Stock market snapshot as of [03/6/2019 0600 GMT]

- Negative follow through in the first trading day for a new month of June as the S&P E-Mini futures staged a gapped down by -0.72% in today’s Asian session to print a current intraday 2732 low from its Friday, 31 May cash index closing level of 2752.

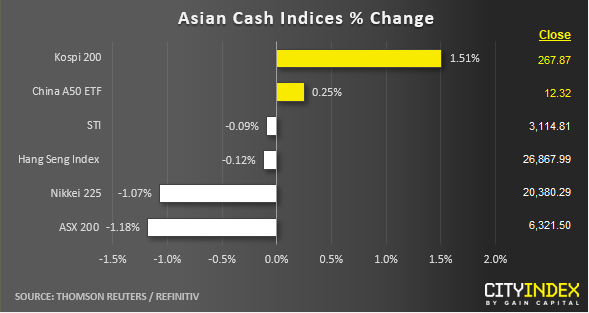

- Mix performance seen in Asian stock markets as today’s Asian mid-session where the Kospi 200 has rallied by 1.51% with modest gains seen in the China A50 at +0.25%. In contrast, the worst performers are the Japan’s Nikkei 225 and Australia’s ASX 200 where both has declined by -1.07% and -1.18% respectively.

- The current bearish muted performance seen in the China related stock markets (China A50 & Hang Seng Index) can be attributed to a better than expected China’s Caixin Manufacturing PMI for May that stood at 50.2 versus a consensus of 50 and also fared better that the government complied NBS manufacturing PMI that contracted to 49.4 in May.

- From a technical analysis perspective, the on-going decline seen in the major stock indices have been “overextended” and the risk of an imminent corrective rebound increases at this juncture (click here to assess our latest weekly technical outlook report).

- European stock indices CFD futures are tracking the current negative performance seen in the S&P 500 E-Mini futures where the FTSE 100 and German DAX are showing losses of -0.43% and -0.55% respectively.

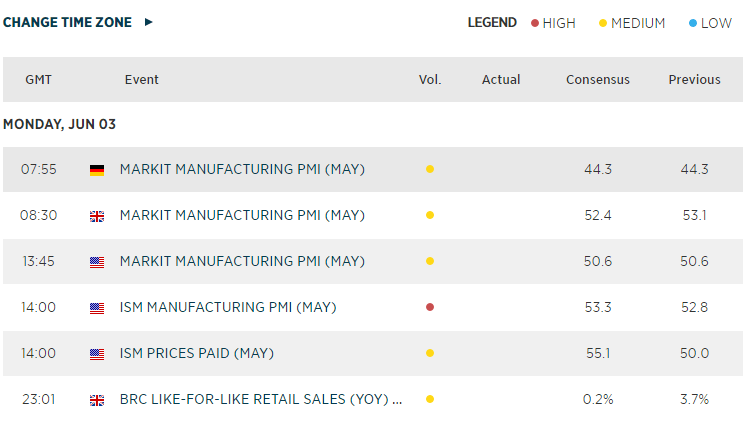

- Upcoming key European data releases to take note will be Germany manufacturing PMI data for May due later at 0755 GMT follow by UK manufacturing PMI out at 0830 GMT.

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Today 08:33 AM