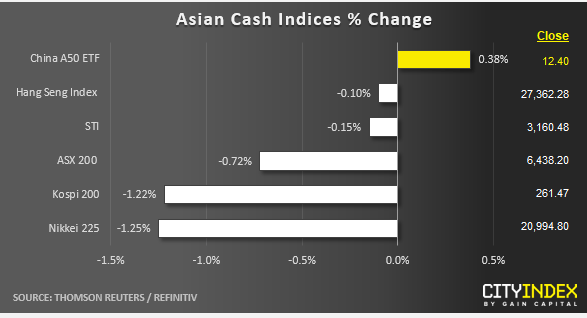

Stock market snapshot as of [29/5/2019 0610 GMT]

- Almost a sea of red for Asian stock markets as at today’s Asia mid-session except for the China stock market where the China A50 has managed to record a modest gain of 0.38%

- The S&P 500 e-mini futures has seen a negative follow through in today’s Asian session after a daily close of -0.84% printed in the overnight U.S. session. It has continued to decline by 0.5% to print a current Asian session intraday low of 2792 that has broken below the psychological level of 2800 and the 13 May 2019 swing low area.

- The worst performers are the Kospi 200 and Nikkei 225 that have declined by -1.22% and -1.25% respectively. 20800 is an important technical level to take note on the Nikkei 225 as a break below it exposes further potential downside. Click here for a recap on our weekly technical outlook report).

- European stock indices CFD futures are feeling the “bearish heat” as well where the FTSE 100 and German DAX are seeing losses of -0.70% and -0.60% respectively.

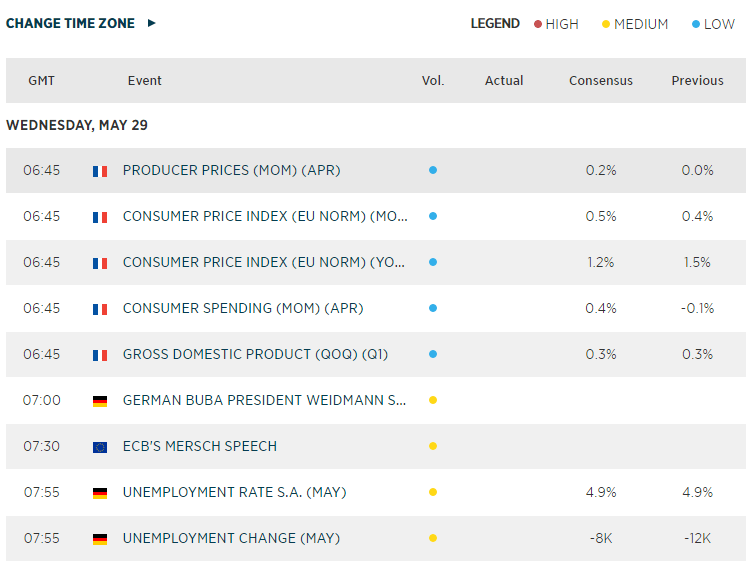

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM