and 200-day eMA’s. The four-hour chart shows a strong bullish pinbar / outside candle form as part of a double bottom at 91.78 and the day closed below trend resistance and the 92.31 low. Ultimately this is a pivotal area but our bias is for a break above 92.32 for a countertrend bounce towards 92.75 – 93.00.

Bullish engulfing candles also appears on USD/CHF and USD/JPY, a bearish engulfing formed on EUR/USD and a bearish pinbar saw AUD/USD close back below 0.7400.

Learn how to trade forex

Commodities: Oil slip accelerates, metals fall on taper comment

Oil prices fell for a third straight day on rising crude stockpiles, a stronger dollar and rise of the Delta variant. WTI fell a further -3.6% and tested trend support projected from the April low, closing below $70.0 for the first time in two-weeks.

Metals were also under pressure as the Fed’s Clarisa said the Fed could start tapering as early as September. This is the second such comment this week from a Fed member, so it appears they are getting their scripts together ahead of the Jackson Hole Symposium at the end of August.

Gold gave back early gains after failing to break above 1834 resistance to close effectively flat just above its 200-day eMA. Silver produced a bearish pinbar back below the broken trend and 200-day eMA after finding resistance at its 50-day eMA. Platinum fell to an 7-month low and within reach of our 1000 – 1011 target.

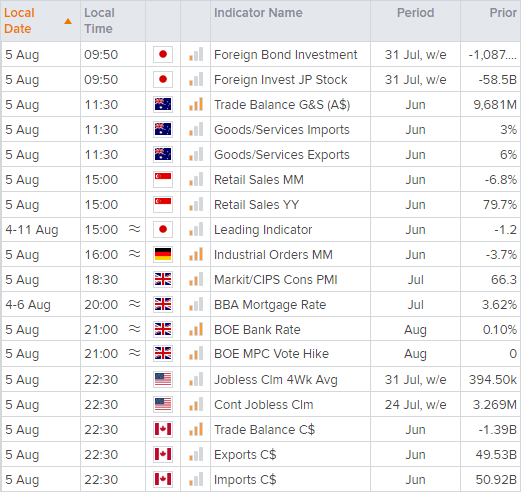

Up Next (Times in AEST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.