Asian Futures:

- Australia's ASX 200 futures are up 26 points (0.35%), the cash market is currently estimated to open at 7,405.30

- Japan's Nikkei 225 futures are up 230 points (0.84%), the cash market is currently estimated to open at 27,811.66

- Hong Kong's Hang Seng futures are up 791 points (3.12%), the cash market is currently estimated to open at 26,264.88

UK and Europe:

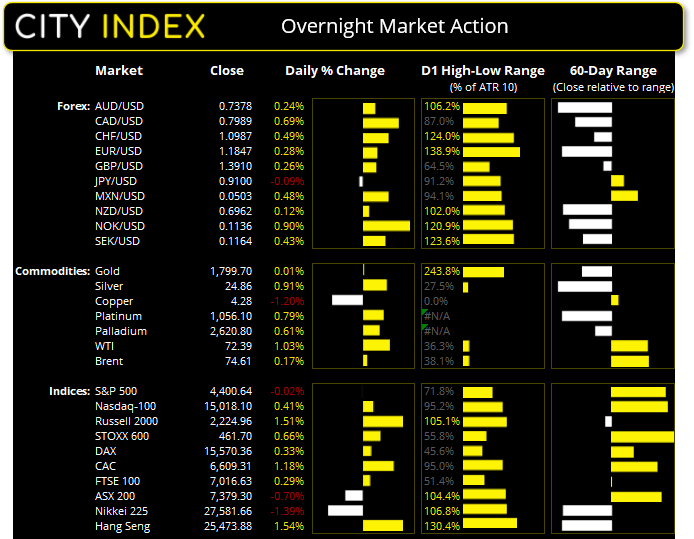

- UK's FTSE 100 index rose 20.55 points (0.29%) to close at 7,016.63

- Europe's Euro STOXX 50 index rose 38.2 points (0.94%) to close at 4,103.03

- Germany's DAX index rose 51.23 points (0.33%) to close at 15,570.36

- France's CAC 40 index rose 77.39 points (1.19%) to close at 6,609.31

Wednesday US Close:

- The Dow Jones Industrial fell -127.59 points (-0.36%) to close at 34,930.93

- The S&P 500 index fell -0.82 points (-0.02%) to close at 4,400.64

- The Nasdaq 100 index rose 61.128 points (0.41%) to close at 15,018.10

Learn how to trade indices

Small caps outperform in low volatility session on Wall Street:

The Fed were slightly more hawkish than expected and made a step towards tapering by leaving the potential for a full announcement at next month’s Jackson Hole meeting. The Fed sees the economy as still making progress despite a rise of coronavirus cases.

It was effectively a flat close for the S&P 500 at just -0.02% lower, with energy stocks providing support and consumer staples capping gains. A small Rikshaw Man Doji formed on the daily chart and prices are holding above the 10-day eMA, just off its record high.

The Nasdaq biotech index rallied nearly 3% to close just off the June high. Small cap growth stocks also outperformed, rising 1.86% whilst FAANGS were up 1.75% as Alphabet (GOOG), Microsoft (MSFT) and Apple (AAPL) all beat earnings this week.

The ASX 200 is making hard work of its breakout, having closed back beneath 7400 yesterday after just one close to a record high. Still, the daily trend remains bullish overall so we’ll monitor for clues for its next higher/swig low to form.

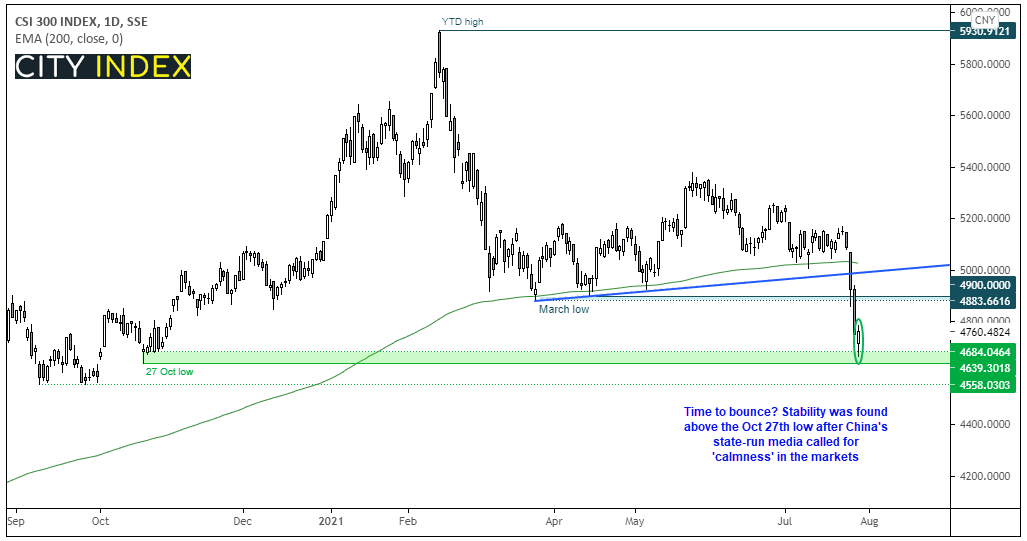

Asian markets set to bounce after ‘calls for calmness’?

With calls from China’s state-run media yesterday for ‘calmness’ in markets after a stock market rout, the bleeding appears to have slowed. Hong Kong’s Hang Seng index (HSI) found stability around 25k after falling nearly -10% since Friday when Beijing announced new regulations on the education and tech sectors. But if we were to back a horse for a corrective bounce it would probably be on China’s CSI300, as it’s plausible that interventionalist buying may also have occurred (or perhaps about to) as another line of defence alongside the media’s narrative.

The CSI300 topped out in February bearish momentum accelerated after a daily close beneath the 200-day eMA and trend support. Yet a small bullish candle appeared above the October 27th low, which leaves the potential for a corrective bounce against the prior move. With next major resistance near the March low then 4900 make a viable target over the near-term. A break beneath 4369 invalidates that bias.

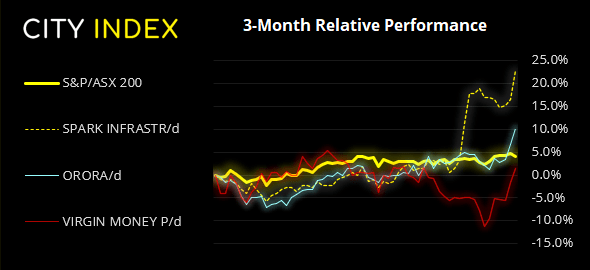

ASX 200 Market Internals:

ASX 200: 7379.3 (-0.70%), 28 July 2021

- Real Estate (0.86%) was the strongest sector and Information Technology (-2.13%) was the weakest

- 9 out of the 11 sectors closed lower

- 52 (26.00%) stocks advanced, 140 (70.00%) stocks declined

- 64.5% of stocks closed above their 200-day average

- 52.5% of stocks closed above their 50-day average

- 49% of stocks closed above their 20-day average

Outperformers:

- + 5.38% - Spark Infrastructure Group (SKI.AX)

- + 3.16% - Orora Ltd (ORA.AX)

- + 3.02% - Virgin Money UK PLC (VUK.AX)

Underperformers:

- -11.1% - Nickel Mines Ltd (NIC.AX)

- -6.67% - Redbubble Ltd (RBL.AX)

- -6.66% - Netwealth Group Ltd (NWL.AX)

