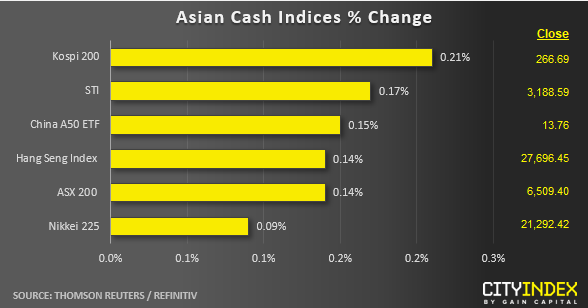

Stock market snapshot as of [22/5/2019 0600 GMT]

- Cautious trading with marginal gains seen in the Asian stock markets so far in today’s Asian mid-session despite overnight significant gains seen in the U.S. stock market where the S&P 500 and Nasdaq 100 both rose by 0.85% and 1.01% respectively.

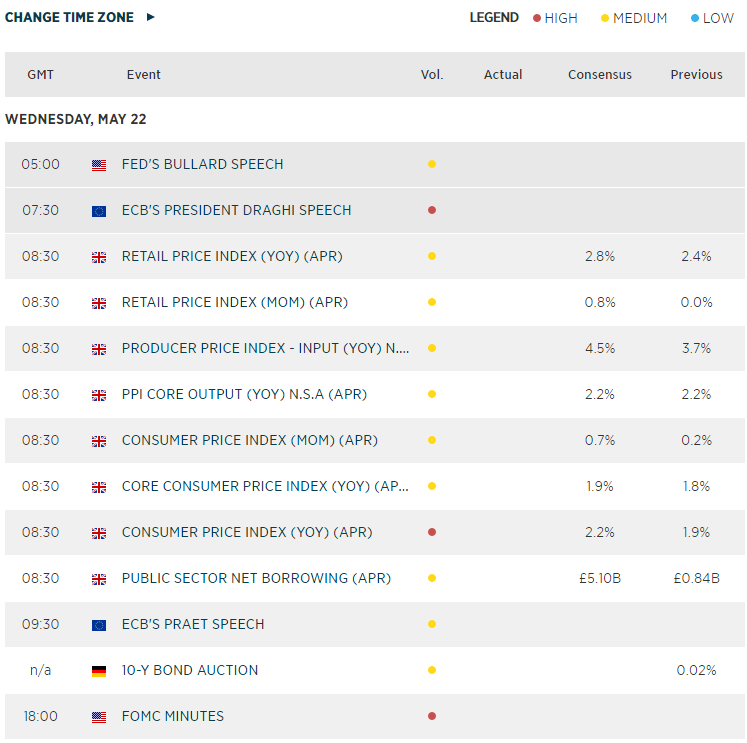

- Today’s range bound trading seen in the above highlighted Asian benchmark stock indices seems to indicate that market participants are waiting for new developments in the on-going U.S. and China trade tensions that has spilled over into a “technology cold war”. Media reports have indicated that the U.S. administration is planning to blacklist more Chinese firms; the next targets are five Chinese surveillance firms that includes HiKvision Digital Technology and Zhejiang Dahua Technology. Also, markets will also be focusing on the minutes of the recent Fed FOMC meeting held on 30 April to 01 May to be released at 1800 GMT later today for clues on future monetary policy stance.

- Moreover, the USD/CNH (offshore Yuan), a key “risk on/risk off” indicator is still holding steady above its key short-term support at 6.9160.

- Mix performance seen in the European stock indices CFD futures where the FTSE 100 is up slightly by 0.29% while the German DAX is almost unchanged from yesterday, 21 May cash index closing level of 12143.

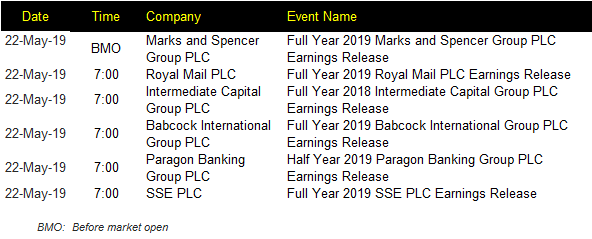

Corporate Highlights (U.K.)

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM