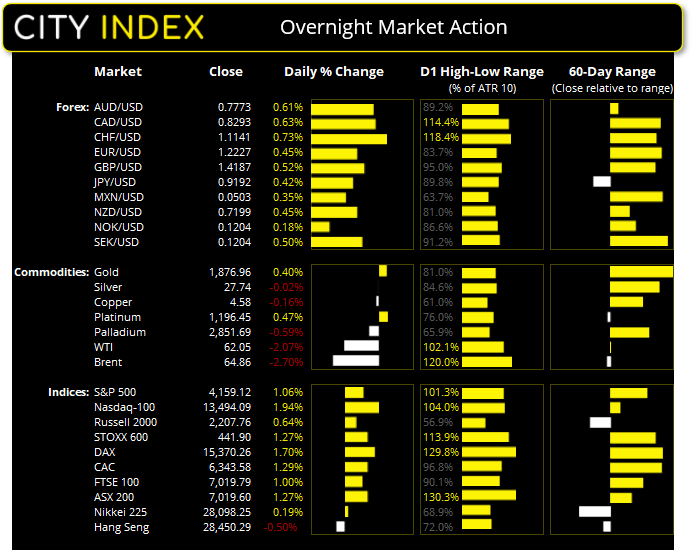

Asian Futures:

- Australia's ASX 200 futures are up 27 points (0.39%), the cash market is currently estimated to open at 7,046.60

- Japan's Nikkei 225 futures are up 120 points (0.43%), the cash market is currently estimated to open at 28,218.25

- Hong Kong's Hang Seng futures are up 127 points (0.45%), the cash market is currently estimated to open at 28,577.29

UK and Europe:

- UK's FTSE 100 index rose 69.59 points (1.0%) to close at 7,019.79

- Europe's Euro STOXX 50 index rose 63.17 points (1.6%) to close at 3,999.91

- Germany's DAX index rose 256.7 points (1.7%) to close at 15,370.26

- France's CAC 40 index rose 81.03 points (1.29%) to close at 6,343.58

Thursday US Close:

- The Dow Jones Industrial rose 43.44 points (1.06%) to close at 4,159.12

- The S&P 500 index rose 43.44 points (1.06%) to close at 4,159.12

- The Nasdaq 100 index rose 256.185 points (1.94%) to close at 13,494.09

Learn how to trade indices

Indices close to recouping this week’s losses:

The usual rule applied where yields were sent lower and tech stocks led the rally on Wall Street. The Nasdaq 100 posted a heathy 1.9% gain after finding support at 13,000 during Wednesday’s gap-down. And yesterday’s rally confirmed a double bottom pattern which projects a target around 13,900. The broader Nasdaq composite rose 1.8% and small cap stocks (Russell 2000) was up 1.2%, although remained beneath Tuesday’s high unlike tech stocks. The S&P 500 posted a 1% gain with 10 out of the 11 sectors rising in tandem (led by tech stocks, obviously) with just the energy sector closing in the red.

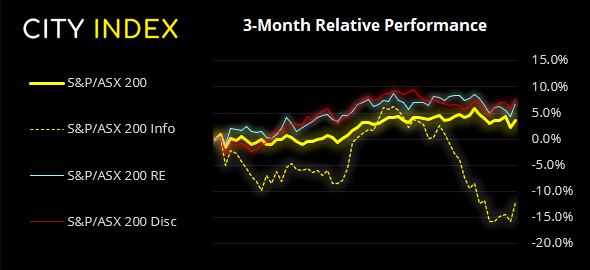

The ASX 200 recouped around ¾ of Wednesday’s sell-off and rallied directly from the open. We had noted yesterday that a bounce was potential due to 80% of stocks being below their 20-day average, although a little surprised to see only 35% of them were above the average by yesterday’s close given the strength of the rebound. That said, futures are pointing to a firmer open and sentiment from Wall Street is also positive. As it stands, the weekly and monthly chart are effectively flat at yesterday’s closing price, so it hangs in balance as to which way the ‘famously bearish month’ actually wants to close.

ASX 200 Market Internals:

ASX 200: 7019.6 (1.27%), 20 May 2021

- Information Technology (4.31%) was the strongest sector and Materials (-0.42%) was the weakest

- 8 out of the 11 sectors closed higher

- 160 (80.00%) stocks advanced, 34 (17.00%) stocks declined

- 2 hit a new 52-week high, 6 hit a new 52-week low

- 64% of stocks closed above their 200-day average

- 49% of stocks closed above their 50-day average

- 35% of stocks closed above their 20-day average

Outperformers:

- + 7.67% - Afterpay Ltd (APT.AX)

- + 6.63% - Altium Ltd (ALU.AX)

- + 6.45% - Redbubble Ltd (RBL.AX)

Underperformers:

- -6.83% - Nuix Ltd (NXL.AX)

- -4.41% - Iluka Resources Ltd (ILU.AX)

- -3.25% - Elders Ltd (ELD.AX)

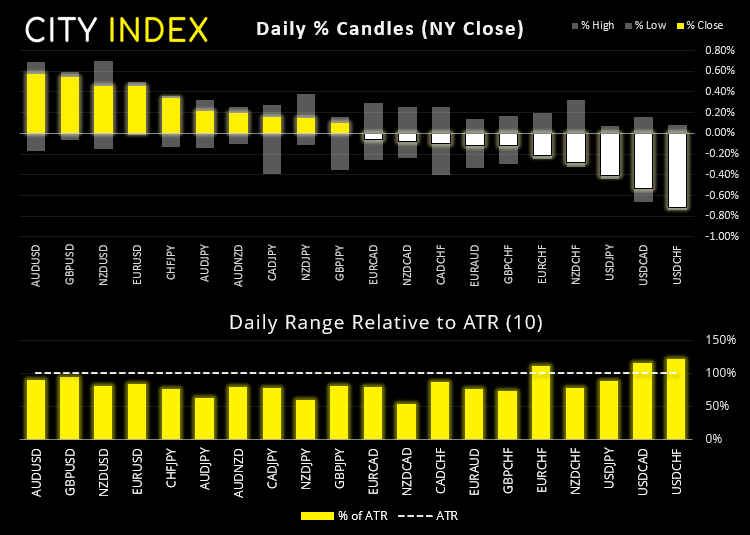

Forex: USD thrown overboard again

The dollar was thrown overboard again with the revival of a risk-on appetite, sending the US dollar index (DXY) back near this week’s lows. A break beneath 89.68 assumes bearish trend continuation and marks 90.29 as a new lower high. EUR/USD rallied back above 1.2220 but failed to retest it highs. Whilst momentum is pointing higher, we are monitoring its potential to form a bearish wedge reversal pattern. Early days though.

The Canadian dollar was stronger on comments from BOC (Bank of Canada) Governor Tiff Macklem saying there is room for interest rates to go up and his acknowledgement of the overheating housing market.

USD/CAD reversed Wednesday’s gains and fell back to the September 2017 low. CAD/JPY formed a bullish inside day following its bearish outside day the previous session, suggesting perhaps the swing low is in place at 90.0. CAD/CHF remains above key support, but a break beneath 0.7425 confirms a bearish hammer on the weekly chart.

EUR/AUD printed a bearish inside day, although its low respected the 1.5700 bullish breakout level so our bias remains bullish over the near-term. Keep an eye on Australian PMI data set for 09:00 as a particularly strong print could send this through key support. EUR/CHF has been removed from the watchlist given its direct break below 1.0988 support overnight.

AUD/USD keeps on teasing with a break above 1.0800 but, given the series of prior, failed attempts to close above it we would prefer to wait for a daily close above 1.0800 to confirm a resumption of its bullish trend. Cleary there is not enough of a divergent theme to break the deadlock between AU and NZD at present. One to watch regardless, because when it moves it does so with gust.

