Asian Futures:

- Australia's ASX 200 futures are up 9 points (0.12%), the cash market is currently estimated to open at 7,426.40

- Japan's Nikkei 225 futures are down -60 points (-0.22%), the cash market is currently estimated to open at 27,722.42

- Hong Kong's Hang Seng futures are down -162 points (-0.62%), the cash market is currently estimated to open at 26,153.32

UK and Europe:

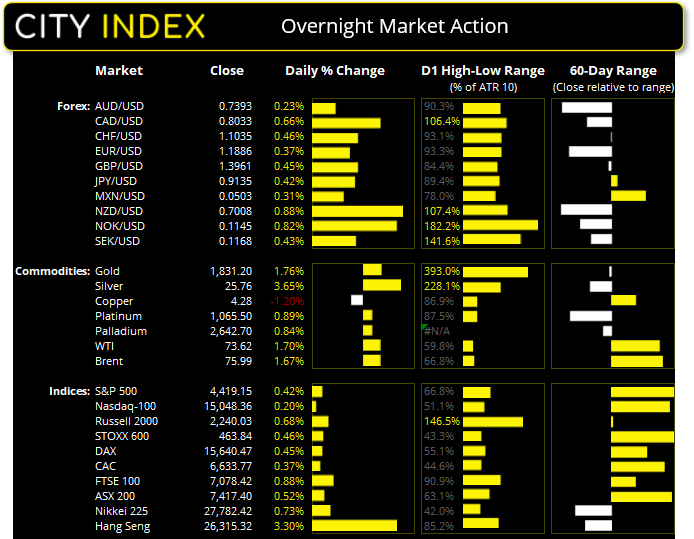

- UK's FTSE 100 index rose 61.79 points (0.88%) to close at 7,078.42

- Europe's Euro STOXX 50 index rose 13.74 points (0.33%) to close at 4,116.77

- Germany's DAX index rose 70.11 points (0.45%) to close at 15,640.47

- France's CAC 40 index rose 24.46 points (0.37%) to close at 6,633.77

Thursday US Close:

- The Dow Jones Industrial rose 153.6 points (0.44%) to close at 35,084.53

- The S&P 500 index rose 18.51 points (0.43%) to close at 4,419.15

- The Nasdaq 100 index rose 30.263 points (0.2%) to close at 15,048.36

Learn how to trade indices

GDP falls short of consensus, earnings lift Wall Street:

Annualised GDP for the US rose 6.5% in Q2, which was not as high as some forecasts but inline with the Fed Atlanta’s NowCast model as of Wednesday. It was however its highest level since the pandemic, and these number’s aren’t exactly terrible in the grand scheme of things.

Robust earnings on Wall Street lifted US indices and saw the S&P 500 post an intraday record high before closing at 4419.15, up by 0.42%. The Nasdaq 100 rose 0.2% and FAANGS rose just 0.1%. Small caps once again outperformed with the S&P SC 600 rising 1.15% and Russell 2000 value stocks rising 0.84%.

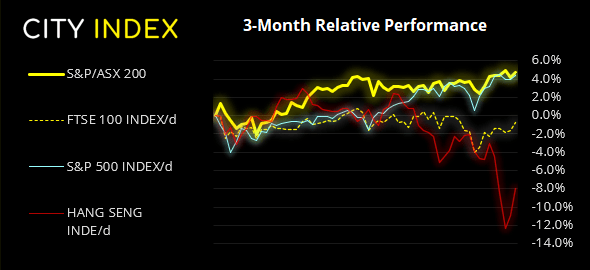

Today we’ll see if Asian indices can continue their corrective bounce. The Hang Seng rallied over 3% and closed back above 26k, and the CSI300 rose 1.88% to close at 4850.27. With reports that institutional buying (on orders of regulators) is underway we suspect upside potential remains.

The ASX 200 is forming some rendition of a bull flag just off its record highs on the daily chart, although a peek at the four-hour chart is less convincing. Three bullish bars bounced off of 7368.90 support yet remains within the range of a large bearish candle, so 7368 remains a pivotal level to keep in focus as we head into the weekend.

ASX 200 Market Internals:

ASX 200: 7417.4 (0.52%), 29 July 2021

- Information Technology (2.59%) was the strongest sector and Real Estate (-1.2%) was the weakest

- 9 out of the 11 sectors closed higher

- 3 out of the 11 sectors closed lower

- 4 out of the 11 sectors outperformed the index

- 125 (63.13%) stocks advanced, 57 (28.79%) stocks declined

- 0 hit a new 52-week high, 0 hit a new 52-week low

- 65.15% of stocks closed above their 200-day average

- 54.55% of stocks closed above their 50-day average

- 54.04% of stocks closed above their 20-day average

Outperformers:

- + 13.9% - Iress Ltd (IRE.AX)

- + 7.08% - Polynovo Ltd (PNV.AX)

- + 5.79% - Zip Co Ltd (Z1P.AX)

Underperformers:

- -3.44% - Redbubble Ltd (RBL.AX)

- -2.48% - Stockland Corporation Ltd (SGP.AX)

- -2.16% - BWP Trust (BWP.AX)