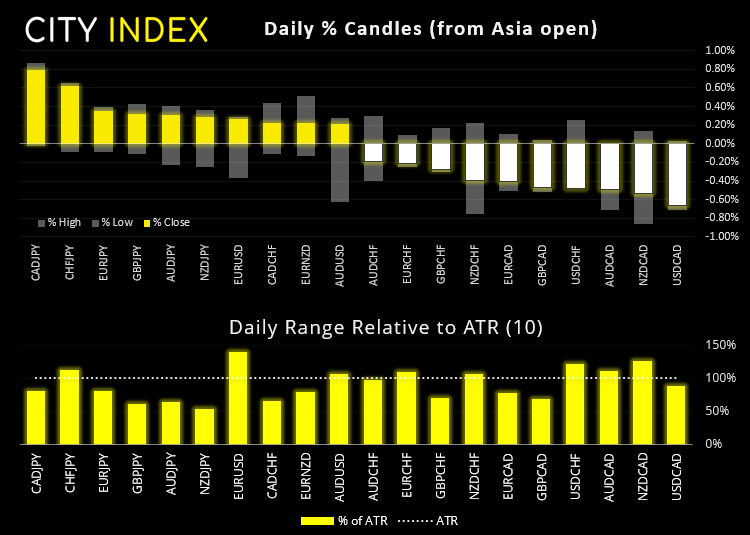

Forex: CAD strongest major

The US dollar index (DXY) was down -0.2% after the FOMC meeting which saw EUR/USD rise to a 9-day high. A bearish outside candle formed on USD/CAD after finding resistance at the 200-day eMA and closed -0.6% lower and USD/CHF broke fell to a 5-week low.

The Canadian dollar was the strongest major and the Japanese yen was the weakest, placing the cross CAD/JPY at the top of the leader board. Canada’s inflation is not quite as hot as expected yet remains in line with BOC’s recent target of ‘at or above 3%’ which should please the central bank and keep them on the path to taper.

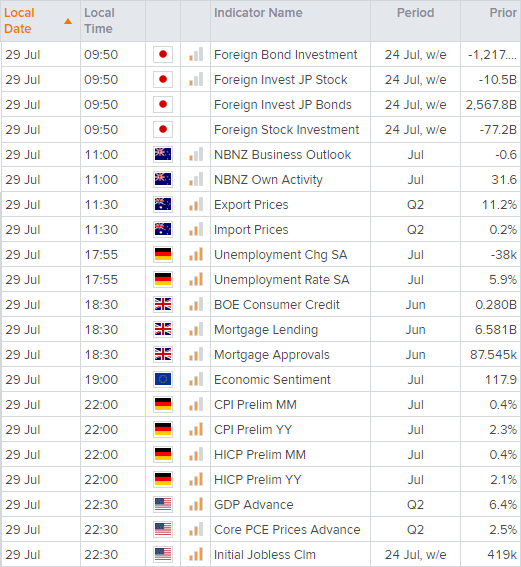

New Zealand’s NBNZ business outlook and activity is released at 11:00 AEST. Outlook is expected to rose to 0.2% of respondent to improve over the next year (up from 0.6% expecting it to deteriorate) whilst activity is expected to fall to 30.5 from 31.6. As RBNZ took the hawkish move to confirm (and since) cease their QE programme at their July meeting, it could take quite a deviation from expectation for it to impact the NZ dollar. Australian export prices are forecast to rise at a slower pace of 1.2% from 11.2% previously at 11:30 AEST.

AUD/JPY remains in the lower half of Tuesday’s bearish range so out bias remains bearish beneath the 81.66 high. AUD/CAD remains in a tight range between 0.9217 – 0.9287 and on track to close beneath the October 2020 low. Given its bearish daily trend we are on guard for a bearish breakout.

Learn how to trade forex

Commodities slightly higher on slightly weaker dollar

The slightly weaker dollar lifted commodities but it wasn’t a particularly volatile day overall. The CRB commodity index rose 0.3% after finding support at the July high, WTI rose 1% after US inventories dropped and silver rose 0.9%.

Focus shifts to US GDP data for Q2, advanced Core PCE prices and initial jobless claims tonight at 22:30 AEST.

Up Next (Times in AEST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.