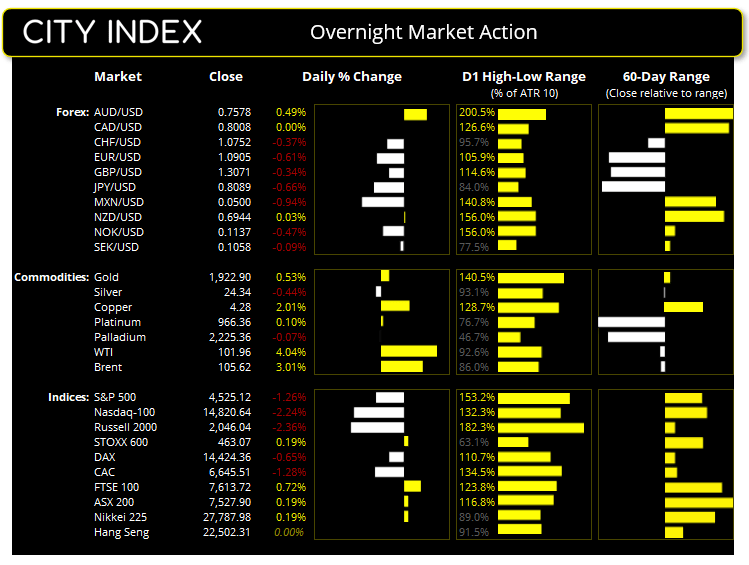

Tuesday US cash market close:

- The Dow Jones Industrial rose 280.7 points (0.8%) to close at 34,641.18

- The S&P 500 index rose -57.52 points (2.51%) to close at 34,058.75

- The Nasdaq 100 index fell -338.942 points (-2.24%) to close at 14,820.64

Asian futures:

- Australia's ASX 200 futures are up 0 points (0.35%), the cash market is currently estimated to open at 7,527.90

- Japan's Nikkei 225 futures are down -250 points (-0.9%), the cash market is currently estimated to open at 27,537.98

- Hong Kong's Hang Seng futures are up 144 points (0.64%), the cash market is currently estimated to open at 22,646.31

- China's A50 Index futures are down -197 points (-1.4%), the cash market is currently estimated to open at 13,812.59

Wall Street was lower overnight as equity traders finally took on board the hawkish rhetoric of Fed members. A 50-bps hike is increasingly likely in May, resulting in all major US benchmarks trading lower by the close. The Nasdaq 100 fell -2.2% and pulled back to its 100-day eMA. The Dow and S&P 500 printed bearish engulfing days ad lower highs.

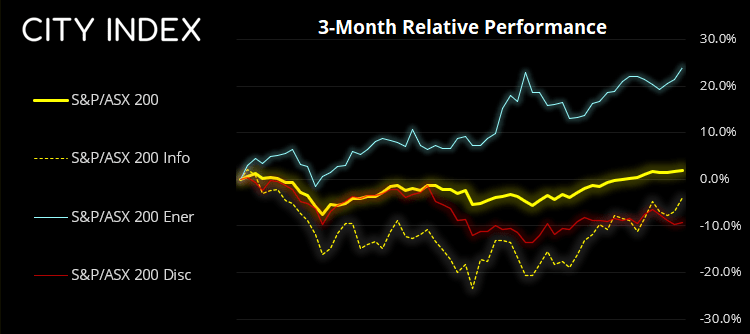

ASX 200:

ASX 200: 7527.9 (0.19%), 05 April 2022

- Info Tech (3.1%) was the strongest sector and Materials (-0.76%) was the weakest

- 8 out of the 11 sectors closed higher

- 7 out of the 11 sectors outperformed the index

- 112 (56.00%) stocks advanced, 83 (41.50%) stocks declined

Outperformers:

- +6.22% - Block Inc (SQ2.AX)

- +5.69% - Mineral Resources Ltd (MIN.AX)

- +4.91% - Novonix Ltd (NVX.AX)

Underperformers:

- -8.16% - Lake Resources NL (LKE.AX)

- -8.13% - Core Lithium Ltd (CXO.AX)

- -7.89% - AVZ Minerals Ltd (AVZ.AX)

Fed members continue to beat the hawkish drum

Hawkish comments from Fed members saw the US dollar take the top spot as the strongest currency yesterday. Daly said the Fed are committed to doing our work to bring inflation down, they can tackle inflation by end of year without a recession and, whilst growth will slow, it will be a short-lived event. He also thinks balance sheet reduction can begin at their May meeting. Brainard also states that “inflation is too high” and getting it down is their most important task. The US dollar was the strongest major by the end of the day and saw the US dollar index rise for a fourth consecutive day and hit a 23-month high. Markets are now pricing in a 77.1% chance of a 50-bps hike at the May FOMC meeting.

AUD settles for second place post hawkish-RBA meeting

The Australian dollar was originally the strongest currency but had to settle for second place, thanks to yesterday’s hawkish RBA meeting. Estimates for their hike range from June to August, after the Federal election after the RBA removed “patience” from their statement in reference for to raise interest rates. AUD/NZD hit a 13-month high, AUD/JPY reached our target around 94.40 (monthly R1 pivot and March high) and EUR/AUD fell to a 5-year low. AUD/USD had earlier reached a 10-year high but the hawkish comments from Fed members saw it hand back gain and close below 0.7600.

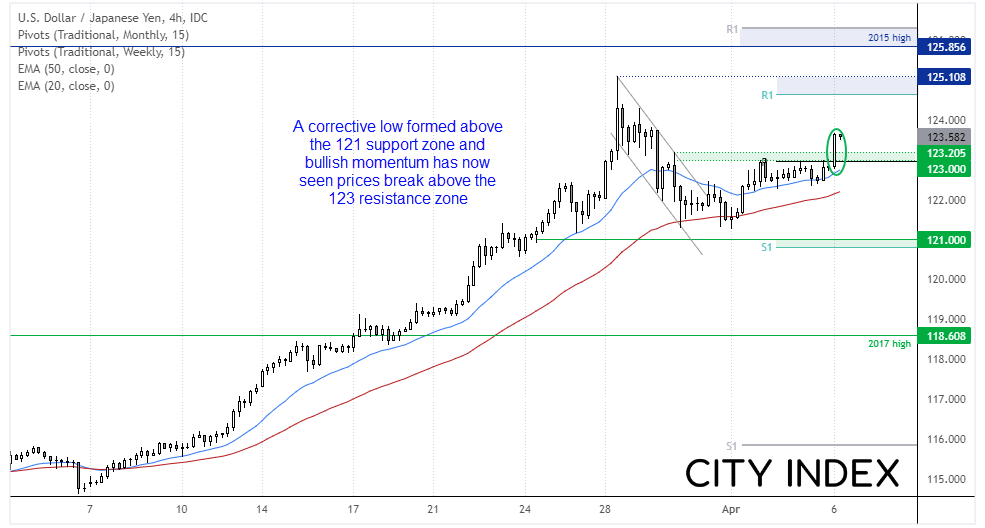

USD/JPY headed for 125?

Last week we outlined a case for USD/JPY to form a corrective low above 121 and, after a slow start, momentum has finally turned higher with conviction. The four-hour chart remains in a bullish trend and prices broke above the weekly pivot point and 123 – 123.20 resistance zone. We remain bullish above 122.70 (last H4 candle low) and our next target is 125, with this resistance zone between the weekly R1 pivot and March high.

Everything you should know about the Japanese yen

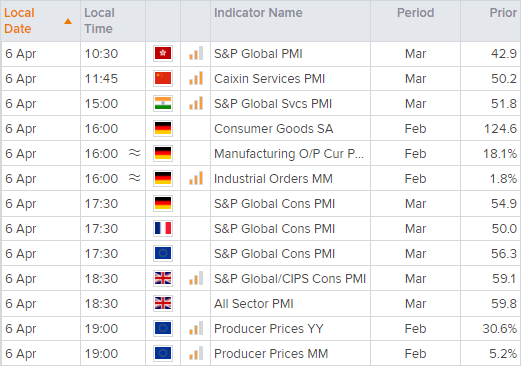

Up Next (Times in AEST)

China Services PMI is scheduled for 11:45 AEST. The headline figure expanded at its slowest pace in six months and the new business index contracted for its first time in six years. However, business reported a stronger optimism for the year end, but we should be on guard for the headline figure to dip into contractive territory today.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade