Stock market snapshot as of [06/6/2019 0550 GMT]

- The U.S. benchmark stock markets continued to soar yesterday, 05 Jun where the S&P 500 had recorded a gain of 0.82% with a daily close at 2826 that was above the 2802/12 key medium-term resistance. The corrective down move in place since 01 May 2019 has been invalidated (click here for the update). The S&P 500 E-Mini futures has managed to recover from its earlier Asian session losses today where it printed a current intraday low of 2812 to trade back up at 2826, the closing level of yesterday, U.S. session.

- Market participants have ignored the negative impact that a deal has not been reached between U.S and Mexico and failure to reach a deal by Friday shall see the risk of a 5% tariff on Mexican goods to take effect next Monday, 10 June. The on-going optimism in the global stock markets have been driven by an increasing dovish U.S. central bank where Fed Chair Powell has echoed similar remarks from his dovish colleagues that the Fed is open to a rate cut.

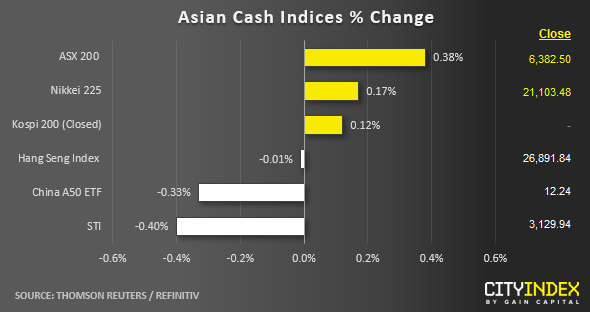

- The bearish force has also taken a retreat in Asian stock markets with mix performances as at today’s Asian mid-session where modest gains have been recorded in the ASX 200 and Nikkei 225; up by 0.38% and 0.17% respectively.

- European stock indices CFD futures are not showing any significant movement where the FTSE 100 is up by 0.06% while the German DAX has dropped by -0.28%.

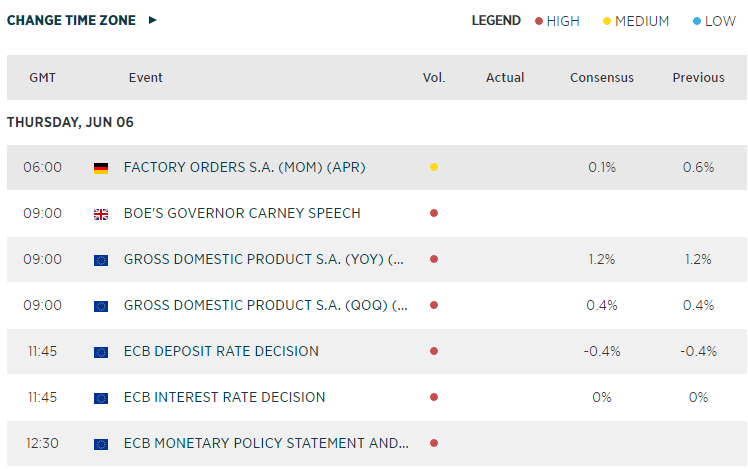

- Key European/UK data and events to take note later will be BoE Governor’s speech, Eurozone Q1 GDP follow by ECB monetary policy announcement.

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.