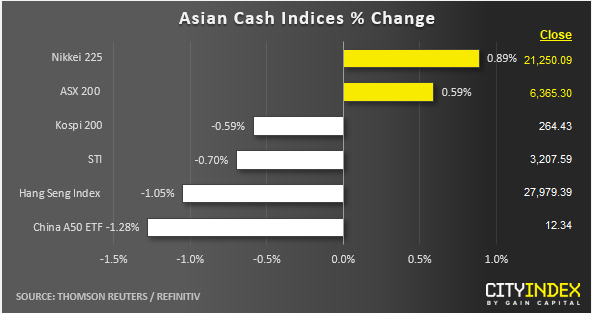

Stock market snapshot as of [17/5/2019 0628 GMT]

- Despite yesterday’s optimistic performances seen in the U.S. benchmark stock indices where the S&P 500 and Nasdaq 100 have rallied by 0.8% to 1%, there are no clear positive follow through seen in the Asian stock markets.

- As at today’s Asian mid-session, China, Hong Kong and Singapore stock markets are the underperformers where the China A50, Hang Seng and STI are showing losses of -1.28%, -1.05% and -0.70% respectively. Reasons that attribute for these lacklustre performances is the resilient bullish tone seen in the USD/CNH (offshore Yuan) where the pair has managed to stage a bullish breakout from its minor range resistance of 6.9190 (formed on 14 May/15 May) and it is now approaching the major Jan 2017 swing high of 6.9875.

- Secondly, negative trade news flow where China’s state media has indicated a lack of interest in resuming trade negotiation talks with the U.S and a spokesman from China’s Ministry of Commence has stated that he has no information on any U.S. officials heading to Beijing for fresh round of trade talks. In contrast with a speech made by U.S. Treasury Secretary Mnuchin on Wed that indicated a visit to Beijing “in the near future”.

- European stock indices CFD futures are “feeling the chill” as well where the FTSE 100 and German DAX are showing losses of close to -0.40%.

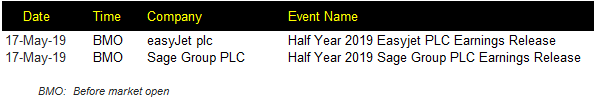

Corporate Highlights (U.K.)

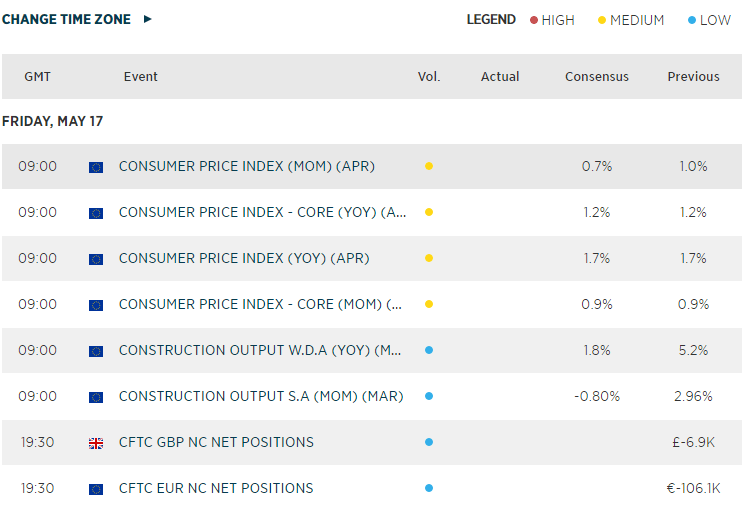

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.