Asia Morning: U.S. Stocks End in the Red

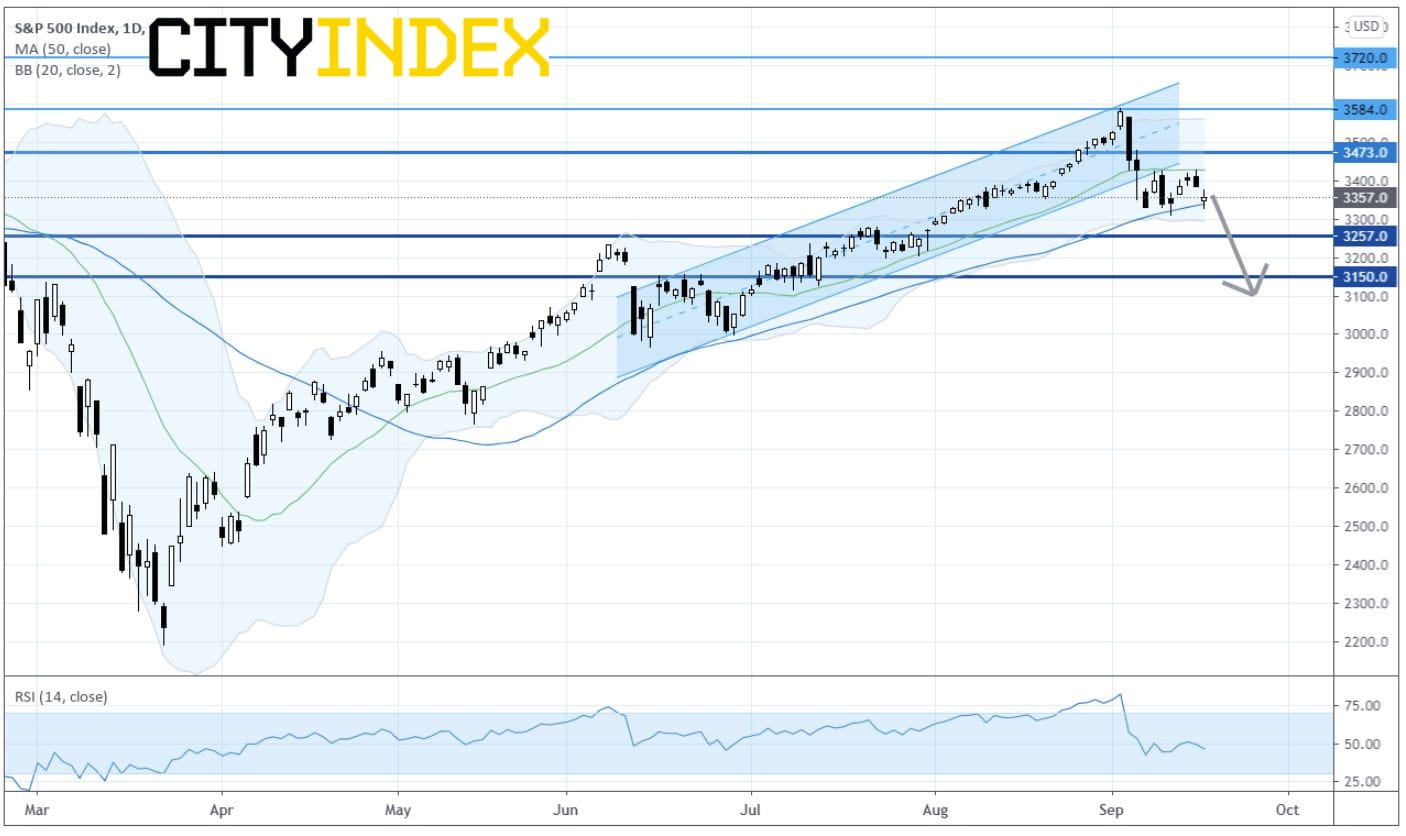

On Thursday, U.S. stocks ended in negative territory. The Dow Jones Industrial Average fell 130 points (-0.47%) to 27902, the S&P 500 dropped 28 points (-0.84%) to 3357 and the Nasdaq 100 slid 166 points (-1.48%) to 11080.

S&P 500 Index: Daily Chart

Sources: GAIN Capital, TradingView

The persistently high claims for U.S. jobless benefits caused some concerns. The U.S. Labor Department reported that Initial Jobless Claims fell to 860,000 in the week ended September 12 (850,000 expected, 893,000 in the prior week). And U.S. Housing Starts declined to an annualized rate of 1.416 million units in August (1.488 million units expected).

Real Estate (-2.19%), Media (-2.17%) and Retail (-1.71%) sectors lost the most. Illumina (ILMN -7.58%), American Tower (AMT -4.77%), NetApp Inc (NTAP -4.28%) and Southwest Airlines (LUV -4.04%) were top losers. Meanwhile, General Electric (GE +4.37%) and Ford Motor (F +3.85%) were higher.

And tech giants - Apple (AAPL -1.60%), Amazon.com (AMZN -2.25%) and Tesla (TSLA -4.15%) - were broadly lower.

Approximately 66.4% (64.2% in the prior session) of stocks in the S&P 500 Index were trading above their 200-day moving average and 57.4% (53.7% in the prior session) were trading above their 20-day moving average.

European stocks ended in the red. The Stoxx Europe 600 Index fell 0.51%, Germany's DAX 30 dropped 0.36%, France's CAC 40 slid 0.69%, and the U.K.'s FTSE 100 was down 0.47%.

The benchmark U.S. 10-year Treasury yield marked a low of 0.646% before bouncing back to 0.6822%.

Oil prices increased after the Organization of the Petroleum Exporting Countries (OPEC) and its allies stressed commitment to their agreed output cut. U.S. WTI crude oil futures (October) advanced 2.0% to $40.97 a barrel.

Spot gold lost $15.00 (-0.77%) to $1,944 an ounce.

On the forex front, the U.S. dollar weakened against its major peers, with the ICE Dollar Index dropping 0.3% on day to 92.91

EUR/USD marked a day-low of 1.1737 before closing up 0.3% to 1.1853.

GBP/USD gained 0.1% to 1.2975, up for a fourth straight session. The Bank of England held its benchmark rate at 0.10% and maintained its asset purchases target at 745 billion pounds as expected. BOE said "the Monetary Policy Committee will keep under review the range of actions that could be taken to deliver its objectives". Later today, U.K. retail sales data for August will be released (+0.8% on month expected).

USD/JPY fell 0.2% to 104.71, posting a four-day losing streak. The Bank of Japan decided to keep its benchmark rate at -0.10% as expected. This morning, official data showed that Japan's national CPI grew 0.2% on year in August (as expected),

USD/CAD slipped 0.2% to 1.3145. Canada's retail sales data for July will be reported later in the day (+1.0% on month expected).

Meanwhile, AUD/USD gained 0.2% to 0.7318. Government data showed that the Australian economy added 111,000 jobs in August (-35,000 jobs expected), while jobless rate dropped to 6.8% (7.7% expected) from 7.5% in July.

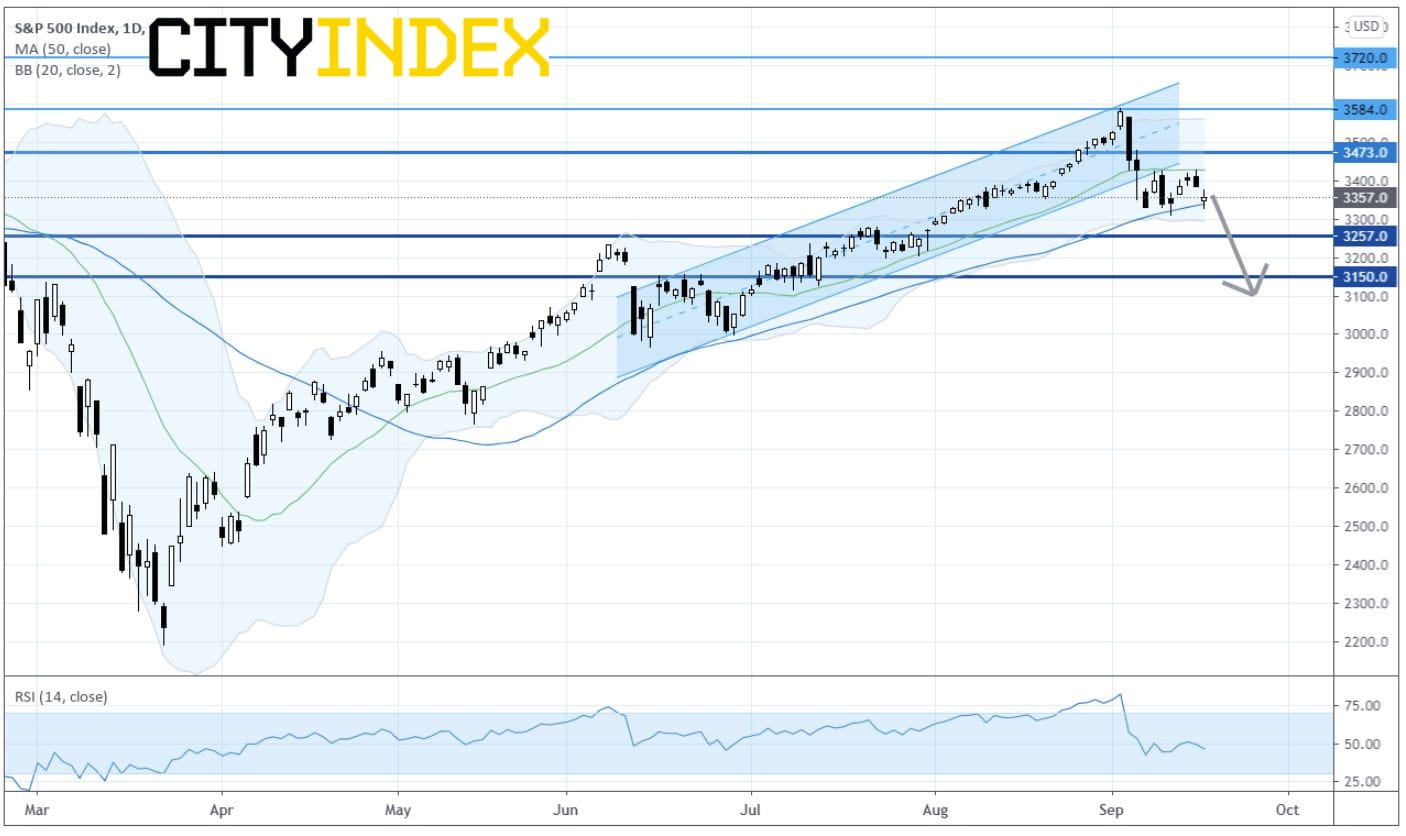

S&P 500 Index: Daily Chart

Sources: GAIN Capital, TradingView

The persistently high claims for U.S. jobless benefits caused some concerns. The U.S. Labor Department reported that Initial Jobless Claims fell to 860,000 in the week ended September 12 (850,000 expected, 893,000 in the prior week). And U.S. Housing Starts declined to an annualized rate of 1.416 million units in August (1.488 million units expected).

Real Estate (-2.19%), Media (-2.17%) and Retail (-1.71%) sectors lost the most. Illumina (ILMN -7.58%), American Tower (AMT -4.77%), NetApp Inc (NTAP -4.28%) and Southwest Airlines (LUV -4.04%) were top losers. Meanwhile, General Electric (GE +4.37%) and Ford Motor (F +3.85%) were higher.

And tech giants - Apple (AAPL -1.60%), Amazon.com (AMZN -2.25%) and Tesla (TSLA -4.15%) - were broadly lower.

Approximately 66.4% (64.2% in the prior session) of stocks in the S&P 500 Index were trading above their 200-day moving average and 57.4% (53.7% in the prior session) were trading above their 20-day moving average.

European stocks ended in the red. The Stoxx Europe 600 Index fell 0.51%, Germany's DAX 30 dropped 0.36%, France's CAC 40 slid 0.69%, and the U.K.'s FTSE 100 was down 0.47%.

The benchmark U.S. 10-year Treasury yield marked a low of 0.646% before bouncing back to 0.6822%.

Oil prices increased after the Organization of the Petroleum Exporting Countries (OPEC) and its allies stressed commitment to their agreed output cut. U.S. WTI crude oil futures (October) advanced 2.0% to $40.97 a barrel.

Spot gold lost $15.00 (-0.77%) to $1,944 an ounce.

On the forex front, the U.S. dollar weakened against its major peers, with the ICE Dollar Index dropping 0.3% on day to 92.91

EUR/USD marked a day-low of 1.1737 before closing up 0.3% to 1.1853.

GBP/USD gained 0.1% to 1.2975, up for a fourth straight session. The Bank of England held its benchmark rate at 0.10% and maintained its asset purchases target at 745 billion pounds as expected. BOE said "the Monetary Policy Committee will keep under review the range of actions that could be taken to deliver its objectives". Later today, U.K. retail sales data for August will be released (+0.8% on month expected).

USD/JPY fell 0.2% to 104.71, posting a four-day losing streak. The Bank of Japan decided to keep its benchmark rate at -0.10% as expected. This morning, official data showed that Japan's national CPI grew 0.2% on year in August (as expected),

USD/CAD slipped 0.2% to 1.3145. Canada's retail sales data for July will be reported later in the day (+1.0% on month expected).

Meanwhile, AUD/USD gained 0.2% to 0.7318. Government data showed that the Australian economy added 111,000 jobs in August (-35,000 jobs expected), while jobless rate dropped to 6.8% (7.7% expected) from 7.5% in July.

Latest market news

Today 08:33 AM