Learn how to trade forex

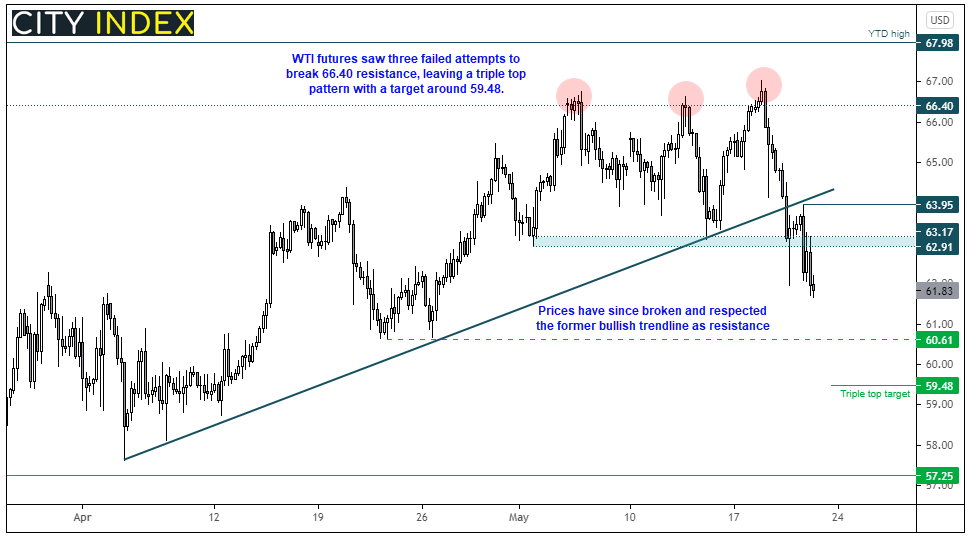

Commodities: Energy lower on anticipation of increased Iranian oil supply.

During a televised speech, Iran’s President claimed that the US was set to lift sanctions, although this is yet to be confirmed by US. India’s top refiner noted its interest to buy Iranian oil if or once sanctions are to be lifted. The energy sector broadly lower for a third session to see gasoline futures fall -2.9%, heating oil down 4.5%, whilst WTI and brent futures fell -2.2% and -2.7% respectively.

WTI tried (yet failed) to break above 66.40 resistance on three occasions, leaving a triple top reversal pattern in its wake. A break beneath the 62.90 – 63.17 the pattern and the breakout also invalidated trendline support. A subsequent retracement respected the broken trendline as resistance and left a prominent swing high at 63.95, so our bias is now bearish below 64.0. Next targets for bears to consider are the 60.61 – 61.00 zone and 59.48 – 60.00.

Keep in mind that WTI is sensitive to the Iran nuclear deal news. So, if the deal were to fall apart then oil prices could rip higher, whereas confirmation (from the US) that a deal has been struck and sanctions imposed upon Iran have been removed, further downside appears likely over the near-term.

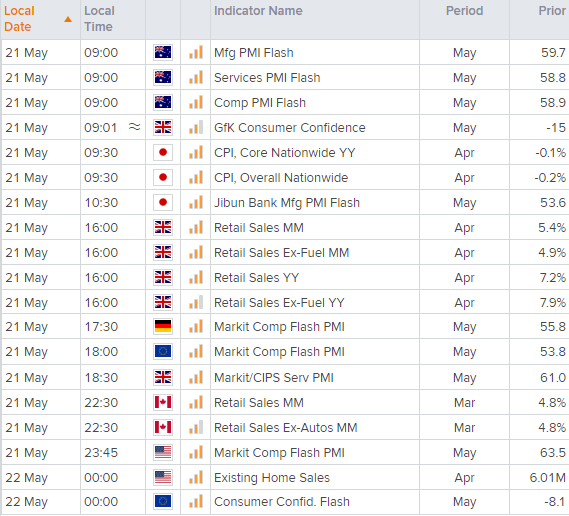

Up Next (Times in AEST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.