Asian Futures:

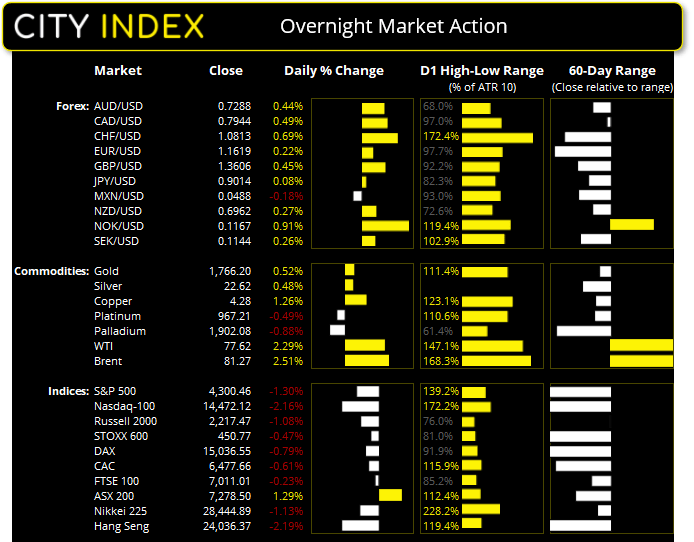

- Australia's ASX 200 futures are down -68 points (-0.94%), the cash market is currently estimated to open at 7,210.50

- Japan's Nikkei 225 futures are down -380 points (-1.35%), the cash market is currently estimated to open at 28,064.89

- Hong Kong's Hang Seng futures are down -29 points (-0.12%), the cash market is currently estimated to open at 24,007.37

UK and Europe:

- UK's FTSE 100 index fell -16.06 points (-0.23%) to close at 7,011.01

- Europe'sEuro STOXX 50 index fell -38.89 points (-0.96%) to close at 3,996.41

- Germany's DAX index fell -119.89 points (-0.79%) to close at 15,036.55

- France's CAC 40 index fell -40.03 points (-0.61%) to close at 6,477.66

Monday US Close:

- The Dow Jones Industrial fell -94 points (-3.2354%) to close at 34,002.92

- The S&P 500 index fell -56.58 points (-1.3%) to close at 4,300.46

- The Nasdaq 100 index fell -319.742 points (-2.16%) to close at 14,472.12

Indices:

Wall Street hit new lows overnight as Joe Biden conceded he cannot guarantee the government will not breach the debt limit. Currently they are on track to default in two weeks. Traders are also likely squaring up ahead of a busy data week and earnings season, whilst concerns linger over weak growth in an inflationary environment. The S&P 500 slipped -1.3% and touched its lowest level since Mid-July with 7 of its 11 sectors trading lower, led by technology and communication services sectors. Tech stocks slid -2.% and the Dow fell -0.9%.

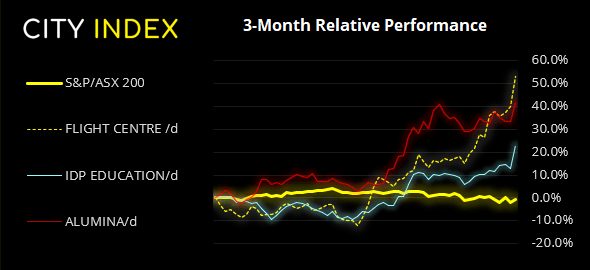

Daily Volatility on the ASX 200 has remained elevated for the past week, yet its direction has flipped over the past 4-days. This could be indicative of a turning point or simply a corrective shakeout before losses resume. But until the market tips its hand then traders of the cash index may want to remain nimble whilst prices remain within the 7180 – 7300 range.

ASX 200 Market Internals:

ASX 200: 7278.5 (1.29%), 04 October 2021

- Financials (2.55%) was the strongest sector and Healthcare (-0.49%) was the weakest

- 9 out of the 11 sectors closed higher

- 5 out of the 11 sectors outperformed the index

- 154 (77.00%) stocks advanced, 43 (21.50%) stocks declined

- 62% of stocks closed above their 200-day average

- 40.5% of stocks closed above their 50-day average

- 33% of stocks closed above their 20-day average

Outperformers:

- + 9.61%-Flight Centre Travel Group Ltd(FLT.AX)

- + 8.64%-IDP Education Ltd(IEL.AX)

- + 6.19%-Alumina Ltd(AWC.AX)

Underperformers:

- ·-5.36%-Sealink Travel Group Ltd(SLK.AX)

- ·-4.14%-Redbubble Ltd(RBL.AX)

- ·-3.23%-Kogan.com Ltd(KGN.AX)

Forex:

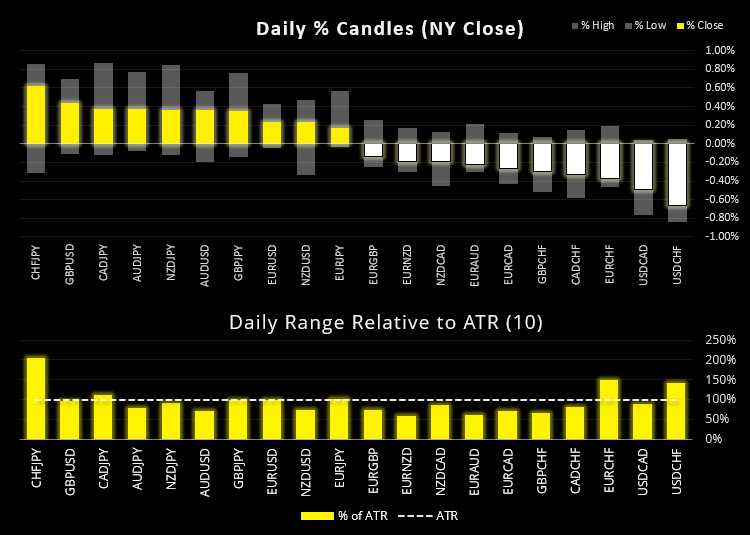

The dollar corrected for a third consecutive session, which saw the US dollar index (DXY) touch a 4-day low and retest the August high. The daily trend remains bullish above the 93.00 low which still allows plenty of wriggle room as part of this correction, although it’s plausible it may struggle to rally ahead of Friday’s NFP report.

