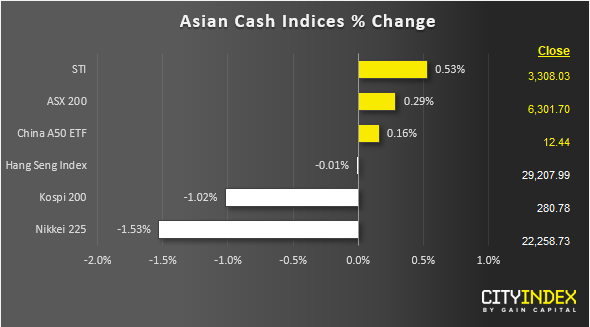

Stock market snapshot as of [07/5/2019 0606 GMT]

- Mix performance for Asian stock markets so far in today’s Asian mid-session after a significant drop seen in the S&P 500 E-mini futures in today’s Asian session at the open. It declined by 0.85% to print an intraday low of 2909 that has erased all the gains recorded in yesterday, 06 May U.S session. The cash S&P 500 ended 06 May U.S. session with a close of 2932.

- On-going renewed trade tension between U.S. and China where media reports had quoted from U.S. top trade negotiator, Robert Lighthizer that U.S. administration had planned to proceed with a tariff hike on Chinese imports on Fri.

- Japan cash stock market has reopened for business for the 1st day today after its extended Golden Week holiday where the Nikkei 225 plummeted by -1.5% and it is now looking vulnerable for a bearish breakdown below the 21880 key medium-term range support (click here for more details as per highlighted in our latest weekly outlook report).

- The Australian ASX 200 has given up its earlier gains and traded near its intraday low of 6283 after RBA put its key policy cash rate on hold and cited developments in the labour market will play a significant pivotal role on its interest rate decision in the upcoming meetings.

- European stock indices futures are indicating a negative open where the FTSE 100 and German DAX futures are downed by -0.55% and -0.32% respectively.

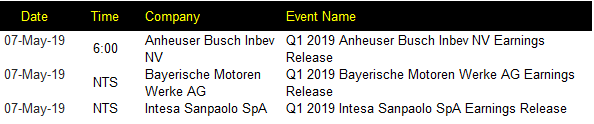

Corporate Highlights (Europe)

NTS: no time specific

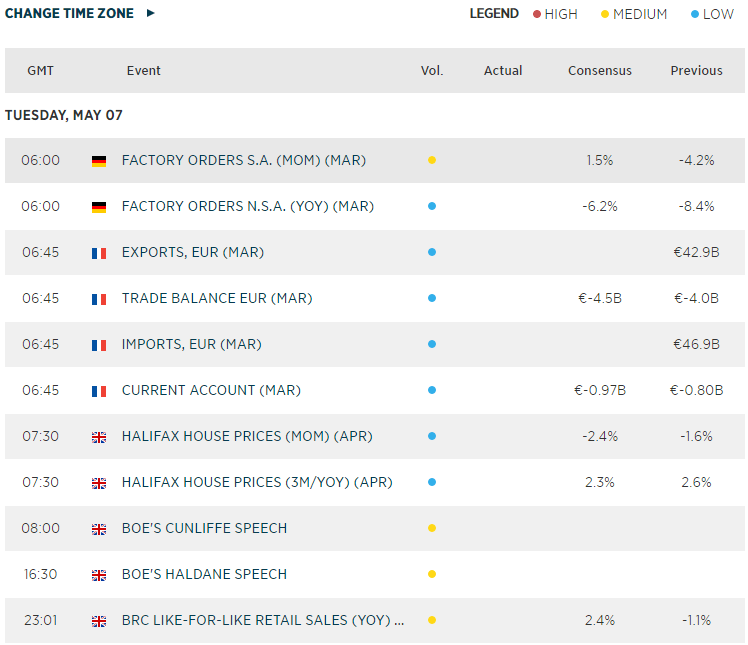

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM