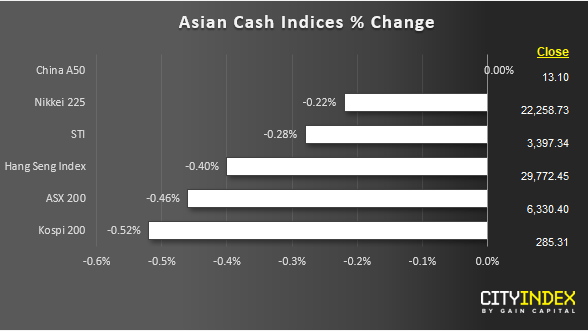

Stock market snapshot as of [30/4/2019 0558 GMT]

- Most Asian stock markets are seeing the sea of red in today’s Asian mid-session ahead of Labour Day holiday tomorrow where the China cash stock market will enter its Golden Week holiday for 3 days from 01 May to 03 May. Japan cash stock market remains shut for today for its extended Golden Week holiday till 06 May 2019.

- The overall weak performance can be attributed to two main factors; the negative spill over effect from weaker than expected Q1 2019 revenue from Google (part of the resurgence momentum play FAANG group) where revenue growth dipped to its lowest pace since 2015. Google share price tanked 7.3% in after hours trading after the release of its earnings results. Secondly, a weaker China PMI data for Apr where the Caixin manufacturing PMI indicated a slowdown in growth to 50.2 from 50.8 seen in Mar and the official manufacturing PMI also declined to 50.1 from 50.5 in Mar.

- Despite the current lacklustre performance, the medium-term uptrend remains intact for the major stock indices; click here for a recap on our latest weekly technical outlook.

- Mix performance seen in the European stock indices futures where the FTSE 100 is unchanged while the German Dax is down by -0.18%

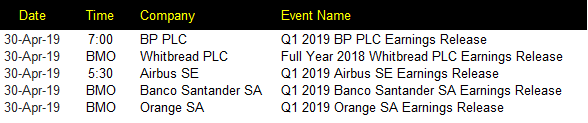

Corporate Highlights (U.K & Europe)

BMO: before market open

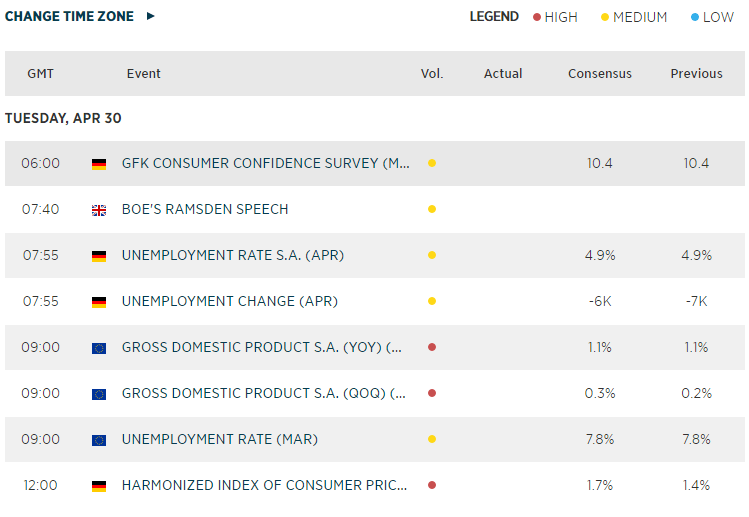

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM