Stock market snapshot as of [24/5/2019 0502 GMT]

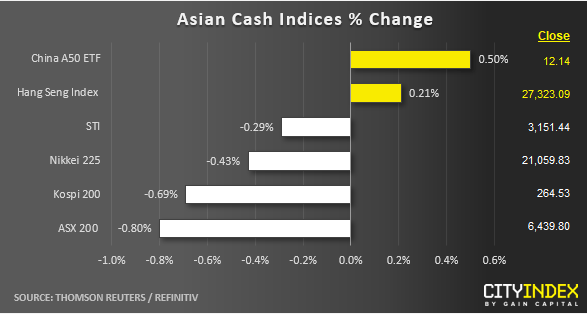

- Most Asian stock markets have continued to trade lower as at today’s Asian mid-session despite a 0.4% rebound seen in the S&P 500 e-mini futures to print a current intraday high of 2829 in today’s Asian session after a -1.19% decline seen in the overnight U.S. session to bring it close to last week’s swing low of 2801.

- U.S. President Trump stated that there is a “good possibility” Washington will reach an agreement with Beijing to end the on-going escalating trade conflict and the recent blacklisted Chinese telecom and technology firm, Huawei can be included in a trade deal.

- The latest “smoothing” remark from President Trump could be the catalyst for the on-going bounce seen in the China A50 and Hang Seng Index but despite its current gains, both indices are on track for a third week of consecutive losses.

- Key European stock indices CFD futures are also displaying modest gains after yesterday’s cash market losses of -1.5% to -1.8%. Both FTST 100 and German DAX are up by 0.28% and 0.50% respectively.

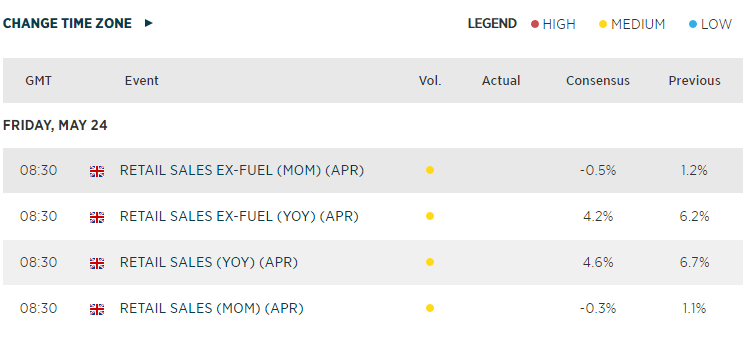

- There are no earnings releases on major UK or European firms for today and key economic data to focus in the European session will be UK retail sales for April out later at 0830 GMT.

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Today 08:33 AM