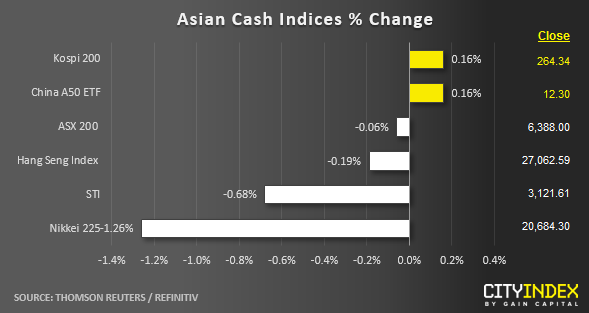

Stock market snapshot as of [31/5/2019 0530 GMT]

- Asian stock markets have continued to wobble as trade tensions are showing no signs of abating. U.S President Trump has fired a warning shot to its southern neighbour, Mexico on a threat to impose 5% tariffs on Mexican goods and even can goes up to 25% if Mexico does not address the rising trend of illegal immigrants from entering U.S.

- The S&P 500 e-min futures have tumbled by 0.9% in today’s Asian session from yesterday’s U.S. session close of 2788 that has wiped out its entire daily gain. It has printed an Asian session current intraday low of 2763 which is breaking below this week’s current low of 2766 and the key 200-day moving average. Technical elements are not favouring any signs of recovery at this juncture with the risk of further downside towards the medium-term support/target of 2730 as per highlighted in our weekly outlook report published on Mon, 27 May (click here for a recap).

- The worst performer is the Japan stock market where the Nikkei 225 has staged the expected bearish breakdown below the key technical level of 20800 and tumbled by -1.26% as at today’s Asian mid-session. The on-going weakness seen in Japanese stocks have been reinforced by a resurgence of JPY strength where the USD/JPY is now breaking below the 109.00 psychological level.

- European stock indices CFD futures are facing the bearish heat as well where FTSE 100 has declined by -0.50% (click here for a detailed analysis by my colleague, Matt Simpson). Also, the German DAX is tumbling by close to -1.00% and it is now testing a key support level of 11800 with weak technical elements.

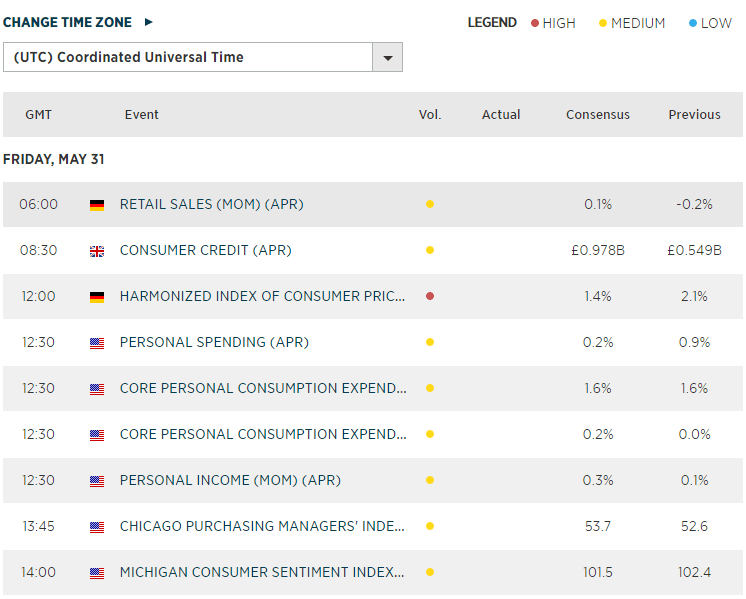

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM