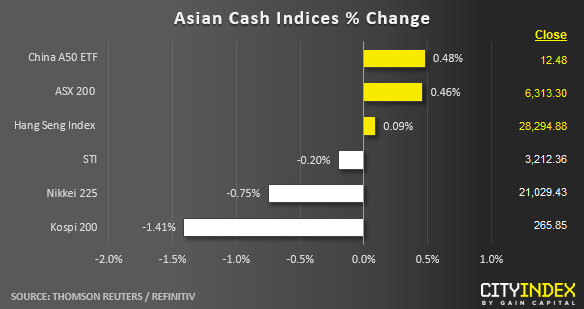

Stock market snapshot as of [16/5/2019 0540 GMT]

- Cautious stance seen in Asian session today as the Asian stock markets are taking the cue from the S&P 500 E-min futures where it has dipped by 0.7% from yesterday, U.S. session high of 2860 to print a current intraday low of 2840 seen so far in today, Asian mid-session. The initial “risk on rally” seen in yesterday, U.S. session that has been reinforced by U.S. President Trump’s proposal to delay auto tariffs by up to six months seems to have fizzled out.

- The worse performers are the Korea and Japan stock markets where the Kospi 200 and Nikkei 225 are down by -1.41% & -0.75% respectively. Latest news flow development in trade tension front was the signing of an executive order by U.S. President Trump on Wed, 15 May that could restrict Chinese telecommunication firms; Huawei and ZTE from selling their products in the U.S.

- European stock indices CFD futures are also inching downwards where the FTSE 100 and German DAX have shed -0.14% and -0.56% respectively.

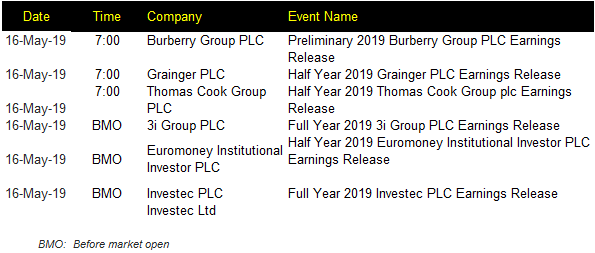

Corporate Highlights (U.K.)

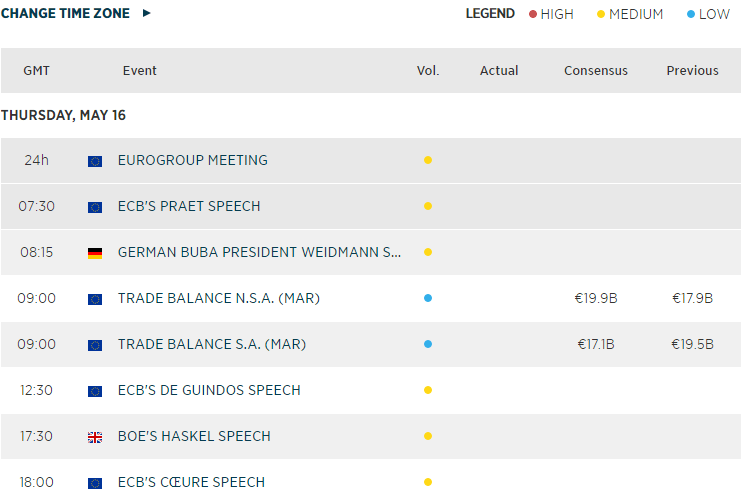

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM