Asia Morning: US Stocks Sell-off Continues

On Tuesday, U.S. stocks closed sharply lower as tech-led sell-off continued. Nasdaq 100 slumped 553 points (-4.8%) to 11068, posting a three-day decline totaled 10.9%. The Dow Jones Industrial Average plunged 632 points (-2.3%) to 27500 and S&P 500 sank 95 points (-2.8%) to 3331.

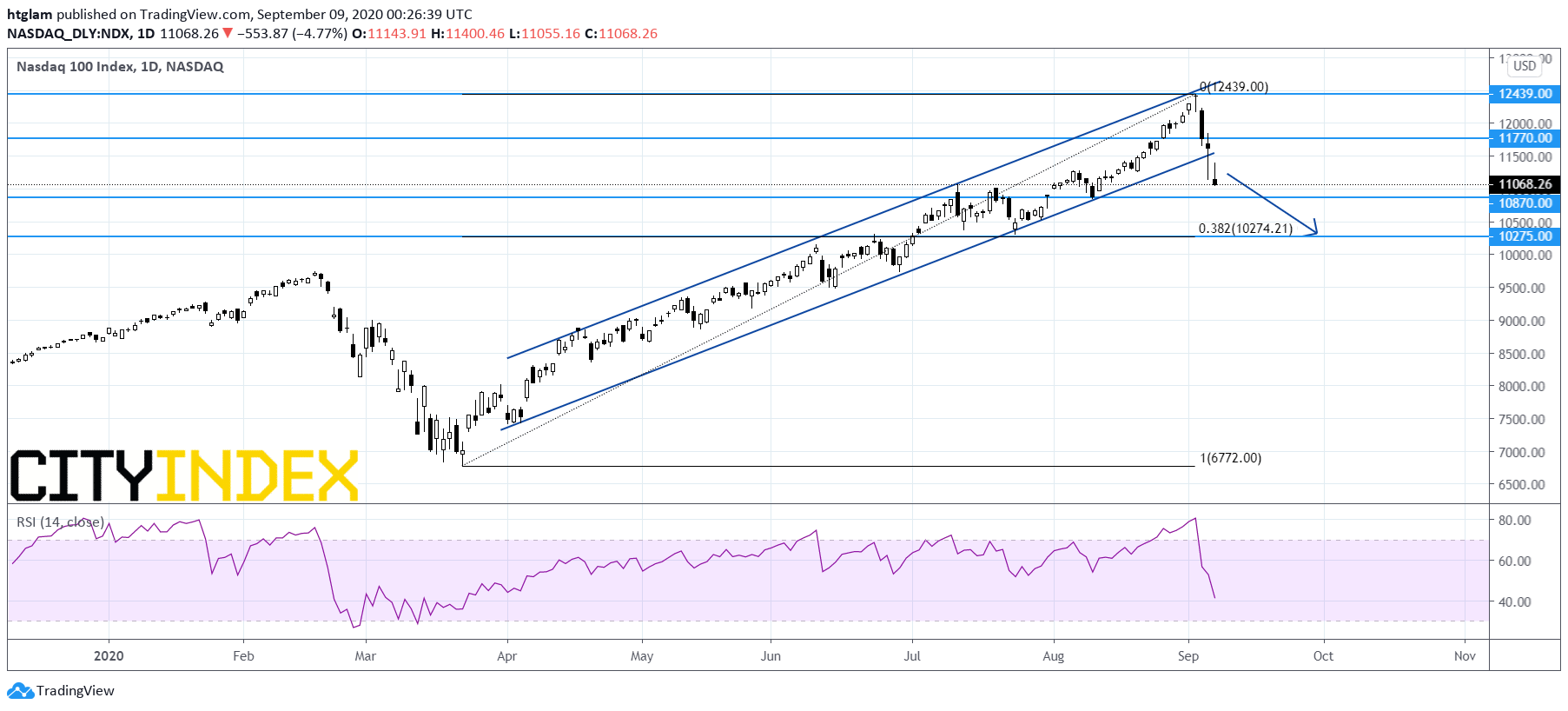

Nasdaq 100 daily chart:

Source: Gain Capital, TradingView

Technology Hardware & Equipment (-5.85%), Semiconductors & Semiconductor Equipment (-4.63%) and Software & Services (-3.85%) sectors led the decline. Approximately 63.6% of stocks in the S&P 500 Index were trading above their 200-day moving average and 48.1% were trading above their 20-day moving average.

European stocks were broadly lower. The Stoxx Europe 600 Index dropped 1.4%, Germany's DAX 30 lost 1.0%, France's CAC 40 slid 1.6% and U.K.'s FTSE 100 was down 0.1%.

The benchmark U.S. 10-year Treasury yield fell to 0.6788% from 0.7180% in the prior session.

WTI crude oil futures (October) plummeted 7.6% to $36.76 a barrel, the lowest level since June, amid demand worries.

Spot gold marked a day-low near $1,906 before ending 0.1% lower at $1,932, as stock market sell-off spurred demand for the safe-haven asset.

On the forex front, the ICE U.S. Dollar Index climbed 0.5% on day to 93.52, the highest level since mid-August.

EUR/USD slid 0.5% to 1.1762. Official data showed that the eurozone's second quarter GDP growth was confirmed at -14.7% on year (-15.0% expected).

GBP/USD slumped 1.5% to 1.2964, the lowest level since July 30. Jonathan Jones, head of the U.K. government legal service, has resigned and it is reported that his departure was due to Prime Minister Boris Johnson's plan to overwrite parts of the Northern Ireland protocol. Brandon Lewis, secretary of state for Northern Ireland, said the plan "does break international law in a very specific and limited way".

USD/JPY fell 0.2% to 106.03.

USD/CAD jumped 1.1% to 1.3244, pressured by slumping oil prices. Meanwhile, the Bank of Canada is expected to keep its benchmark rate unchanged at 0.25% later today.

Other commodity-linked currencies also weakened against the greenback, AUD/USD sank 1.0% to 0.7203 and NZD/USD plunged 1.2% to 0.6609.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM