Stock market snapshot as of [04/6/2019 0640 GMT]

- The Nasdaq 100 was the worst performer among the major U.S. benchmark stock indices where it tanked by -1.61% yesterday, 03 Jun led by the FAANG stocks where Facebook, Apple and Google may face fresh antitrust probes. We had highlighted this “bloodbath” scenario earlier on last Fri, 31 May in a short video due to its negative technical elements (click here to recap on the next key support level to watch).

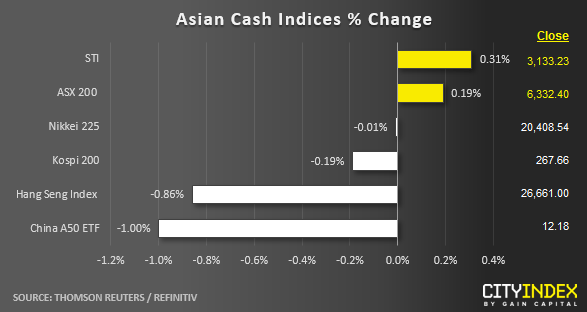

- China related stock markets have continued to resume their down moves after yesterday’s breather from a better than expected China’s Caixin manufacturing PMI data for May. The China A50 is the worst performer as at today’s Asia mid-session where it tumbled by -1.00% follow by a -0.86% drop seen in the Hang Seng Index.

- Australian central bank, RBA has cut its benchmark policy interest rate by 25 bps as expected to a fresh record low of 1.25%; refer to this link for the three key takeaways on today’s RBA meeting. A dovish RBA could be the reason for a resilient ASX 200 as seen today where it has inched up a slight gain of 0.19% despite the sell-off seen in the China stock market. However, from a technical analysis perspective, the ASX 200 still faces the risk of further downside pressure (click here for a recap on our latest weekly technical outlook).

- European stock indices CFD futures are trading in the red now after yesterday, 03 Jan modest gains of 0.50% to 0.60% seen in several key European stock indices. FTSE 100 and German DAX CFD futures are trading lower at -0.37% and -0.47% respectively.

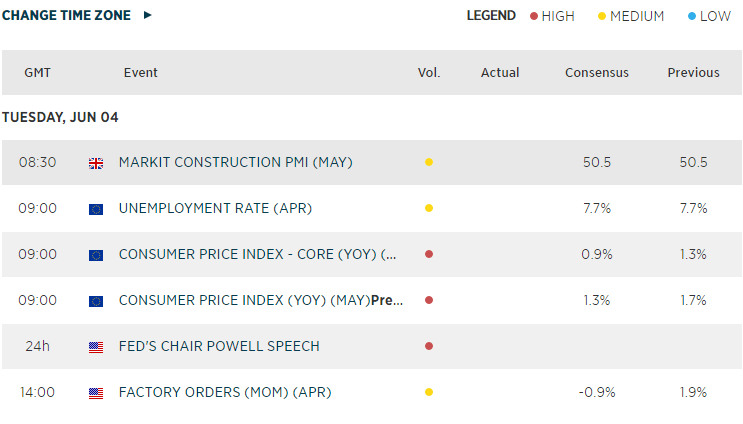

- Key U.K/European economic data to take note later will be U.K construction PMI for May and EU CPI data. Fed “speak event” today from the Chairman Powell later in the U.S. session at 1355 GMT in the second day of the “Conference On Monetary Policy Strategy, Tools & Communications Practices” in Chicago. It will be interesting to hear if Powell echoes similar dovish remarks from St Louise Fed Bullard that has stated yesterday that an interest rate cut may be warranted soon.

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM