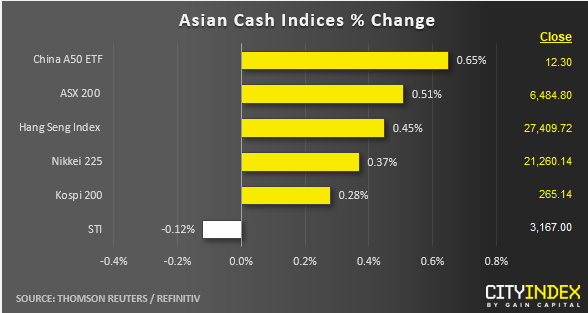

Stock market snapshot as of [28/5/2019 0624 GMT]

- Most Asian stock markets has chalked up modest gains in today’s Asian mid-session except for Singapore STI. The leaders are China A50, ASX 200 and Hang Seng Index with gains between 0.65% and 0.45%.

- The current rally seen in the Chinese stock market has been led by automobile stocks which soar between 6% to 4% where the government offices in Guangdong Province has outlined specific measures to optimise and upgrade auto consumption. On the other hand, a potential Alibaba secondary listing on the Hong Kong Stock Exchange could see a boast to liquidity in the Hong Kong stock market.

- The current rally seen in both Chinese and Hong Kong stocks have shrugged off the negative impact of a weaker yuan seen today where the USD/CNH (offshore yuan) has recovered from yesterday’s losses inflicted by a verbal intervention from a top Chinese official over the weekend. It has traded back up above yesterday, 27 May high of 6.9157. In addition, from a technical analysis perspective, the major stock indices are still at risk of shaping another leg of down move (click here for a recap on our latest weekly technical outlook report).

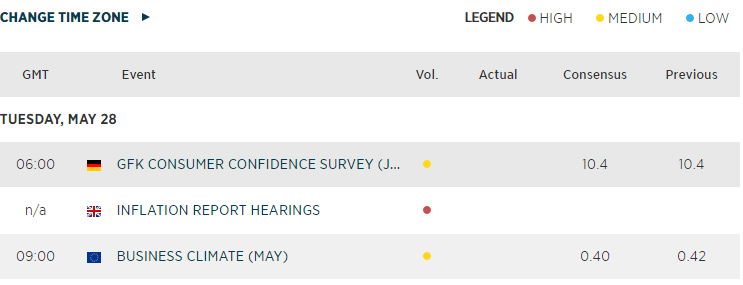

- No much activity on the European and UK economic calendar for today. European stock indices CFD futures have recorded modest gains while UK market reopens today. Both German DAX & FTSE 100 CFD futures are up by 0.20%.

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 08:33 AM