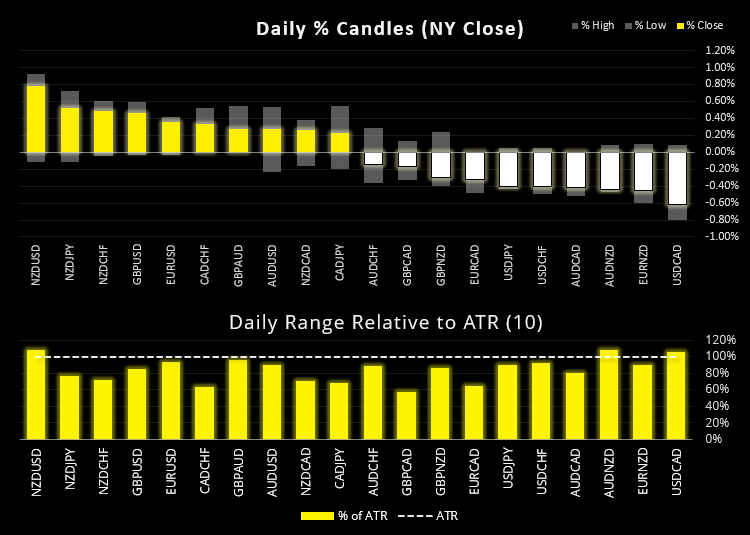

Dollar extends losses post-Fed

USD was the weakest currency after the Fed steered clear from any firm tapering talk. The US dollar index (DXY) closed below our 92.00 target and is around 30 points above our 91.60 target. And commodity currencies reversed earlier losses as they lapped up the slight risk-on tone to markets.

USD/CAD broke trend support on the daily chart and saw a firm daily close beneath it, before finding support at the 1.2426 low. The policy divergence between the Bank of Canada (BOC) and Fed (Federal Reserve) favours further downside for the pair with next support in sights at the 1.23 handle.

USD/CHF broken beneath 0.9093 support highlighted in yesterday’s video and probed the initial support zone around 0.9050. A break beneath 0.9045 brings 0.9000 and the 0.8950 handle into focus, just above the June lows.

GBP/USD continues to trade higher within its bullish channel following the breakout from its flag from Wednesday’s highs, and trades just 40 pips from our 1.40 target.

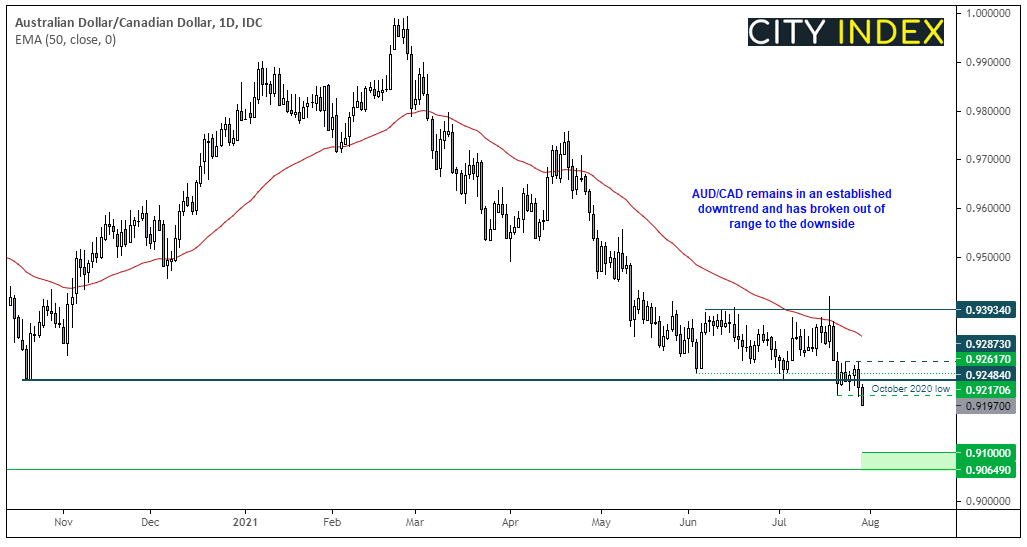

AUD/CAD had spent the best part of two-months in a sideways range, holding above the October 2020 low. Not any more though, as it broke to a 13-month low overnight. The 50-day eMA has capped as resistance and bearish momentum is picking up. Next major support resides around 0.9065 – 0.9100 and our bias remains bearish below 0.9250.

Learn how to trade forex

Commodities gain in a weak dollar environment

Commodities were broadly higher with the Thomson Reuters CRB commodity index breaking to a fresh 4-year high. Support at the previous record high of 217.72 remains intact and our bias remains bullish above it.

Oil prices rose to a 2-week high on tighter supply with inventories at Oklahoma and Cushing stories hubs continues to fall. The front contract WTI rose to $73.61 and brent settled at 76.03.

Gold bulls enjoyed their most bullish session in two months as the lack of firm taper-talk from the Fed weighed on the US dollar and increased the desire for gold. Real rates (represented by TIPS) are also just off their record low which is another supportive feature for gold traders.

Silver rose to an 8-day high and probed the previously broken trendline and 25.75 resistance to invalidate our bearish bias.

Copper futures rose 1% after finding support at the 4.435 breakout level (resistance turns into support) so out bias remains bullish above this level over the near-term.

Up Next (Times in AEST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.