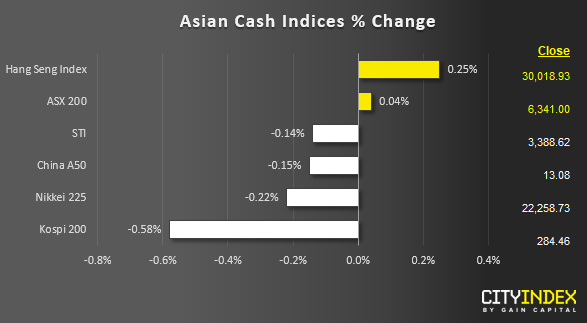

Stock market snapshot as of [03/5/2019 0555 GMT]

- Light trading dominated in Asian stock markets today on the back of a lacklustre performance in the U.S stock market coupled with the China and Japan markets remain shut for the Golden Week holidays. The U.S S&P 500 has ended yesterday’s session with 0.2% decline, its second consecutive day of decline post FOMC. Interestingly, it has managed to have a daily close above the 2908 key medium-term pivotal support (click here for a recap) after an intraday drop of 0.8% to print a low of 2900.

- Hong Kong’s Hang Seng Index (HSI) has continued to hold above 29500 key medium-term pivotal support and erased its earlier morning losses with a slight gain of 0.25% in today’s Asian mid-session aided by better than expected Q1 2019 earnings from HSBC, the 2nd largest component stock in HSI where HSBC’s share price soared by 3.00%. In contrast, Korea’s Kospi 200 has underperformed with a drop of 0.58%; dragged down by its largest component, Samsung Electronics which declined by 0.76%.

- European stock indices futures are trading slightly higher where the FTSE 100 and German DAX are showing a gain of 0.12%.

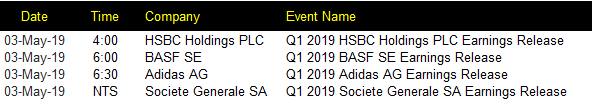

Corporate Highlights (U.K/Europe)

NTS: no time specific

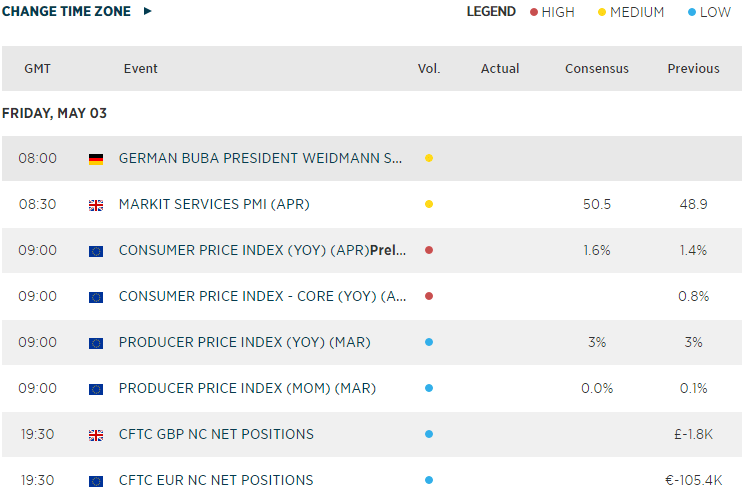

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 08:33 AM