CHF was the strongest major currency as it sucked in safe-haven flows from lower equity markets. CHF/JPY was the best performing pair, rising 0.86% by its high and moving 200% of its 10-day ATR. A bullish engulfing candle has formed above the 200-day eMA and trend support and shows the potential to break trend resistance.

USD/JPY fell for a third day after rallying to 112 and breaking a 6-day winning streak. It’s trying to form a base around 110.90 – 111.00 but we may need to wait for NFP until we see which way this one really wants to break.

The RBA hold their monetary policy meeting today and reveal their decision at 14:30 AEDT. No change of rate is expected until 2024 according to the latest Reuters poll, and bond buying will continue into Q3 of 2022. So expectations for fireworks at today’s meeting remain low, to say the least.

Commodities:

Oil prices turned higher again after OPEC+ confirmed they will maintain their decision to gradually increase oil output. Brent futures broke above $80 for the first time in nearly 3-years whilst WTI futures broke above the October 2018 high.

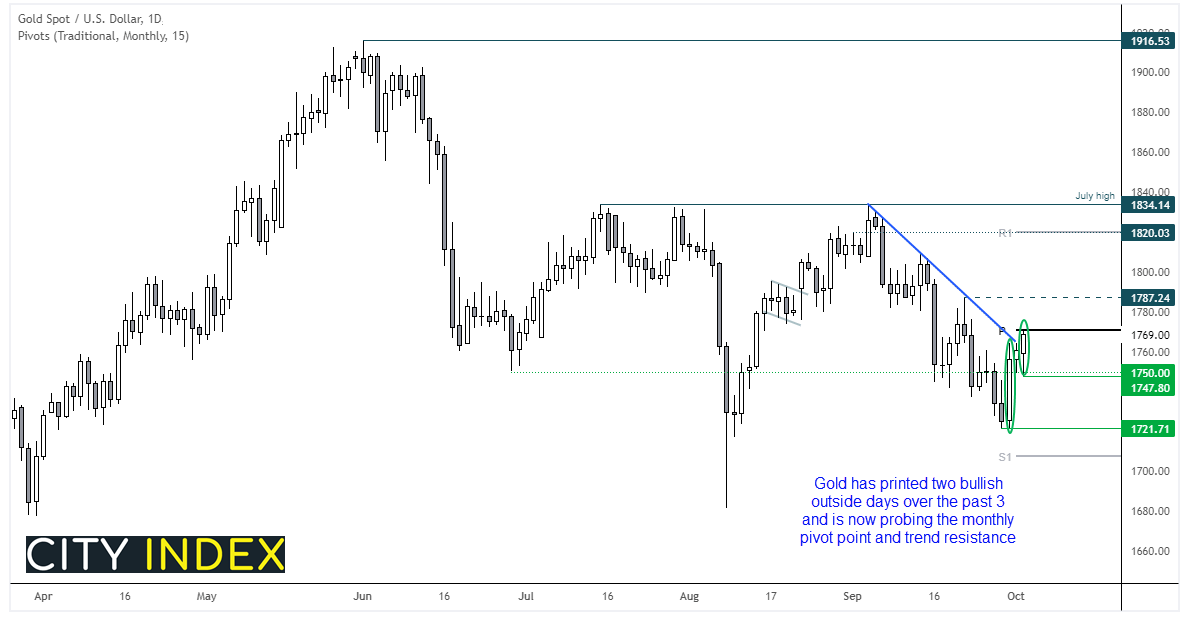

Gold printed another bullish outside candle yesterday after find support at the June low / 1750 area. Thursday printed an elongated bullish engulfing / outside candle to strongly hint a significant low had occurred at 1721.71, and yesterday’s close broke above trend resistance. We are now waiting for a break above yesterday’s high (which would also break above the monthly pivot point). This then brings 1787, 1800 and 1820 resistance levels into focus for bulls.

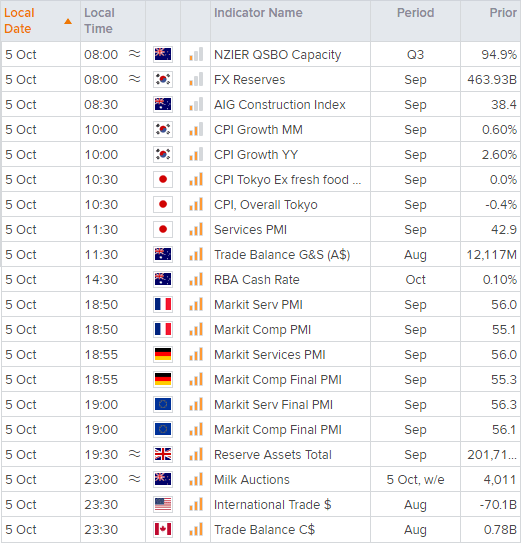

Up Next (Times in AEDT)