Stock market snapshot as of [02/5/2019 0610 GMT]

- Mix bag performance seen in Asian stock markets so far in today’s Asian mid-session despite a weak closing in the key benchmark U.S. stock indices post FOMC where Fed Chair Powell stated in the press conference that current low rates of inflation were transitory in nature that the Fed did not see a strong case for either an interest rate cut or hike.

- The S&P 500 tumbled by 1% from its current intraday fresh all-time high level of 2954 prior to yesterday’s FOMC to a print a low of 2923. The key medium-term support to watch rests at 2908 where the e-min S&P 500 futures has continued to inch lower in today’s Asian session to print a current intraday low of 2915. Click here for a recap for more details as per highlighted in our earlier published weekly outlook report.

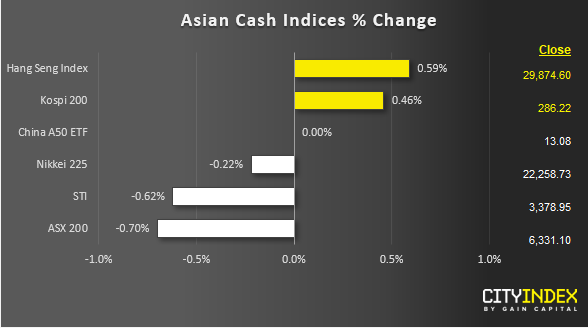

- Both Hang Seng Index and Kospi 200 outperformed in the Asian region as both advanced by 0.63% and 0.44% respectively on the back of a CNBC report that highlighted a potential U.S/China trade deal to be announced as soon as next Fri from unnamed sources while Japan and China stock markets remain shut for Golden Week holidays.

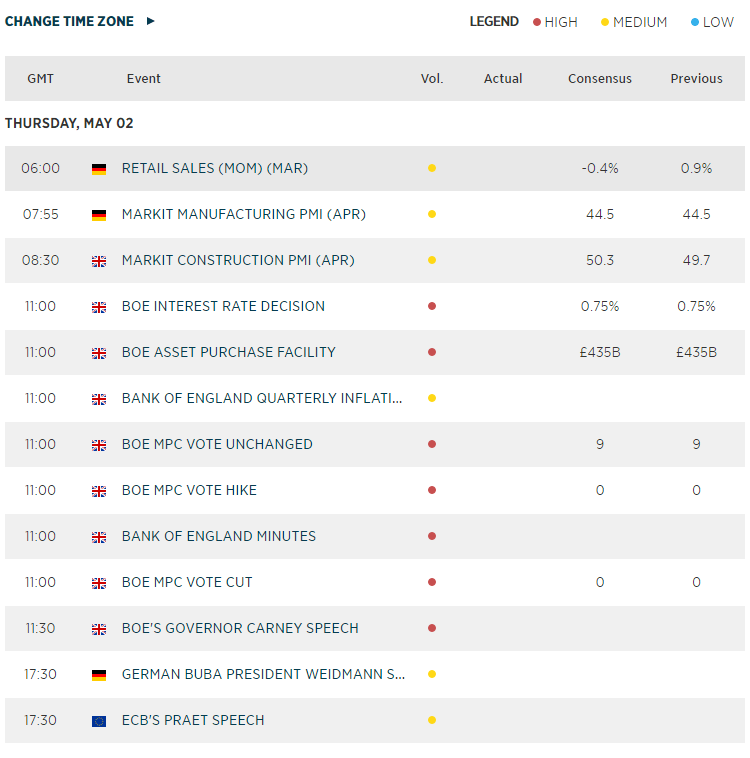

- European stock indices futures are trading lower where the FTSE 100 and Germany DAX are both down by -0.23% and -0.45% respectively ahead of key earnings releases out later in the U.K & European region and Bank of England’s monetary policy decision (see below)

Corporate Highlights (U.K/Europe)

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Today 08:33 AM