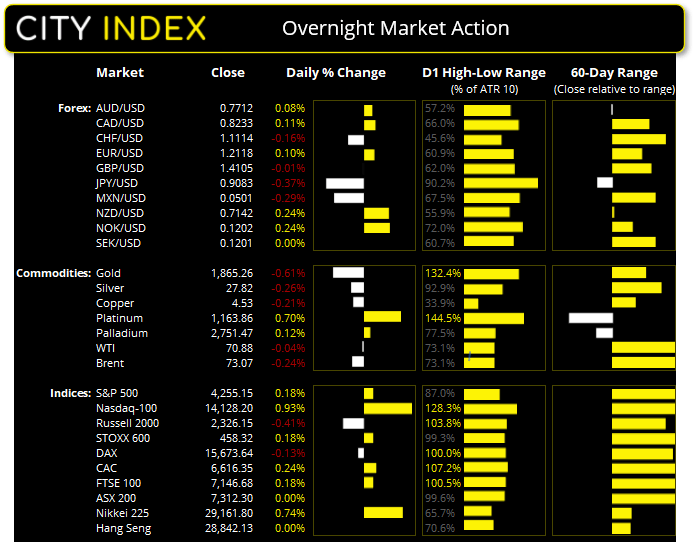

Asian Futures:

- Australia's ASX 200 futures are up 13 points (0.18%), the cash market is currently estimated to open at 7,325.30

- Japan's Nikkei 225 futures are up 100 points (0.34%), the cash market is currently estimated to open at 29,261.80

- Hong Kong's Hang Seng futures are down -89 points (-0.31%), the cash market is currently estimated to open at 28,753.13

UK and Europe:

- UK's FTSE 100 index rose 12.62 points (0.18%) to close at 7,146.68

- Europe's Euro STOXX 50 index rose 5.97 points (0.14%) to close at 4,132.67

- Germany's DAX index fell -19.63 points (-0.13%) to close at 15,673.64

- France's CAC 40 index rose 15.69 points (0.24%) to close at 6,616.35

Monday US Close:

- The Dow Jones Industrial fell -85.85 points (-0.25%) to close at 34,393.75

- The S&P 500 index rose 7.71 points (0.19%) to close at 4,255.15

- The Nasdaq 100 index rose 129.899 points (0.93%) to close at 14,128.20

Learn how to trade indices

Nasdaq and S&P 500 hit new highs

A recent survey in Reuters showed the majority of economists polled don’t expect any taper talk until the Jackson Hole symposium in August. Price action overnight suggests markets are aligned with their expectations at present. The Nasdaq 100 rose 0.93% and closed at record high on the eve of this month’s FOMC meeting. After a dubious start the S&P 500 also scraped a new record high by rising 0.18% as it rallied into the close. Industrial stocks continue to lag with the Dow Jones falling 0.25%.

ASX traders return to their desks after a three-day weekend in NSW for the Queen’s birthday. SPI futures are currently up by 0.2% suggesting the cash market to open around 7325. The index essentially traded sideways last week although a break beneath 7265.60 confirms a bearish hammer on the daily chart. Both the weekly and daily chart tested the upper Keltner band so, whilst the trend points higher, its potential for a retracement over the coming week/s should be kept in mind. But, whilst 7265.60 holds as support, dip buyers are likely to be interested in minor moves lower within last week’s range.

ASX 200 Intraday S/R Levels

- R3: 7350

- R2: 7335

- R1: 7330

- S1 7314

- S2: 7306

- S3: 7295

- S4: 7283

- S5: 7275

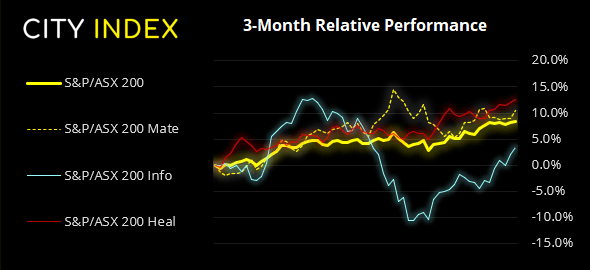

ASX 200 Market Internals:

ASX 200: 7312.3 (0.13%), 11th June 2021

- Materials (1.33%) was the strongest sector and Real Estate (-0.6%) was the weakest

- 9 out of the 11 sectors closed higher

- 5 out of the 11 sectors outperformed the index

- 100 (50.00%) stocks advanced, 89 (44.50%) stocks declined

- 75.5% of stocks closed above their 200-day average

- 75% of stocks closed above their 50-day average

- 81% of stocks closed above their 20-day average

Outperformers:

- + 7.69% - Resolute Mining Ltd (RSG.AX)

- + 5.91% - Mesoblast Ltd (MSB.AX)

- + 5.56% - Appen Ltd (APX.AX)

Underperformers:

- -3.83% - EML Payments Ltd (EML.AX)

- -3.00% - Eagers Automotive Ltd (APE.AX)

- -2.60% - Hub24 Ltd (HUB.AX)

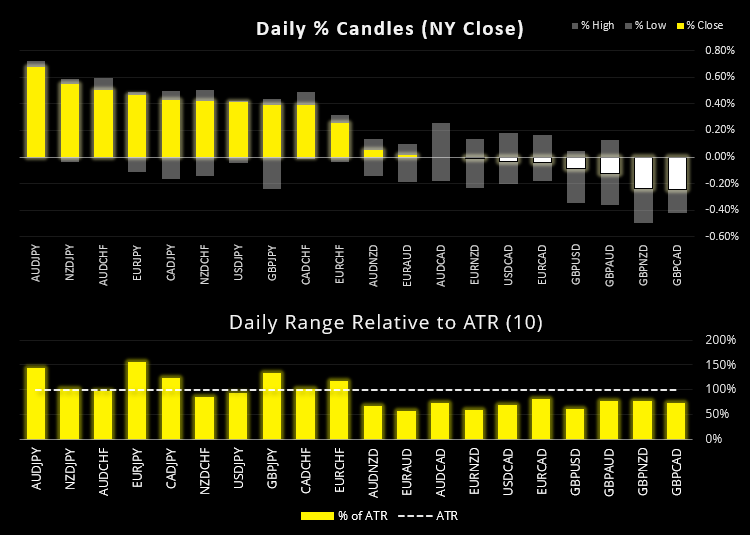

Risk-on tone for forex markets

The New Zealand and Australian dollars were the strongest majors of the session, whilst at the other end of the scale, safe-haven currencies Japanese yen and Swiss franc were the weakest currencies overnight. These are classic risk-on plays to currency player which saw AUD/JPY and NZD/JPY leading the pack higher.

This has kept AUD/JPY above trendline support and not too far below 85.00. Whilst this places the bearish outlook on the back burner, a daily close above 85.0 would be constructive for the bull-camp, given the multiple failed attempts it has had at this level over the past few months. The RBA release their minutes of the meeting today at 11:30 AEST, although it is arguably the July meeting that is the main focus for traders as the RBA stated it is when they will decide whether to roll forward their 3-year April 20204 target bond, or shift over to the November 2024 bond.

The euro zone’s economy is at a turning point according ECB’s President Christine Lagarde, yet it remains too early to begin debating QE. The recovery must be firm and stable before such talks can take place, according to an interview in the Politico. To hammer home their gentle approach to tapering she was quoted saying "I am not suggesting that the pandemic emergency purchase programme is going to stop on 31 March" and "it is far too early to debate these issues" regarding winding back PEPP.

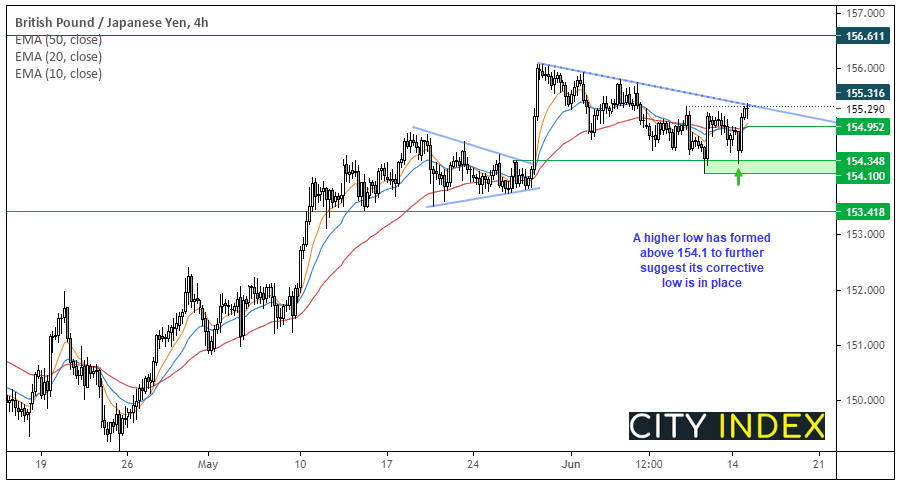

EUR/CHF rose 0.3% to a two-day high and formed a bullish engulfing candle at its three-month low, although headed straight for the resistance zone between 1.0915 – 1.0928. EUR/JPY also held above the March 21st low and formed a bullish engulfing candle and (like GBP/JPY) shows the potential to form a trough.

We’ve been tracking GBP/JPY since last week as we believe its correction was at, or nearing, an end. Yesterday’s bullish engulfing candle formed a higher low wick above 154.1, so we suspect the low is no in place. We can see the higher low on the four-hour chart and prices have since found resistance at the retracement line but, given the long-term uptrend on the daily chart and signs of demand at recent lows, we now await a break of the retracement line and for momentum to realign with its

Learn how to trade forex

Gold’s fall finds support

Gold hit our 1850 target overnight after breaking the March trendline during Asian hours yesterday. However, given the intraday V-shape recovery we’ll step aside from the yellow metal until after the FOMC meeting.

Platinum rose to a four-day high an on its 10-day average. As mentioned in yesterday’s video traders continue to unwind their long bets and increase shorts but prices are grinding lower at a relatively slow pace. So, either prices or positioning may be wrongfooted at some point and lead to a volatile move. Over the near-term we’ll step aside from the short bias with a break above 1179.

WTI futures continued higher to settle at 71.19 with a high of 71.78 on reports that demand continues to rise whilst lockdown restrictions globally are eased overall. Brent futures rose 0.63% to settle at 73.18.

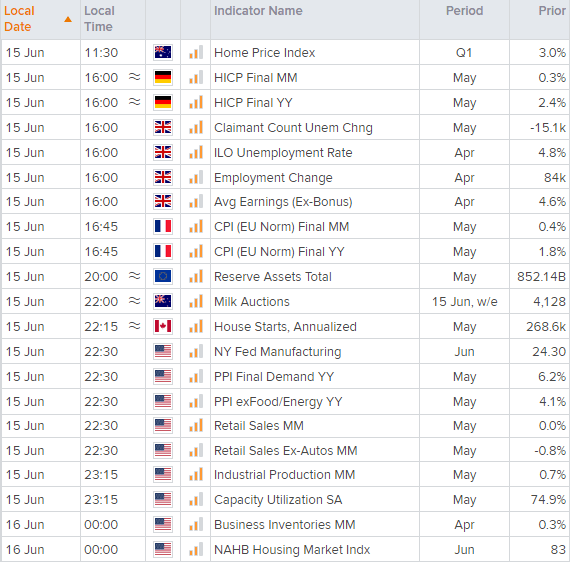

Up Next (Times in AEST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.