Asian Futures:

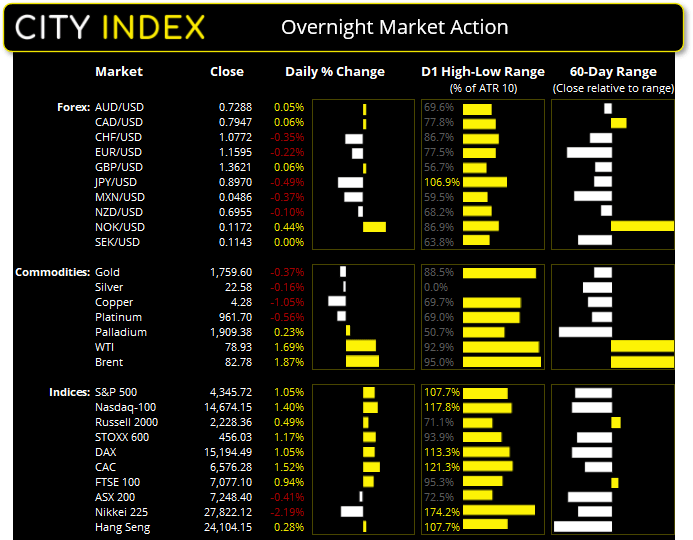

- Australia's ASX 200 futures are up 36 points (0.5%), the cash market is currently estimated to open at 7,284.40

- Japan's Nikkei 225 futures are up 450 points (1.62%), the cash market is currently estimated to open at 28,272.12

- Hong Kong's Hang Seng futures are up 218 points (0.91%), the cash market is currently estimated to open at 24,322.15

UK and Europe:

- UK's FTSE 100 index rose 66.09 points (0.94%) to close at 7,077.10

- Europe's Euro STOXX 50 index rose 69.02 points (1.73%) to close at 4,065.43

- Germany's DAX index rose 157.94 points (1.05%) to close at 15,194.49

- France's CAC 40 index rose 98.62 points (1.52%) to close at 6,576.28

Tuesday US Close:

- The Dow Jones Industrial rose 92 points (3.1175%) to close at 34,313.67

- The S&P 500 index rose 45.26 points (1.06%) to close at 4,345.72

- The Nasdaq 100 index rose 202.021 points (1.4%) to close at 14,674.15

US Indices bounce from their lows

The ISM services rose to 61.9 from 61.7 which is still at historically high levels, with business activity, new orders and prices paid rising with it. The Markit services and composite reads also rose, helping to lift sentiment on Wall Street and send indices higher. It is something we mused yesterday on the Nasdaq, as it had held above two key support levels and was the stronger performer at +1.4% for the day. The S&P 500 rose just over 1% and the Dow was up around 0.9%.

The ASX 200 switched its daily direction for a fifth consecutive day, although its volatile shakeout may be nearing an end as its daily range was the lowest since the 7416.4 high. And despite some intraday noise, the ASX failed to close back beneath the May 11th high, so there are small signs of demand build above and around that level. As futures markets (and the positive lead from Wall Street) point to a higher open for the cash index today, a break above 7333 could suggest we’ve seen the corrective low.

ASX 200 Market Internals:

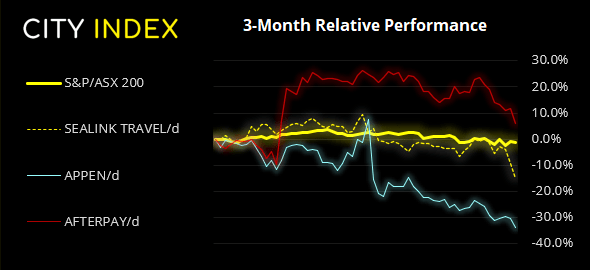

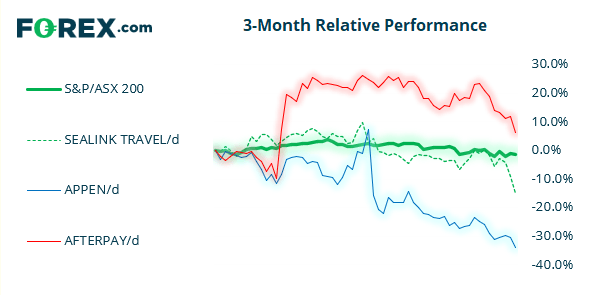

ASX 200: 7248.4 (-0.41%), 05 October 2021

- Energy (2.44%) was the strongest sector and Information Technology (-2.97%) was the weakest

- 9 out of the 11 sectors closed lower

- 5 out of the 11 sectors outperformed the index

- 55 (27.50%) stocks advanced, 141 (70.50%) stocks declined

- 59% of stocks closed above their 200-day average

- 40.5% of stocks closed above their 50-day average

- 35% of stocks closed above their 20-day average

Outperformers:

- + 7.23%-Gold Road Resources Ltd(GOR.AX)

- + 7.19%-Redbubble Ltd(RBL.AX)

- + 5.67%-Silver Lake Resources Ltd(SLR.AX)

Underperformers:

- ·-6.27%-Sealink Travel Group Ltd(SLK.AX)

- ·-5.03%-Appen Ltd(APX.AX)

- ·-5.02%-Afterpay Ltd(APT.AX)

