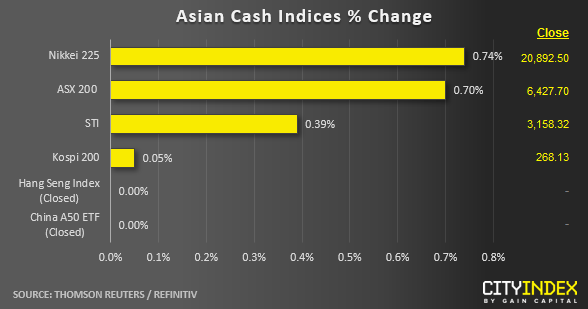

Stock market snapshot as of [07/6/2019 0513 GMT]

- All Asian stock markets have continued to see gains as at today’s Asia mid-session, a positive following through from the performances seen in the key benchmark U.S. stock indices overnight where the S&P 500 and Nasdaq 100 have gained by 0.61% and 0.76% respectively. China and Hong Kong stock markets are closed for a public holiday today.

- The on-going gains for these Asian stock indices have ignored a latest remark from China PBoC Governor Yi Gang that has stated that no on exchange rate number is more important than others and China has “tremendous” room to adjust momentary policy if the trade war with U.S. deepens. These remarks imply that China may allow the yuan to have a weaker level above 7 per dollar. The USD/CNH (offshore yuan) has rallied by 160 pips (the best gain seen so far for this week) to print a current intraday high of 6.9430 which is just a whisker below the minor range resistance at 6.9490 in place since 17 May 2019.

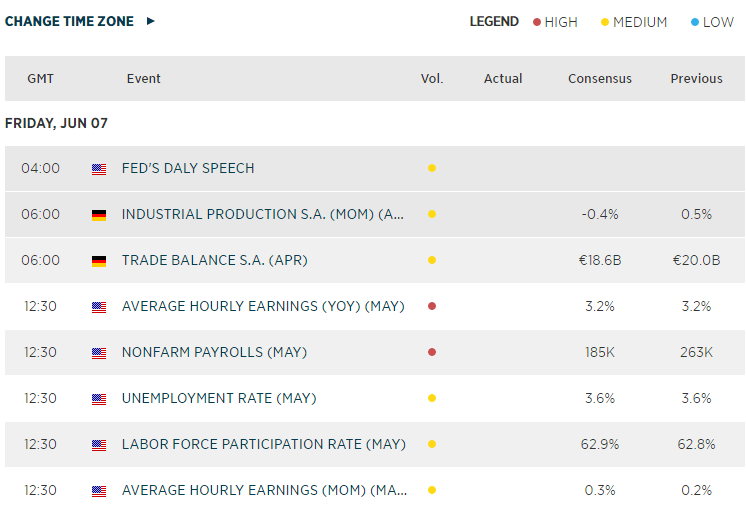

- The major focus will be on the U.S. non-farm payroll data for May out later at 1230 GMT where the consensus is set at an increase of 185K. If the consensus number is missed significantly to the downside, the probability of a Fed interest rate cut by end Jul will increase (the current probability stands at around 70% chance of an interest rate cut based on CME FedWatch tool) which can fuel further potential gains in global stocks.

- Another important date to take note in the near future will be on 29 Jun 2019, that’s the second and last day of the G20 meeting held in Japan as U.S. President Trump has stated to the media yesterday that he will decide whether to enact tariffs on another US$325 billion in Chinese imports after the G20 meeting.

- The FTSE 100 and German DAX CFD futures are posting modest gains at 0.27% and 0.34% respectively.

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.