Asian Futures:

- Australia’s ASX 200 futures rose 107 points (1.6%), the cash market is currently estimated to open at 6,817.8

- Japan's Nikkei 225 futures rose 390 points (1.36%), the cash market is currently estimated to open at 29,254.32

- Hong Kong's Hang Seng futures rose 156 points (0.54%), the cash market is currently estimated to open at 29,254.29

European Friday close:

- UK's FTSE 100 index fell -20.36 points (-0.31%) to close at 6,630.52

- The Euro STOXX 50 index fell -35.31 points (-0.95%) to close at 3,669.54

- Germany's DAX index fell -135.65 points (-0.97%) to close at 13,920.69

- France's CAC 40 index fell -48 points (-0.82%) to close at 5,782.65

US Friday close:

- The Dow Jones rose 572.2 points (1.85%) to close at 31,496.3

- The S&P 500 rose 73.47 points (1.95%) to close at 3,841.94

- The Nasdaq 100 rose 204.508 points (1.64%) to close at 12,668.511

Strong NFP report stabilises equities

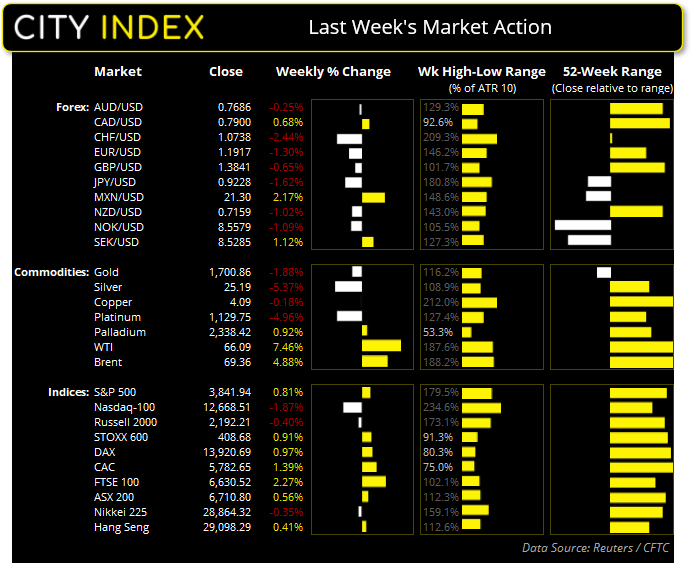

Friday’s rebound helped the S&P 500 and Russell 2000 close effectively flat for the week, above their 50-day eMA’s and form Rikshaw man Doji candles above their 10-week eMA. The Nasdaq 100 was the weakest on Wall Street, falling -1.9% but managing to recover slightly and close on its 20-week eMA. The Dow Jones was the strongest US index with a 1.85% gain for the week.

S&P 500: 05 March 2021

- The index closed -2.75% below its 52-week high

- Energy (3.87%) was the strongest sector and Consumer Discretionary (0.72%) was the weakest

- 7 out of the 11 sectors outperformed the index

- 81.39% of stocks closed above their 200-day average

- 63.56% of stocks closed above their 50-day average

- 60.59% of stocks closed above their 20-day average

Commodities turn higher

Thomson Reuters CRB commodity index turned higher on Friday and trades just beneath its 28-month high. WTI closed at its highest level since April 2019 and appears set to test $70 if it can break above the key level of 66.60. As for metals, gold and silver closed lower for a third consecutive week but bearish momentum is certainly waning. Moreover, gold closed just above 1,700 – a pivotal level this week. Although we see a decent technical argument for a bounce from current levels. Copper formed a bullish inside candle on Friday after its 11% retracement from multi-month highs found support at 3.84 and trades back above $4.00.

Forex: Dollar bulls make a resurgence

Every so often we get reminded that “the dollar is king”. Last week is earned that title. The USD index (DXY) closed 1.2% higher, its most bullish week in six and made notable ground against the Swiss franc, Mexican Peso and Swedish krona. Closing to a 4-month high at 91.12 the next major resistance area for DXY is around 92.8, near its the 200-day eMA.

- EUR/USD sold off for a third consecutive session and closed to a 3-moth low, beneath the 1.2000 barrier. Momentum favours further downside and we remain bearish whilst prices stay below 1.2000.

- AUD/USD broke beneath 0.7700 support on Friday in line with our bearish bias. Whilst there was a recovery late in the session, 0.7700 remains a key level and bears may be tempted to fade into (short) below it.

- GBP/USD met a similar fate and fell to a 3-week low after breaking below (and hitting our bearish target of ) 1.3828. Still, it is holding above a bullish trendline projected from the December 21st low and the 50-day eMA, so we could see bullish interest return around current levels.

- AUD/NZD could also be of interest for bearish swing traders, as a bearish engulfing candle forming on Friday after two bullish hammers on the daily chart suggests its swing high may now be in place.

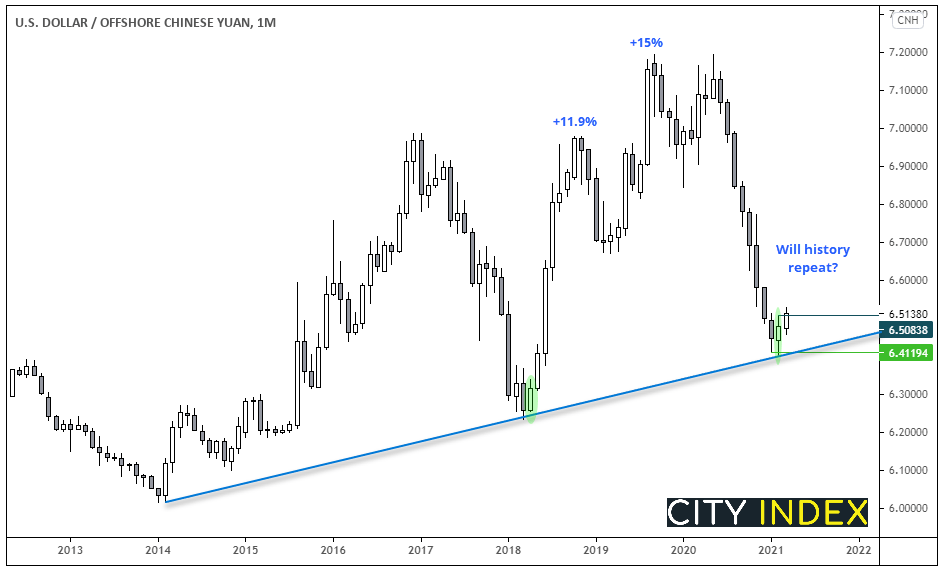

USD/CNH: Stand back to admire the view

Price action on the monthly chart of USD/CNH warrants a look, as it suggests we could be at a significant turning point. Whilst the monthly chart is too high a timeframe for most to participate in, it can help provide a directional bias over the coming month/s before a bullish trend gets underway.

January’s small bullish candle broke an 8-month bearish streak on the monthly chart and respected a bullish trendline from the 2014 low. Just one full week into the month of March and it has already broken to new high. If we are about to witness a move similar to that seen in 2018, USD/CNH could be headed for an 11% rally which would take it back above 7.0000.

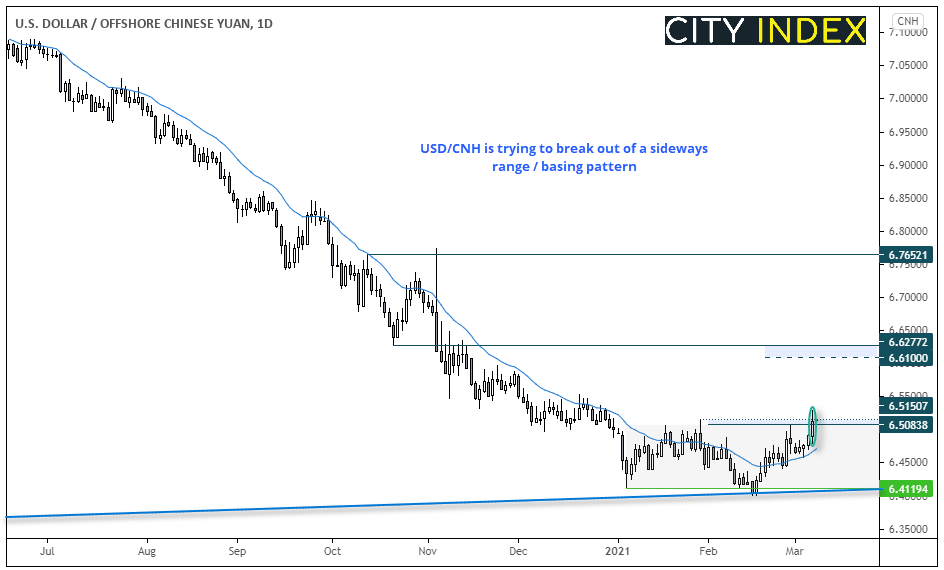

Switching to the daily chart shows prices on Friday closed above last week’s high and has spent the past best part of this year carving out a basing pattern. If we are to target a measured move from the sideways range it projects a target around 6.6100. But, if we truly have seen a significant low on the monthly chart, USD/CNH could find itself at much higher levels over the coming months.

- Bulls could seek long entries with a break above Friday’s high, or wait to see if 0.6515 is respected as support, for a conservative entry.

- Initial target is the 6.6100 – 6.6277 resistance zone.

- A break beneath 6.4000 invalidates the turning point thesis. Whilst a dip back within the range would place it on the backburner temporarily.

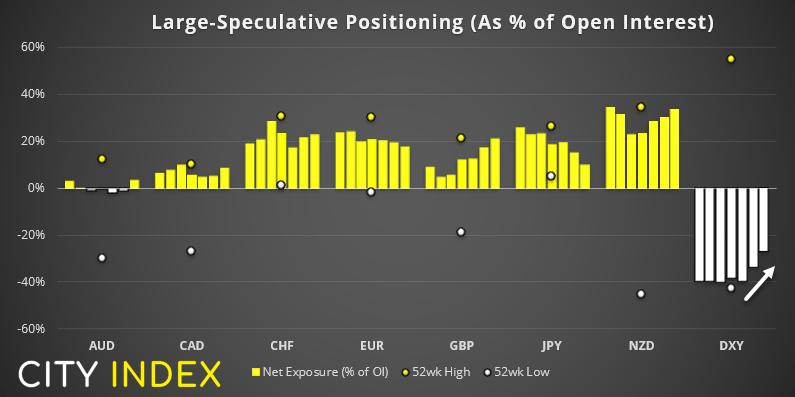

Commitment of Traders Report

As of Tuesday 2nd March:

- Net short exposure to DXY (USD dollar index) futures decreased by -7.3% (-3.75k contracts).

- Large speculators were their most bullish on NZD futures contracts since May 2018. Gross longs are also rising whilst gross shorts are decreasing, which is what we like to see during a healthy bullish trend.

- GBP futures rose to their highest level since April 2018. However, open interest was lower and gross longs and shorts were reduced, so this is not necessarily a healthy move.

- Traders flipped to net-short exposure on 10-year treasuries. At -96.6k contracts short its their most bearish exposure in 10-months.

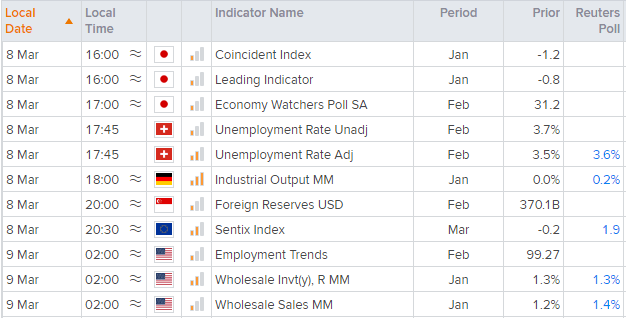

Up Next (Times in AEDT)

- No major economic news is scheduled for today. This could lead to tighter trading ranges, which can be beneficial for intraday mean reversion strategies if no market-moving catalyst is to arrive.

- BOE (Bank of England’s) Governor Andrew Bailey speaks at 21:00 to provide his outlook on the economy to the Resolution Foundation think tank.