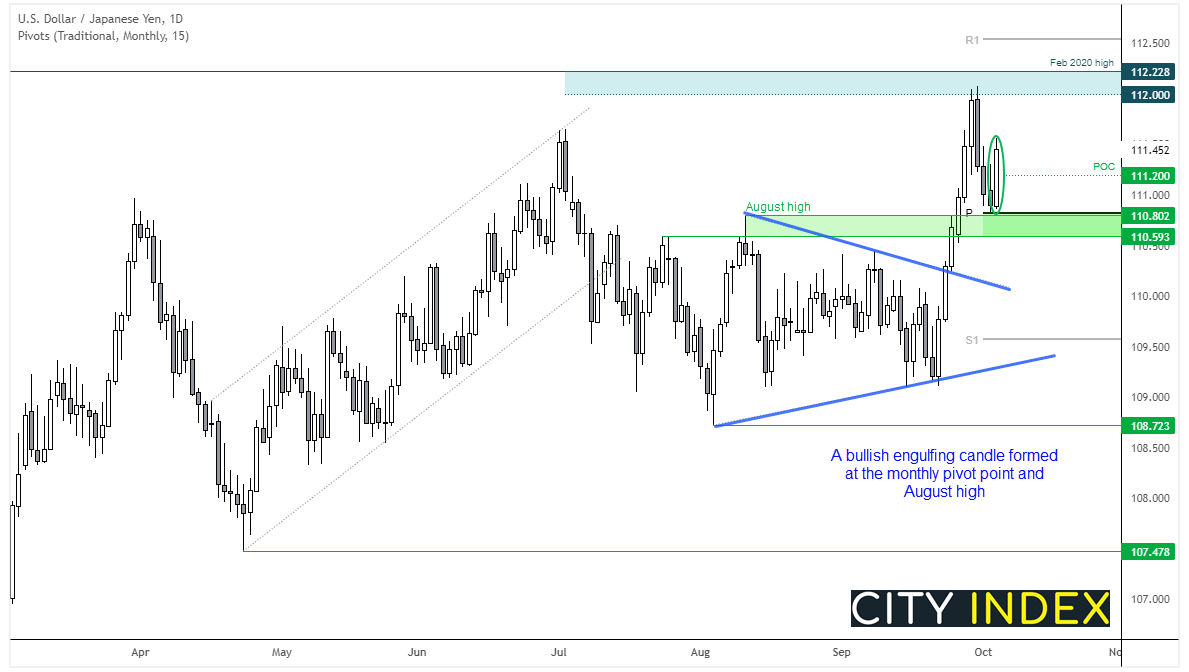

Forex: USD/JPY gunning for 112 again?

The Canadian dollar was strengthened by the continued rise of energy prices, and a wider trade surplus thanks to falling imports (exports also rose). EUR/CAD fell to its lowest level since Feb 2020, CAD/JPY rose to a 3-month high.

The final headline Market PMI’s were upgraded slightly for France, Germany the broader Euro Zone, although they remain notably weaker than August’s read as inflationary pressures weighed on demand. EUR/USD broke its 2-day rally and fell -0.2%, and EUR/GBP fell for a fourth session to a 2-week low.

RBNZ’s monetary policy meeting is the main event in today’s Asian session. Whilst the NZIER shadow board remain divided as to whether they should raise rates, a Reuters poll voted unanimously voted for a 25-bps hike at today’s meeting. However, money markets have fully priced in the expected hike so traders would likely need it to be a ‘hawkish hike’ (a hike and hints of further tightening) to give NZD another boost today.

Price action-wise, USD/JPY looks of interest. Whilst it has retracted against its 6-day bullish run out of a triangle pattern, it has since found support at the monthly pivot point and August high. A bullish engulfing candle shows bulls have regained control, so we’d be keen on any retracements within yesterday’s candle or a break of its high for bullish setups. 111.20 was yesterday’s POC (point of control) which can act like a magnet, so may provide support upon a retracement.

Commodities:

Oil continued to rally with WTI and brent rising around 1.7%. Brent is up 5.3% this month already, on top of its 7.5% rise in September. And whilst it will no doubt top out at some stage there are no immediate signs of it happening just yet. Therefore, WTI and brent could well remain long favourites for intraday dip traders until momentum turns against them.

Gold failed to break above Monday’s bullish outside day and even came close to breaching its low. Whilst a break back above Monday’s high triggers the bullish bias for now it’s a step aside.

Silver could also be setting itself up for a swing high given yesterday’s bearish inside bar / hanging man reversal candle. Although we’d to err on the side of caution and wait for more confirmation of a top below $23.

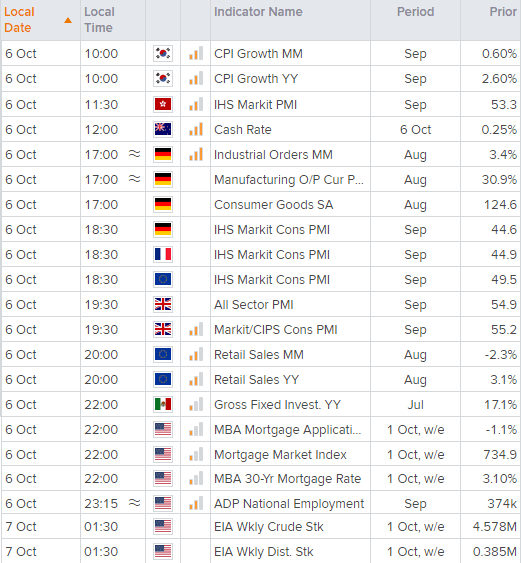

Up Next (Times in AEDT)