Stock market snapshot as of [14/5/2019 0604 GMT]

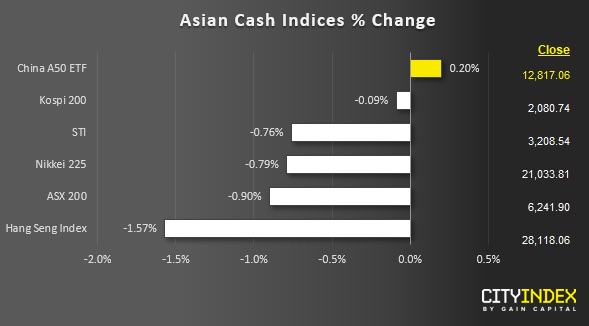

- Several Asian stock markets; China A50 and Kospi 200 have started to trim losses seen in the past 2 days in today’s Asian mid-session despite the trade tension between U.S and China has escalated with the Chinese government’s retaliation to hike tariffs to 25% on 2,493 U.S. products. In addition, the U.S. Trade Representative’s office has upped the ante with a new list of US$300 billion worth of Chinese products (includes toys, mobile phones & laptops) that the U.S. administration can impose new tariffs of 25% that will cover almost all imports from China.

- The Hong Kong stock market has resumed trading for the week after its closure yesterday for a public holiday, a typical “catch up play” where the Hang Seng Index is the worst performer so far today with a decline of -1.57%.

- Interestingly, the S&P 500 e-min futures has started to rebound by 0.80% to print a current intraday high of 2822 in today, Asian mid-session after a low of 2801 printed in the cash index as seen in yesterday, 14 May U.S. session. The current rebound can be attributed to a “so called” optimistic news flow that U.S. President Trump and China President Xi may meet at the next G-20 meeting in June to iron out the “sticking points” of the trade deal. Technically, the S&P 500 is now approaching our first medium-term support/target of 2790 where a potential corrective rebound can materialise Click here & here for our latest weekly technical outlook reports.

- European stock indices CFD futures are showing a slight gain with the FTSE 100 and German DAX up by 0.20% and 0.52% respectively.

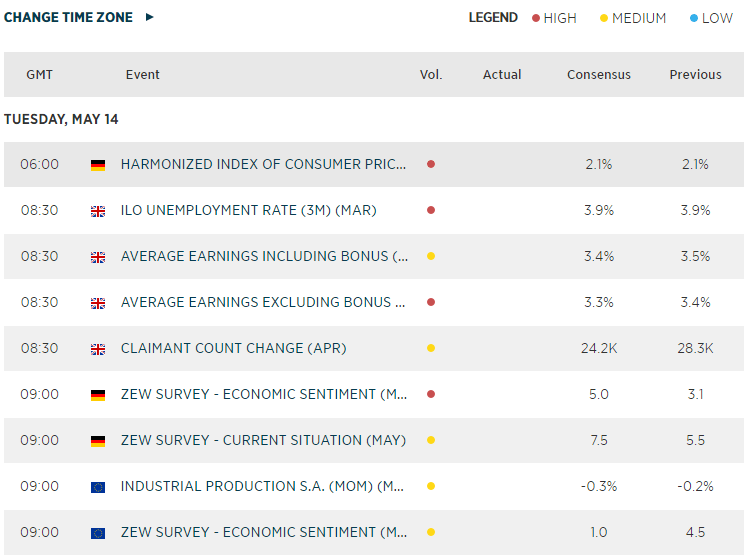

- On U.K and European economic data front, there are several key data releases for today; U.K unemployment/average earnings, German ZEW sentiment report and Eurozone industrial production (see below table for specific timings).

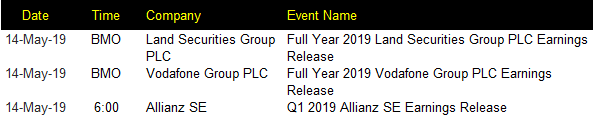

Corporate Highlights (U.K & Europe)

BMO: before market open

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM