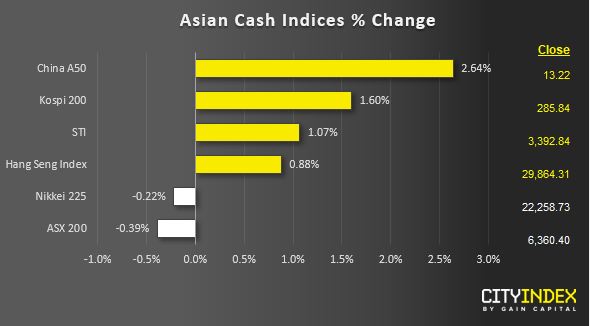

Stock market snapshot as of [29/4/2019 0608 GMT]

- Most Asian stock markets have started on a solid footing for this upcoming heavy economic/event data release week (Fed’s FOMC, China PMI, U.S payrolls & U.S/China trade negotiation talks) as seen in today’s Asian mid-session with the exception of the Australian ASX 200 and the Japan Nikkei 225 where it has been shut for the start of its extended Golden Week holidays from today, 29 Apr to 06 May 2019.

- The best outperformer, China A50 has rallied by 2.6% as it shrugged off last week’s lacklustre performance on the back of a strong China’s industrial profits pick up in Mar with a 13.9% y/y increase after 4 months of contraction, the data was released on last Sat, 27 Apr. Later today, the Big 4 China banks; ICBC, China Construction Bank, Bank of China & China Merchants Bank together with Ping An Insurance and PetroChina will report their respective Q1 2019 earnings data.

- Singapore’s STI has also joined in the bullish bandwagon as it rallied by 1.07% after a sideways trading range since 22 Apr 2019 led by its biggest component stock; DBS that has reported better than expected Q1 2019 earnings data (net profit increased by 9% y/y) before the market open today.

- European stock markets futures are muted where the FTSE 100 and German DAX are trading almost unchanged from last Fri’s close.

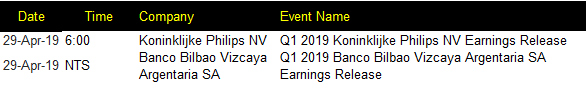

Corporate Highlights

NTS: no time specific

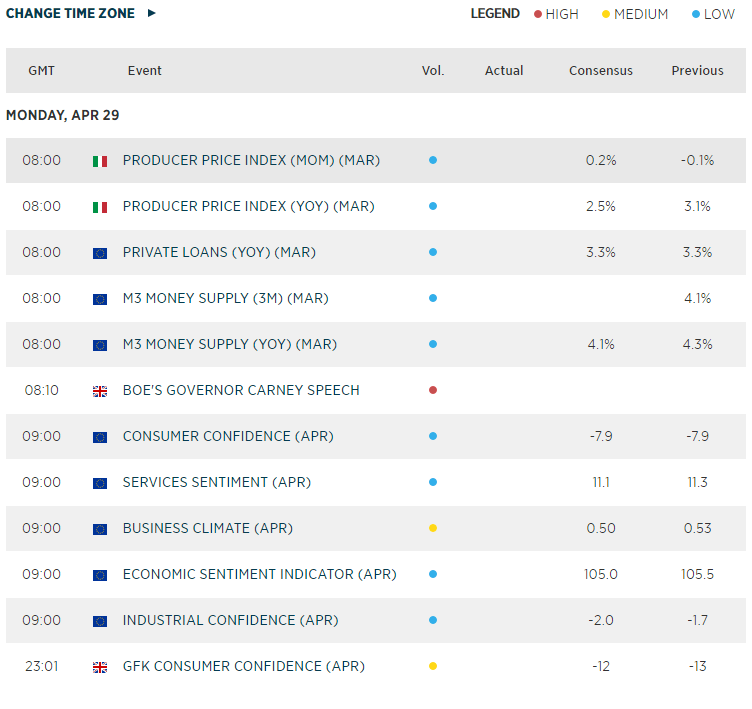

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Today 08:15 AM

Today 05:45 AM

Yesterday 11:09 PM

Yesterday 11:01 PM