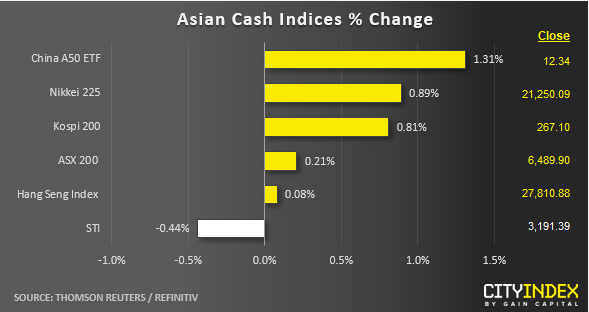

Stock market snapshot as of [21/5/2019 0530 GMT]

- Most Asian stock markets were backed in the black after 2-day of losses from last Fri, 17 May; taking a cue from a rebound of 0.79% seen in the S&P 500 e-min futures in today, Asian mid-session from yesterday, 20 May U.S. session low of 2831.

- “Tic for tat” statements have continued between U.S. and China after U.S administration forbids U.S. technology firms from doing business with Chinese telecommunications firm, Huawei. In a media interview, U.S. President Trump stated that he was “very happy” on the on-going trade war with China while China’s ambassador to the E.U. responded that China could retaliate on U.S. unfair treatment towards Chinese firms.

- Over the short-term it seems that a trade deal between U.S. and China is still far reaching, thus today’s up move seem in Asian stock markets may be another “dead cat bounce”. In addition, the medium-term downtrend for Nikkei 225 and Hang Seng Index remains intact from a technical analysis perspective.

- European stock indices CFD futures have also recovered some lost ground as the FTSE 100 and German DAX are up by 0.40% and 0.30% respectively.

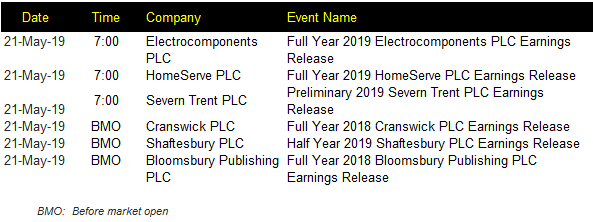

Corporate Highlights (U.K.)

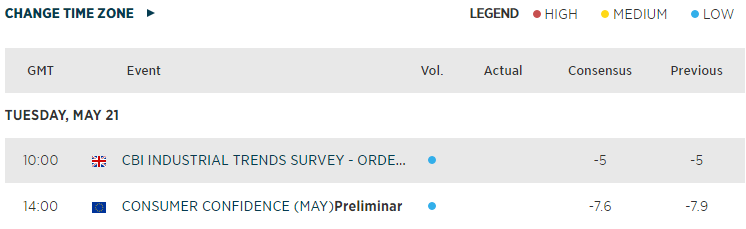

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.