Asian Futures:

- Australia's ASX 200 futures are up 8 points (0.11%), the cash market is currently estimated to open at 7,378.20

- Japan's Nikkei 225 futures are up 250 points (0.85%), the cash market is currently estimated to open at 29,889.40

- Hong Kong's Hang Seng futures are down -65 points (-0.27%), the cash market is currently estimated to open at 24,445.98

UK and Europe:

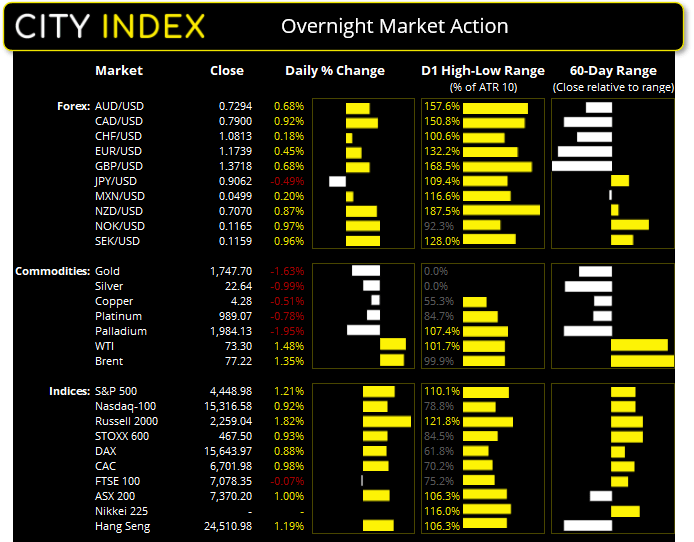

- UK's FTSE 100 index fell -5.02 points (-0.07%) to close at 7,078.35

- Europe's Euro STOXX 50 index rose 44.73 points (1.08%) to close at 4,194.92

- Germany's DAX index rose 137.23 points (0.88%) to close at 15,643.97

- France's CAC 40 index rose 64.98 points (0.98%) to close at 6,701.98

Thursday US Close:

- The Dow Jones Industrial rose 506.5 points (1.48%) to close at 34,764.82

- The S&P 500 index rose 53.34 points (1.22%) to close at 4,448.98

- The Nasdaq 100 index rose 140.071 points (0.92%) to close at 15,316.58

Learn how to trade indices

Indices broadly higher:

Indices, commodities and commodity currencies moved higher in tandem, and yields also rose (with the long end of the curve outperforming) following the Fed’s hawkish meeting. And this is despite flash PMI data hitting a 12-month low in the US and jobless claims rising for a second week. Although a positive on the vaccination front is The CDC (Centre for Disease Control and Prevention) voted to recommend providing booster shots for 65 and above, and high risk adults with medical conditions.

The Flash Markit PMI composite read for the US slipped to 54.5 from 55.4, missing estimates and sitting at its lowest level since September 2012 as supply constraints remained whilst demand softened. Higher input costs remained in place which points to higher levels of inflation, although this had been accounted for in expected average inflation for 2021 in the Fed’s forecasts on Wednesday.

The Dow Jones was the strongest performer, rising 1.5% to a 5-day high. The S&P 500 accelerated above its 200-day eMA for a second day, 9 of its 11 sectors rallied led by energy ad financial stocks. The Nasdaq 100 rose 0.9%.

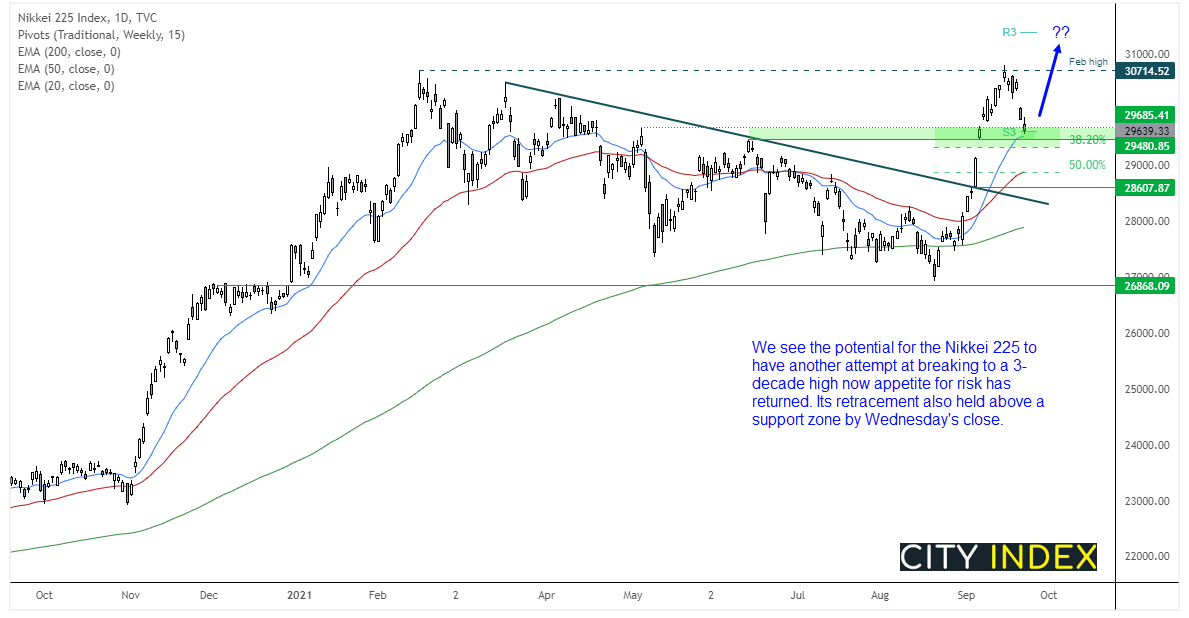

Japan’s exchanges reopen today after today’s public holiday, and they have some catching up to do. We suspect the Nikkei 225 will now track Wall Street higher and attempt to break to a 31-year high.

The break of trend resistance at the start of September suggests momentum had realigned with its long-trend, and its inability to close above the warned a correction was due. Nikkei futures have risen above 3,000 so the cash market could likely follow today. Note that Wednesday’s low respected the 29,480 – 29,685 support zone, which itself is above a 38.2% Fibonacci level. Assuming we see prices break above 30k today then our bias remains bullish above recent lows (or the Fibonacci level if extra wriggle room is required).

Take note that CPI data and flash manufacturing PMI data is released today Japan at 09:30 and 10:00 AEST.

ASX 200 Market Internals:

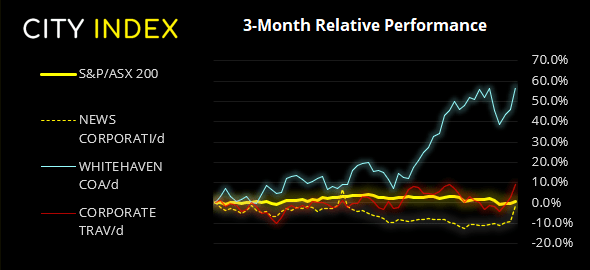

ASX 200: 7370.2 (1.00%), 23 September 2021

- Information Technology (3.01%) was the strongest sector and Healthcare (0.2%) was the weakest

- 11 out of the 11 sectors closed higher

- 7 out of the 11 sectors outperformed the index

- 164 (82.00%) stocks advanced, 28 (14.00%) stocks declined

- 68.5% of stocks closed above their 200-day average

- 61% of stocks closed above their 50-day average

- 49.5% of stocks closed above their 20-day average

Outperformers:

- + 8.42% - News Corp (NWS.AX)

- + 7.24% - Whitehaven Coal Ltd (WHC.AX)

- + 6.56% - Corporate Travel Management Ltd (CTD.AX)

Underperformers:

- -2.39% - Reliance Worldwide Corporation Ltd (RWC.AX)

- -1.41% - Ramelius Resources Ltd (RMS.AX)

- -1.40% - Northern Star Resources Ltd (NST.AX)

Commodity currencies lead the way:

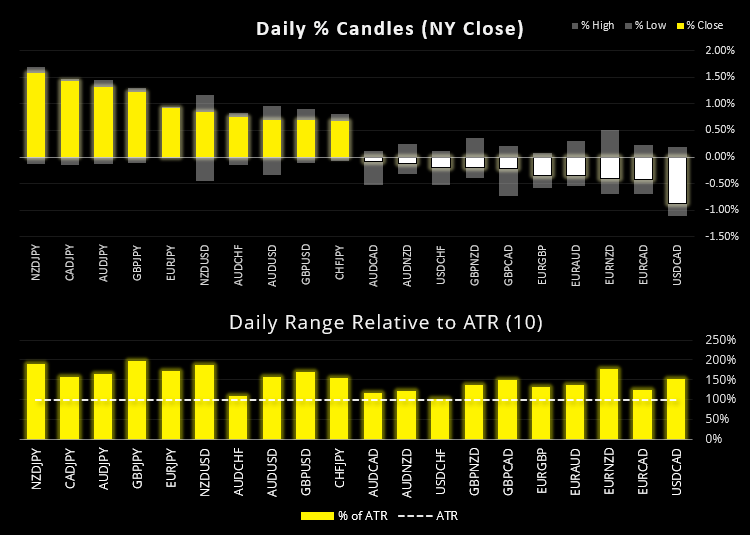

Commodity currencies were the clear winner with NZD, CAD and AUD leading the pack with JPY and USD at the bottom. NZD/JPY was the strongest cross, rising around 1.5% and moving 200% of its ATR (average true range).

In fact, there have been impressive moves on all the xxx/JPY pairs. Whilst it paints an upside bias today, it is questionable as to whether similar levels of volatility could be expected. They may therefore suit bulls on an intraday bias seeking small continuation patterns, whilst remaining nimble.

The US dollar was caught between a hawkish FOMC meeting and weak economic data. The US dollar index (DXY) failed to keep onto FOMC gains and produced a bearish engulfing candle on the daily chart. 93.0 is the key level for bulls to defend but, given the 2-bar bearish reversal, the bias currently favours a break beneath it. Therefore, 93 is the pivotal area of interest to see which way momentum moves from its next.

The pound was also stronger following a hawkish BOE meeting. Rising energy prices didn’t see them hold back from hinting at a rate hike, so markets continue to toy with a potential rise in February. The pound was slightly lower of flat against commodity currencies but made notable ground against the yen, rising 1.2% and erasing over 2 days of losses.

Learn how to trade forex

Commodity basket nears 6-year high:

Commodities were also broadly higher, with the CRB commodity index edging towards its 6-year high. WTI continued higher in line with our bias and closed above $73 to a 7-week high, although resistance sits nearby at 74.23. We suspect it will break above it but a pause in trend is a possibility initially.

Gold hit our initial target (and dipped beneath it) at the 1742 low. With a prominent swing high at 1787 then a move to 1720 remains possible.

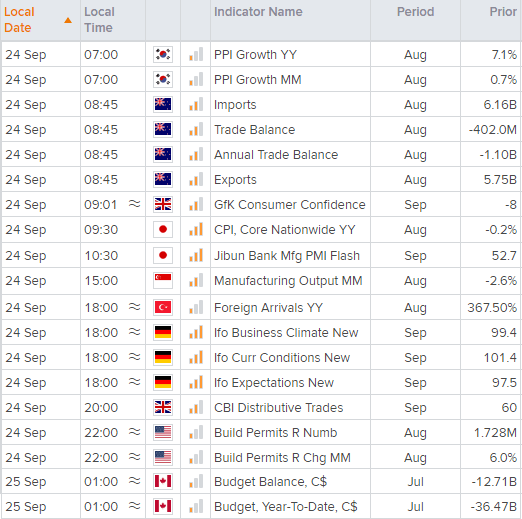

Up Next (Times in AEST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.