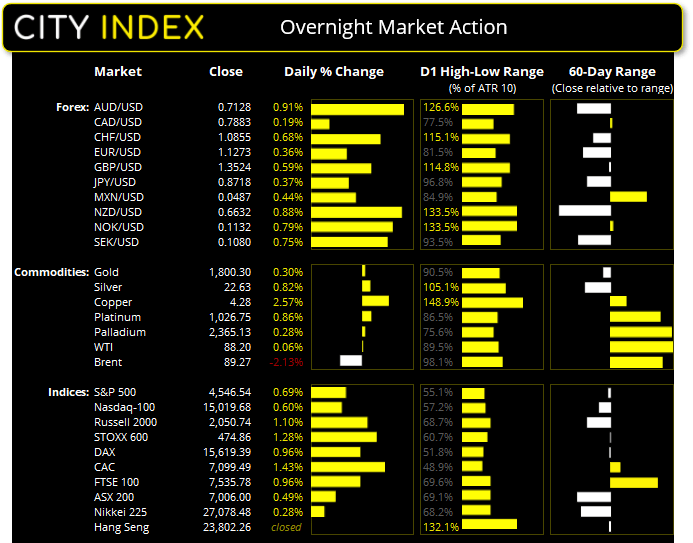

Tuesday US cash market close:

- The Dow Jones Industrial rose 273.38 points (0.78%) to close at 35,405.24

- The S&P 500 index rose 30.99 points (0.69%) to close at 4,546.54

- The Nasdaq 100 index rose 89.624 points (0.6%) to close at 15,019.68

Asian futures:

- Australia's ASX 200 futures are up 55 points (0.8%), the cash market is currently estimated to open at 7,061.00

- Japan's Nikkei 225 futures are up 130 points (0.48%), the cash market is currently estimated to open at 27,208.48

- Hong Kong's Hang Seng futures are down 0 points (0%), the cash market is currently estimated to open at 23,802.26

- China's A50 Index futures are up 3 points (0.02%), the cash market is currently estimated to open at 14,772.78

Wall Street extends it rally (on declining volumes…)

US indices rose for a third day although upside volatility was the lowest of the 3-days. Whilst it’s nice to see equities rise after a drubbing we also remain mindful of the fact they rise on lower volumes. The jury remains out as to whether this is the early stages of a bull rally or simply a bear0market bounce. The S&P 500 rose 0.7% to the Nasdaq’s 0.6%, and the Dow led the way with a 0.8% gain.

Antipodeans take advantage of a weak greenback

The New Zealand dollar retained its place at the top spot yesterday after another strong unemployment print, although the Kiwi and Aussie dollars were already strong due to a weaker dollar. Unemployment hit a new low of 3.2%, although employment change underwhelmed by only growing 0.1%, below 0.3% expected and the 2% prior. Labour costs also rose 0.7% q/q and 2.8% y/y. The Kiwi dollar has experienced its fair share of selling these past few weeks and it has allowed some breathing room to rebound from cycle lows against all majors except AUD.

The dollar continues to correct

US dollar index was lower for a third day with some Fed members helping to keep it under pressure. Bullard thinks the next job report “will not be good” whilst also stating that a 50 bps hike would help the Fed. Coming form a hawk, that should be taken note off if you’re hanging your hat on such a hike in March.

US manufacturing slows to a 14-month low

ISM manufacturing expanded at its slowest rate in 14-months, down to 57.6 from 57.9. Whilst it continues to signal that growth has topped it does remain above its long-term average of 53. New orders slipped to a 19-month low of 57.9 whilst prices paid (inflation component) rose to a 2-month high of 76.1, which remains relatively high to its long-term average of 60.

What are economic indicators?

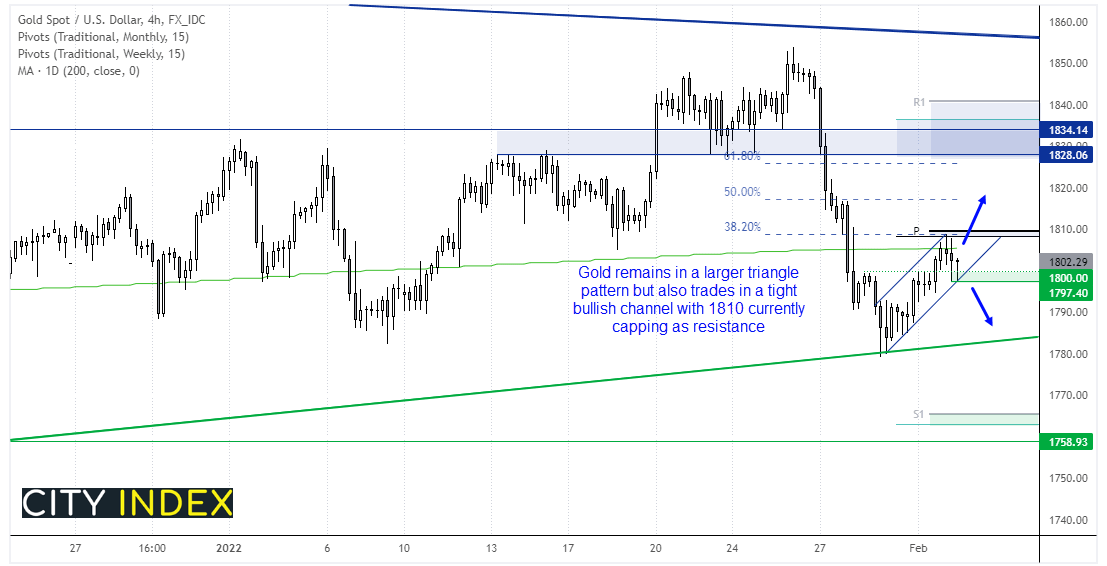

Gold toys with its 200-day eMA

Gold rose to a 3-day high of 1808, meaning it reached both of our near-term upside targets. Yet the 200-day and 50-day eMA’s continues to cap as resistance, and the market is on track for a bearish hammer on the daily chart. The four-hour chart shows the monthly pivot point and 38.2% Fibonacci retracement is also acting as resistance, whilst the market also trades in a tight bullish channel into resistance.

This leaves two potential outcomes; prices could hold the channel and break above 1810 to hint at trend continuation on the four-hour chart. Or bears return and break below 1797 out of the channel, which makes the 1797 - 1810 range of importance over the near-term. Given gold is only up against the US dollar (and lower against all other majors), and real yields rose overnight we’re leaning towards a downside break. But that is not reason to not be on guard for either scenario.

How to start gold trading

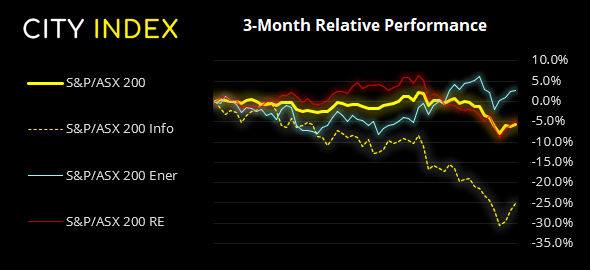

ASX 200 closed above 7,000 (just)

The ASX 200 managed to scrape a close above 7,000, yet the 7042.80 high capped as resistance which reaffirms the level’s importance. Whilst prices are rising it could simply be part of a dead-cat bounce whilst upside volatility remains underwhelming.

ASX 200: 7006 (0.49%), 1ST February 2022

- Utilities (2.57%) was the strongest sector and Materials (-1.21%) was the weakest

- 10 out of the 11 sectors closed higher

- 1 out of the 11 sectors closed lower

- 9 out of the 11 sectors outperformed the index

- 35 (17.50%) stocks advanced, 155 (77.50%) stocks declined

Outperformers:

- +7.28% - Pendal Group Ltd (PDL.AX)

- +6.56% - Judo Capital Holdings Ltd (JDO.AX)

- +6.45% - Imugene Ltd (IMU.AX)

Underperformers:

- ·-5.42% - Genesis Energy Ltd (GNE.AX)

- ·-3.06% - BHP Group Ltd (BHP.AX)

- ·-2.48% - Brambles Ltd (BXB.AX)

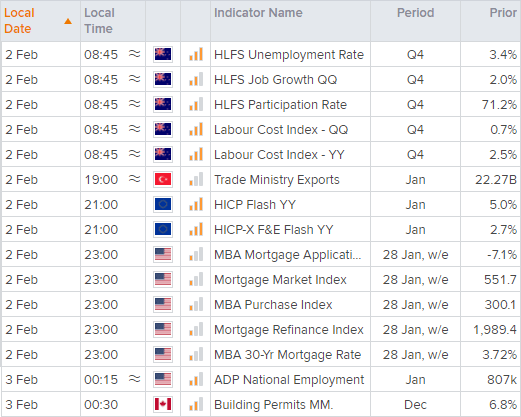

Up Next (Times in AEDT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade