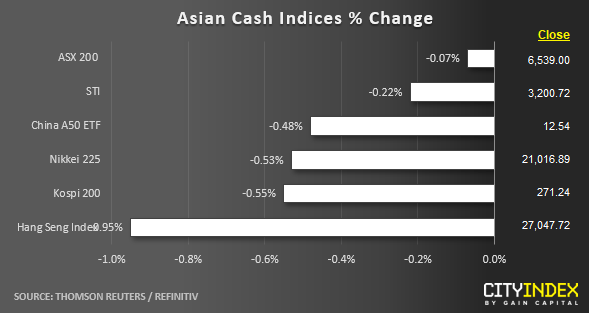

- Equities were broadly lower throughout the Asia session with trade concerns making a comeback after a 1-day hiatus.

- Hong Kong stocks led the decline for a second successive session as protestors took to the streets again, where reports of violence saw the government shut their offices. At time of writing, just 6 stocks have risen, 42 have fallen and 2 remain unchanged within the index, with technology and energy stocks leading the decline.

- Despite the negative sentiment, ASX200 remains relatively firm at just -0.1% lower for the session. Whilst energy stocks plunged with weaker oil prices, the broader index remained support following weak unemployment data, which saw further calls for RBA to cut in July. Just ahead of the close, 85 stocks have risen, 108 have fallen and 7 remain unchanged.

In Corporate news:

- Westfarmers Ltd (WES.AX) have forecast falling earnings for Kmart department stores, for the first time in a decade.

- Challenger (CFG.AX) fell 12% on disappointing earnings outlook.

- Residential developer Stockland Corp (SGP.AX) fell 6.3% on lower settlements outlook.

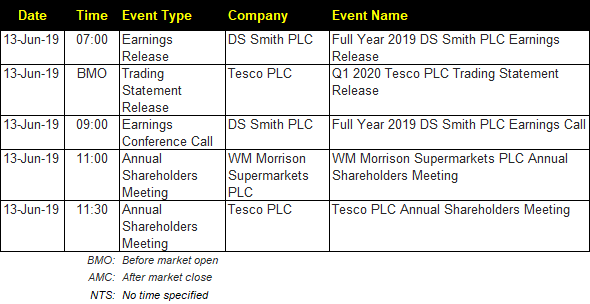

Upcoming corporate highlights

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM