Stock market snapshot as of [13/5/2019 0628 GMT]

- Further volatility has resurfaced at the start of a new trading week where the S&P 500 e-min futures has dropped by 1.4% to print a current intraday low of 2852 as seen in today’s Asian session where markets participants are waiting for the next steps both sides will take after the recent failed U.S/China trade negotiation talk that led the U.S. administration to impose additional tariffs on China products.

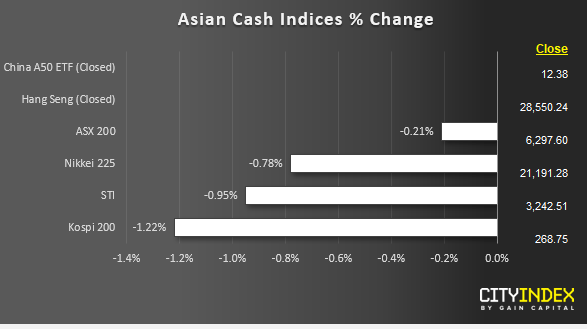

- Asian stock markets are in the red as at today, Asian mid-session except for the Hang Seng Index where the Hong Kong stock market is closed for a public holiday today as well as the China A50 ETF which is quoted from the Hong Kong Stock Exchange. The positive momentum seen in the USD/CNH (offshore Yuan) has also reinforced the on-going weakness seen in the Asian equities; especially where the USD/CNH has decisively broken above the 6.80 key medium-term resistance on last Fri, 10 May at the end of the U.S. session and traded higher today in the Asian session to clear above last week high of 6.8648.

- Major benchmark stock indices from Asia, U.S. and Europe are still at risk shaping further down moves. Click here & here for our latest weekly technical outlook reports.

- European stock indices CFD futures are trading lower where the FTSE 100 and German DAX are showing a decline of -0.93% and -0.97% respectively. No major U.K. and European economic data releases for today.

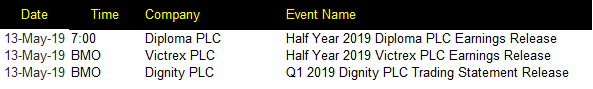

Corporate Highlights (U.K & Europe)

BMO: before market open

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM