'

'

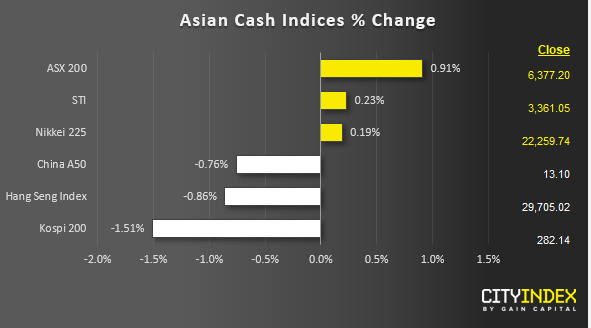

Stock market snapshot as of [24/4/2019 0415 GMT]

- No clear broad-based positive follow through for Asian stock markets despite a strong finishing close seen on the key benchmark U.S stock indices yesterday; the S&P 500 has recorded a fresh all-time high close at 2933 above the Sep 2018 record close of 2930.

- The ASX 200 has continued to outperform since the break above 6290 where today’s up move has been reinforced by a weaker than expected Q1 Australia trimmed mean CPI data (1.6% y/y versus consensus of 1.7% y/y) that has increased the probability of a RBA interest rate cut in the coming months.

- Continued strength seen in the USD has trigged another round of sell-off in the Korean stock market lead by foreigners (net sellers of 46.3 billion won worth of shares) where the Kospi 200 is the worse underperformer in today’s Asian mid-session.

- European stock market futures on FTSE 100 and German DAX are indicating a negative opening where both showing a decline of -0.21% and -0.32% respectively.

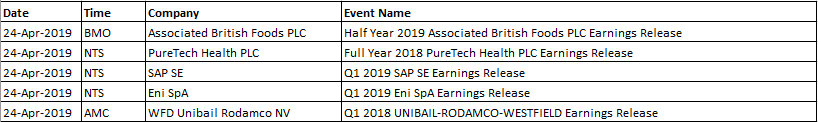

Corporate Highlights

BMO: before market open AMC: after market close NTS: no time specific

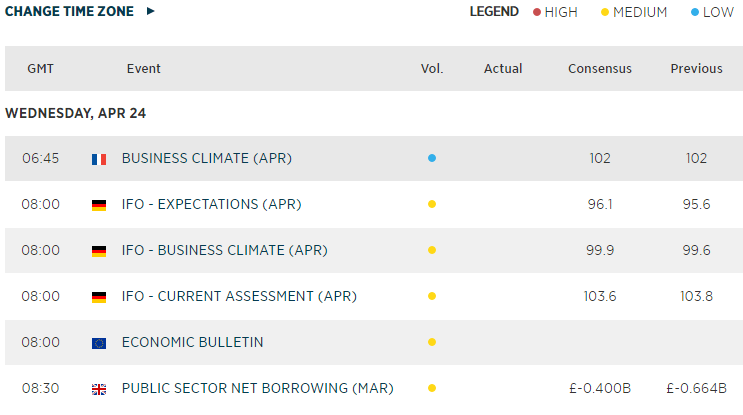

Macroeconomic Calendar

'

'

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.