Asian Futures:

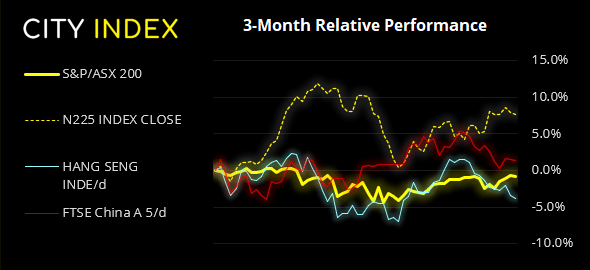

- Australia's ASX 200 futures are up 9 points (0.12%), the cash market is currently estimated to open at 7,461.20

- Japan's Nikkei 225 futures are up 200 points (0.68%), the cash market is currently estimated to open at 29,707.05

- Hong Kong's Hang Seng futures are up 145 points (0.59%), the cash market is currently estimated to open at 24,908.77

- China's A50 Index futures are up 104 points (0.67%), the cash market is currently estimated to open at 15,682.41

UK and Europe:

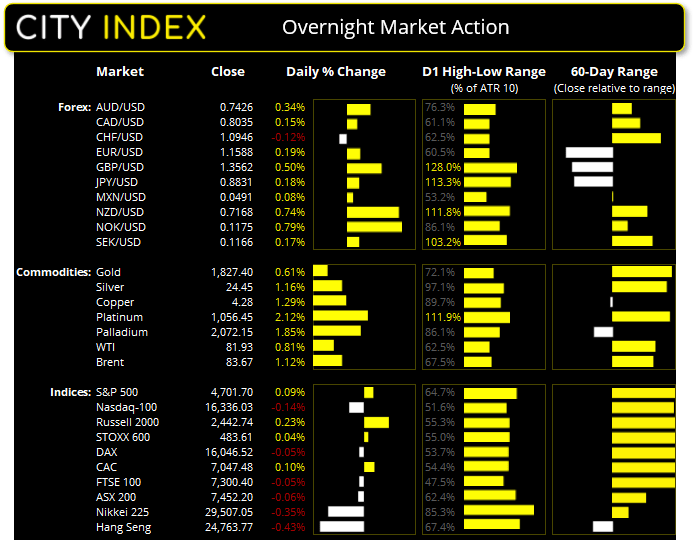

- UK's FTSE 100 index fell -3.56 points (-0.05%) to close at 7,300.40

- Europe's Euro STOXX 50 index fell -10.51 points (-0.24%) to close at 4,352.53

- Germany's DAX index fell -7.84 points (-0.05%) to close at 16,046.52

- France's CAC 40 index rose 6.69 points (0.1%) to close at 7,047.48

Monday US Close:

- The Dow Jones Industrial rose 104.27 points (0.29%) to close at 36,432.22

- The S&P 500 index rose 4.17 points (0.09%) to close at 4,701.70

- The Nasdaq 100 index fell -23.35 points (-0.14%) to close at 16,336.03

Indices:

Tesla fell around -5% after twitter voted in favour of Elon Musk’s selling 10% of his Tesla stock via Twitter pole. As the most heavily weighted stock within the S&P 500, Tesla (TSLA) weighed on the broader index which only managed a 0.2% gain on the day. Around 90% of its companies have now reported Q3 earnings, 81% of which have beaten estimate, and 50 companies reached a new 52-week high compared with 1 new low.

The ASX200 rally has paused below last week’s highs and formed a small inside day / indecision candle. We’d probably need to see it break below 7400 before getting too excited over its downside potential, and even if it can break above the 7487.6 high, 7500 is a likely resistance level not too far away. We therefore have a neutral bias for now.

Fortescue Metals Group (FMG) hold their annual shareholders meeting at 18:00. James Hardie (JHX) and National Australia Bank (NAB) release earnings – although no time has been specified.

The South China Morning Post reports that Hong Kong’s border to mainland China will reopen (quarantine free) by June at the latest.

ASX 200 Market Internals:

ASX 200: 7452.2 (-0.06%), 08 November 2021

- Energy (1.95%) was the strongest sector and Information Technology (-1.72%) was the weakest

- 5 out of the 11 sectors closed higher

- 6 out of the 11 sectors closed lower

- 5 out of the 11 sectors outperformed the index

- 81 (40.50%) stocks advanced, 111 (55.50%) stocks declined

- 67.5% of stocks closed above their 200-day average

- 66% of stocks closed above their 50-day average

- 61% of stocks closed above their 20-day average

Outperformers:

- + 5.71%-Flight Centre Travel Group Ltd(FLT.AX)

- + 5.23%-St Barbara Ltd(SBM.AX)

- + 4.76%-Webjet Ltd(WEB.AX)

Underperformers:

- ·-9.69%-Polynovo Ltd(PNV.AX)

- ·-8.31%-Clinuvel Pharmaceuticals Ltd(CUV.AX)

- ·-6.37%-Domain Holdings Australia Ltd(DHG.AX)

Forex:

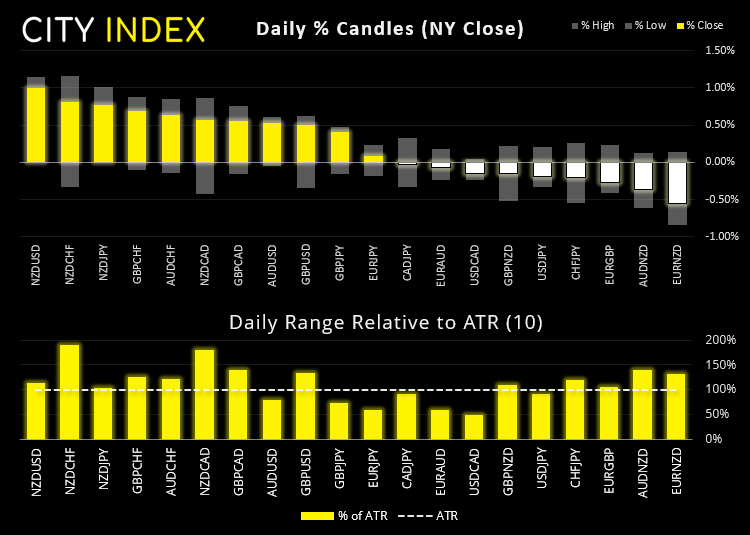

The US dollar index (DXY) fell to a 2-day low after printing a bearish hammer on Friday following Nonfarm Payroll data. 93.80 is next support, then the bullish trendline from the May low on the daily chart.

Federal Reserve Evans says that the Fed could raise rates in 2022 if inflation expectations rise fast enough, and they’ll have a clearer picture on inflation by spring. Although the first hike in 2023 is “still on the table:

The New Zealand dollar retained its top spot on the currency board throughout yesterday, with price action suggesting a swing low is in place. A 3-bar bullish reversal formed on the 200-day sMA, and if prices above 0.7200 perhaps it can resume it uptrend.

Commodities:

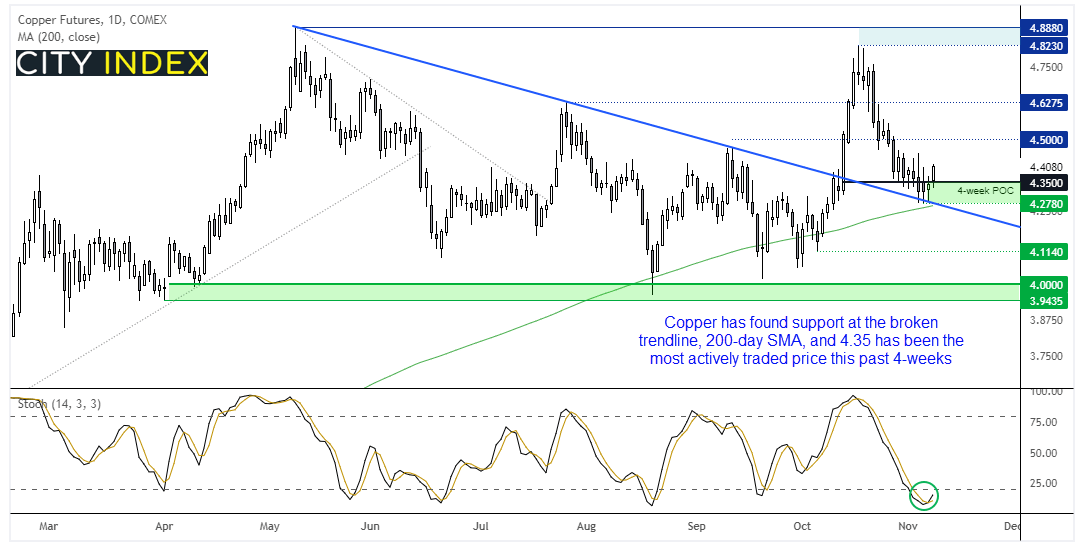

Copper is flirting with the idea that it has seen a corrective low. China’s stronger-then-expected data over the weekend shows a pickup of global demand, helping to lift the metal from its three-week low. Copper has retracted around -11.3% from the October high but bearish momentum has been waning of late, and the retracement also found support around the broken trendline. A stochastic buy signal has also formed on the daily chart and recent lows are holding above the 200-day SMA.

Given that 4.35 is the POC (point of control / most active price) of the past 4-week, we suspect larger buyers are defending this level. Our bias remains bullish above its recent lows, with initial target at 4.450, then 4.627.

Silver moved closer to our initial 24.60 target. As discussed in yesterday’s video, we suspect the recent low at $23. Is the right shoulder of a multi-month inverted head and shoulders pattern. Our initial target is to $25, and the larger pattern is confirmed with a break above that level.Brent couldn’t quite reclaim $84 overnight, instead retreating after briefly testing the level despite the weaker dollar. Natural gas prices were also lower as temperatures remained mild.

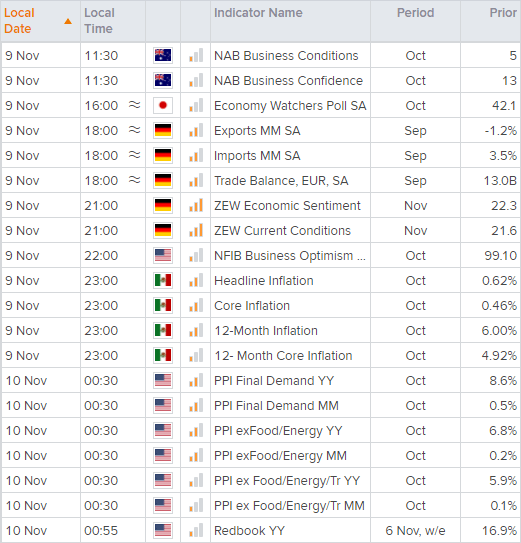

Up Next (Times in AEDT)

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade