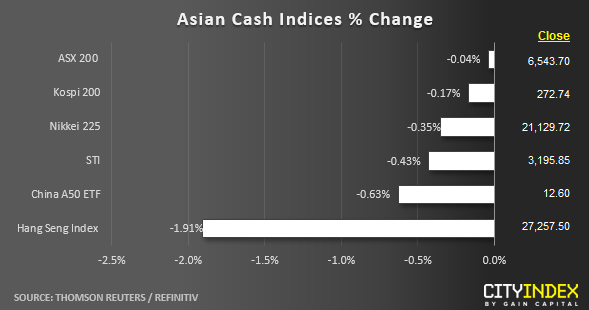

Stock market snapshot as of [12/6/2019 0635 GMT]

- Asian stock markets have started to stage a retreat in line with another weak closing seen in U.S. benchmark stock indices yesterday, 11 Jun. The S&P 500 has failed again to break above the 2900 intermediate resistance and erased its opening gapped-up gains (printed an intraday high of 2910) to close lower at 2885. Thus, the latest price action seen in the S&P 500 has increased the risk of an imminent minor pull-back within a medium-term uptrend phase.

- The worst performer as at today’s Asian mid-session is the Hong Kong’s Hang Seng Index where it tumbled by close to 2% triggered by a large-scale mass public demonstration in Hong Kong to protest the “soon to be passed” controversial China extradition bill. Yesterday’s gains powered up by China’s fiscal stimulus have been wiped out; click here & here to read our latest analysis on the Hong Kong stock market.

- FTSE 100 and Germany DAX CFD indices futures have continued to drop after losses seen at the close of yesterday, 11 Jun European session. Both are down by -0.48% and -0.40% respectively.

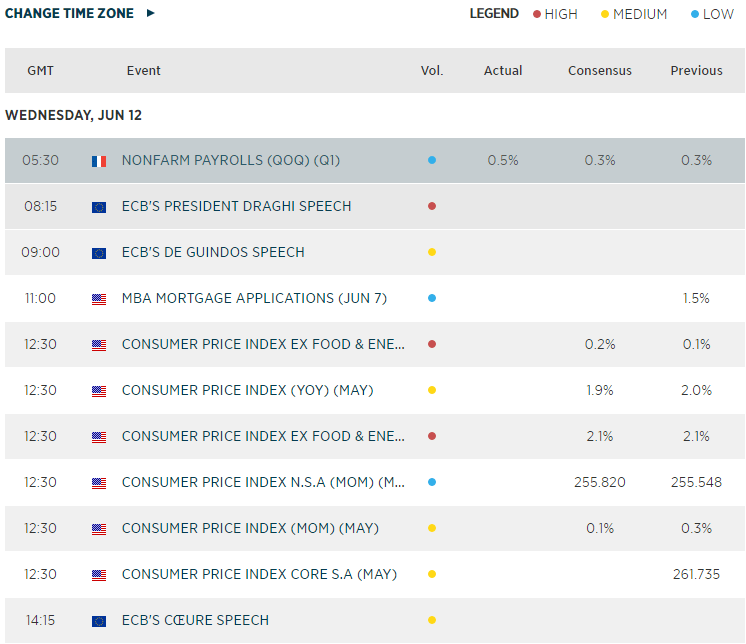

- Key economic event and data to take note later will be ECB President Draghi’s speech at 0815 GMT and the key U.S. CPI data for May out at 1230 GMT.

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM